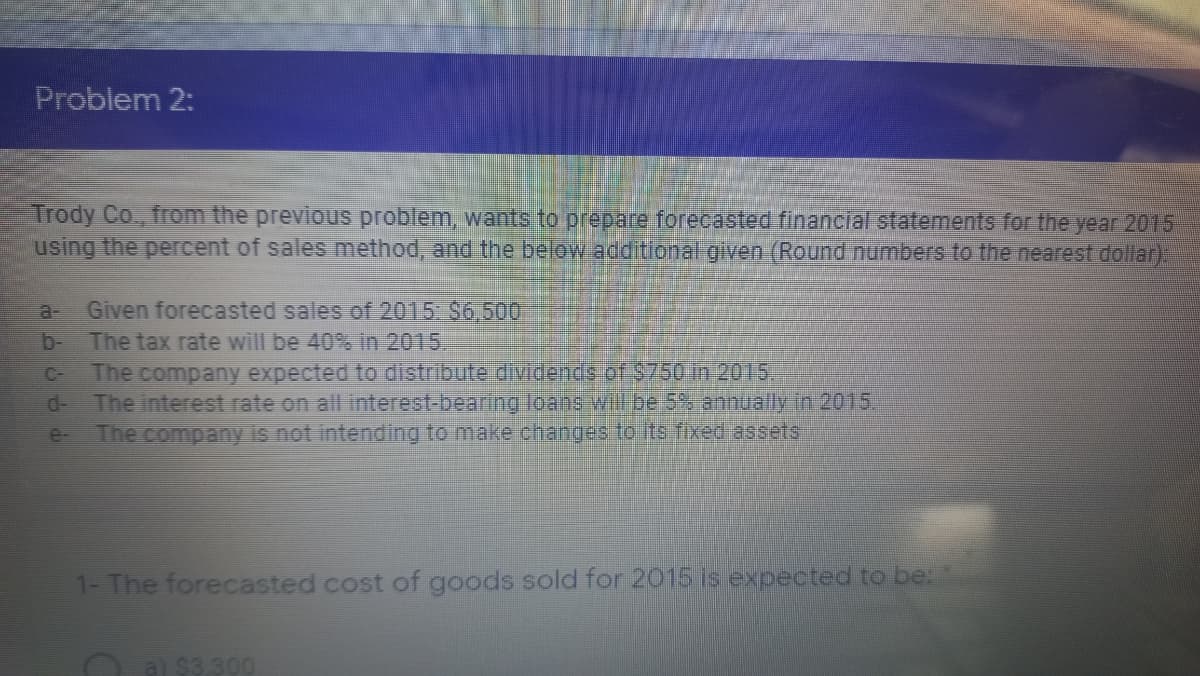

Problem 2: Trody Co., from the previous problem, wants to prepare forecasted financial statements for the year 2015 using the percent of sales method, and the below additional given (Round numbers to the nearest dollar) Given forecasted sales of 2015 $6,500 The tax rate will be 40% In 2015, The company expected to distribute dividends of $750 in 2015, The interest rate on all interest-bearing loans Will be 5% annually in 2015. The company is not intending to make changes to its fixed assets a- b- C- d- e- 1- The forecasted cost of goods sold for 2015 is expected to be:

Problem 2: Trody Co., from the previous problem, wants to prepare forecasted financial statements for the year 2015 using the percent of sales method, and the below additional given (Round numbers to the nearest dollar) Given forecasted sales of 2015 $6,500 The tax rate will be 40% In 2015, The company expected to distribute dividends of $750 in 2015, The interest rate on all interest-bearing loans Will be 5% annually in 2015. The company is not intending to make changes to its fixed assets a- b- C- d- e- 1- The forecasted cost of goods sold for 2015 is expected to be:

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter9: Corporate Valuation And Financial Planning

Section: Chapter Questions

Problem 9P

Related questions

Question

question: how much is the forcasted accounts receivable

for 2015 is expected to be

Transcribed Image Text:Problem 2:

Trody Co., from the previous problem, wants to prepare forecasted financial statements for the year 2015

using the percent of sales method, and the below additional given (Round numbers to the nearest dollar)

Given forecasted sales of 2015 $6,500

b The tax rate will be 40% In 2015

The company expected to distribute dividends of $750 in 2015

a-

C-

d-

The interest rate on all interest-bearing loane will be 5% annually in 2015,

e-

The company is not intending to make changes to its fixed assets

1- The forecasted cost of goods sold for 2015 is expected to be.

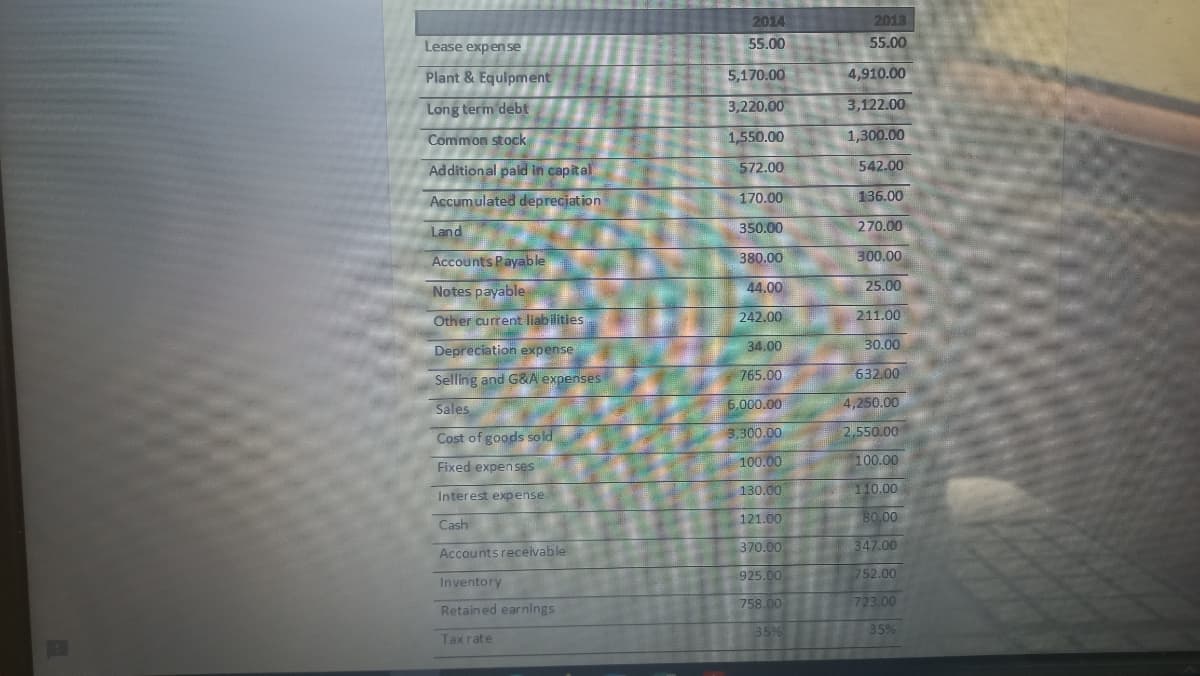

Transcribed Image Text:2014

2013

Lease expen se

55.00

55.00

Plant & Equipment

5,170.00

4,910.00

Long term debt

3,220.00

3,122.00

Common stock

1,550.00

1,300.00

Additional pald in capital

572.00

542.00

Accumulated depreciation

170.00

136.00

350.00

270.00

Land

Accounts Payable

380.00

300.00

Notes payable

44.00

25.00

Other current liabilities

242.00

211.00

Depreciation expense

34.00

30.00

Selling and G&A expenses

765.00

632.00

Sales

6,000.00

4,250.00

Cost of goods so ld

3,300.00

2,550.00

Fixed expenses

100.00

100.00

Interest expense

130.00

110.00

121.00

80.00

Cash

Accounts receivable

370.00

347.00

925.00

752.00

Inventory

758.00

723.00

Retained earnings

35%

35%

Tax rate

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning