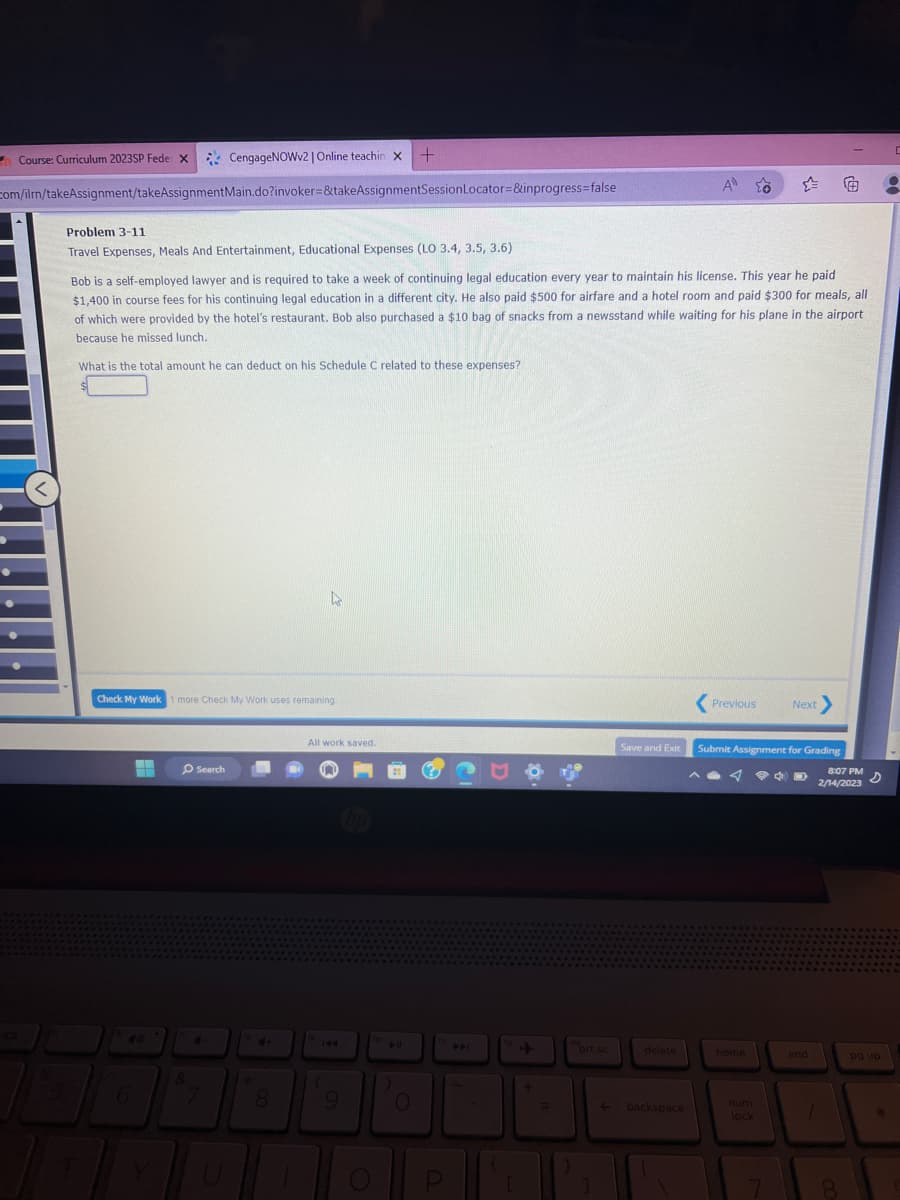

Problem 3-11 Travel Expenses, Meals And Entertainment, Educational Expenses (LO 3.4, 3.5, 3.6) Bob is a self-employed lawyer and is required to take a week of continuing legal education every year to maintain his license. This year he paid $1,400 in course fees for his continuing legal education in a different city. He also paid $500 for airfare and a hotel room and paid $300 for meals, all of which were provided by the hotel's restaurant. Bob also purchased a $10 bag of snacks from a newsstand while waiting for his plane in the airport because he missed lunch. What is the total amount he can deduct on his Schedule C related to these expenses?

Problem 3-11 Travel Expenses, Meals And Entertainment, Educational Expenses (LO 3.4, 3.5, 3.6) Bob is a self-employed lawyer and is required to take a week of continuing legal education every year to maintain his license. This year he paid $1,400 in course fees for his continuing legal education in a different city. He also paid $500 for airfare and a hotel room and paid $300 for meals, all of which were provided by the hotel's restaurant. Bob also purchased a $10 bag of snacks from a newsstand while waiting for his plane in the airport because he missed lunch. What is the total amount he can deduct on his Schedule C related to these expenses?

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter2: Working With The Tax Law

Section: Chapter Questions

Problem 3RP

Related questions

Question

What is the total amount he can deduct on his schedule c related to these expenses?

Transcribed Image Text:Course: Curriculum 2023SP Fede X CengageNOWv2 | Online teachin x +

com/ilm/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSession Locator=&inprogress=false

Problem 3-11

Travel Expenses, Meals And Entertainment, Educational Expenses (LO 3.4, 3.5, 3.6)

Bob is a self-employed lawyer and is required to take a week of continuing legal education every year to maintain his license. This year he paid

$1,400 in course fees for his continuing legal education in a different city. He also paid $500 for airfare and a hotel room and paid $300 for meals, all

of which were provided by the hotel's restaurant. Bob also purchased a $10 bag of snacks from a newsstand while waiting for his plane in the airport

because he missed lunch.

What is the total amount he can deduct on his Schedule C related to these expenses?

Check My Work 1 more Check My Work uses remaining.

6

Search

D

8

All work saved.

9

O

P

+

A

delete

Next >

Save and Exit Submit Assignment for Grading

4 D

8:07 PM

2/14/2023

backspace

Previous

AC 4

home

num

lock

7

G

end

8

D

pg up

*

C

Expert Solution

Step 1

Schedule C is used as a tax form and it is attached with Form 1040 electronically for the reporting of the profit or loss in the business for the sole proprietorship or Single member LLCs.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you