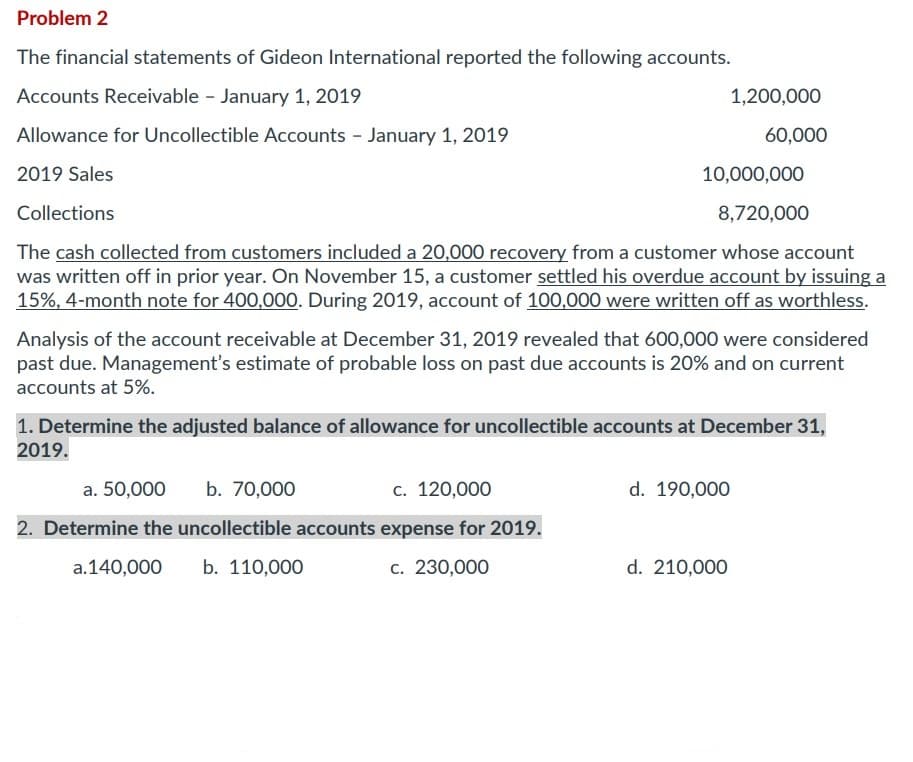

Problem 2 The financial statements of Gideon International reported the following accounts. Accounts Receivable - January 1, 2019 Allowance for Uncollectible Accounts - January 1, 2019 2019 Sales 10,000,000 Collections 8,720,000 The cash collected from customers included a 20,000 recovery from a customer whose account was written off in prior year. On November 15, a customer settled his overdue account by issuing a 15%, 4-month note for 400,000. During 2019, account of 100,000 were written off as worthless. Analysis of the account receivable at December 31, 2019 revealed that 600,000 were considered past due. Management's estimate of probable loss on past due accounts is 20% and on current accounts at 5%. 1,200,000 60,000 1. Determine the adjusted balance of allowance for uncollectible accounts at December 31, 2019. a. 50,000 b. 70,000 c. 120,000 2. Determine the uncollectible accounts expense for 2019. a.140,000 b. 110,000 c. 230,000 d. 190,000 d. 210,000

Problem 2 The financial statements of Gideon International reported the following accounts. Accounts Receivable - January 1, 2019 Allowance for Uncollectible Accounts - January 1, 2019 2019 Sales 10,000,000 Collections 8,720,000 The cash collected from customers included a 20,000 recovery from a customer whose account was written off in prior year. On November 15, a customer settled his overdue account by issuing a 15%, 4-month note for 400,000. During 2019, account of 100,000 were written off as worthless. Analysis of the account receivable at December 31, 2019 revealed that 600,000 were considered past due. Management's estimate of probable loss on past due accounts is 20% and on current accounts at 5%. 1,200,000 60,000 1. Determine the adjusted balance of allowance for uncollectible accounts at December 31, 2019. a. 50,000 b. 70,000 c. 120,000 2. Determine the uncollectible accounts expense for 2019. a.140,000 b. 110,000 c. 230,000 d. 190,000 d. 210,000

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter2: The Accounting Information System

Section: Chapter Questions

Problem 67.2C

Related questions

Question

Transcribed Image Text:Problem 2

The financial statements of Gideon International reported the following accounts.

Accounts Receivable - January 1, 2019

Allowance for Uncollectible Accounts - January 1, 2019

2019 Sales

10,000,000

Collections

8,720,000

The cash collected from customers included a 20,000 recovery from a customer whose account

was written off in prior year. On November 15, a customer settled his overdue account by issuing a

15%, 4-month note for 400,000. During 2019, account of 100,000 were written off as worthless.

Analysis of the account receivable at December 31, 2019 revealed that 600,000 were considered

past due. Management's estimate of probable loss on past due accounts is 20% and on current

accounts at 5%.

1,200,000

60,000

1. Determine the adjusted balance of allowance for uncollectible accounts at December 31,

2019.

a. 50,000 b. 70,000

c. 120,000

2. Determine the uncollectible accounts expense for 2019.

a.140,000 b. 110,000

c. 230,000

d. 190,000

d. 210,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning