Problem 3-7B Adjusting entries (annual) LO4 following information was available: six-year life. b. Accrued revenues at year-end totalled $24,300. this accounting period and represents a two-year policy. d. Accrued salaries at year-end were $21,500. e. One month of interest had accrued at a rate of 3.5% on the $144,000 note payable. f. The annual depreciation on the office equipment was $8,100. g. $6,480 worth of advertising was prepaid on January 1 of the current accounting period and dehited to the Prepaid Advertising account. This covered four months of advertising beginning on the same date. h. It was determined that $4,500 of completed work was included in the $9,200 Unearned Revenue account balance at year-end. i. Interest income accrued at year-end totalled $570. j. The Office Supplies account had a balance of $4,000 at the beginning of the accounting period. During the year, $29,500 of supplies were purchased and debited to the Office Supplies account. At year-end, a count of the supplies revealed that $28,400 had been used. Required Prepare adjusting journal entries for the year ended May 31, 2020, based on the above.

Problem 3-7B Adjusting entries (annual) LO4 following information was available: six-year life. b. Accrued revenues at year-end totalled $24,300. this accounting period and represents a two-year policy. d. Accrued salaries at year-end were $21,500. e. One month of interest had accrued at a rate of 3.5% on the $144,000 note payable. f. The annual depreciation on the office equipment was $8,100. g. $6,480 worth of advertising was prepaid on January 1 of the current accounting period and dehited to the Prepaid Advertising account. This covered four months of advertising beginning on the same date. h. It was determined that $4,500 of completed work was included in the $9,200 Unearned Revenue account balance at year-end. i. Interest income accrued at year-end totalled $570. j. The Office Supplies account had a balance of $4,000 at the beginning of the accounting period. During the year, $29,500 of supplies were purchased and debited to the Office Supplies account. At year-end, a count of the supplies revealed that $28,400 had been used. Required Prepare adjusting journal entries for the year ended May 31, 2020, based on the above.

Corporate Financial Accounting

15th Edition

ISBN:9781337398169

Author:Carl Warren, Jeff Jones

Publisher:Carl Warren, Jeff Jones

Chapter4: The Accounting Cycle

Section: Chapter Questions

Problem 4.3BPR: Income: 27,350 accounts, adjusting entries, financial statements, and closing entries; optional...

Related questions

Question

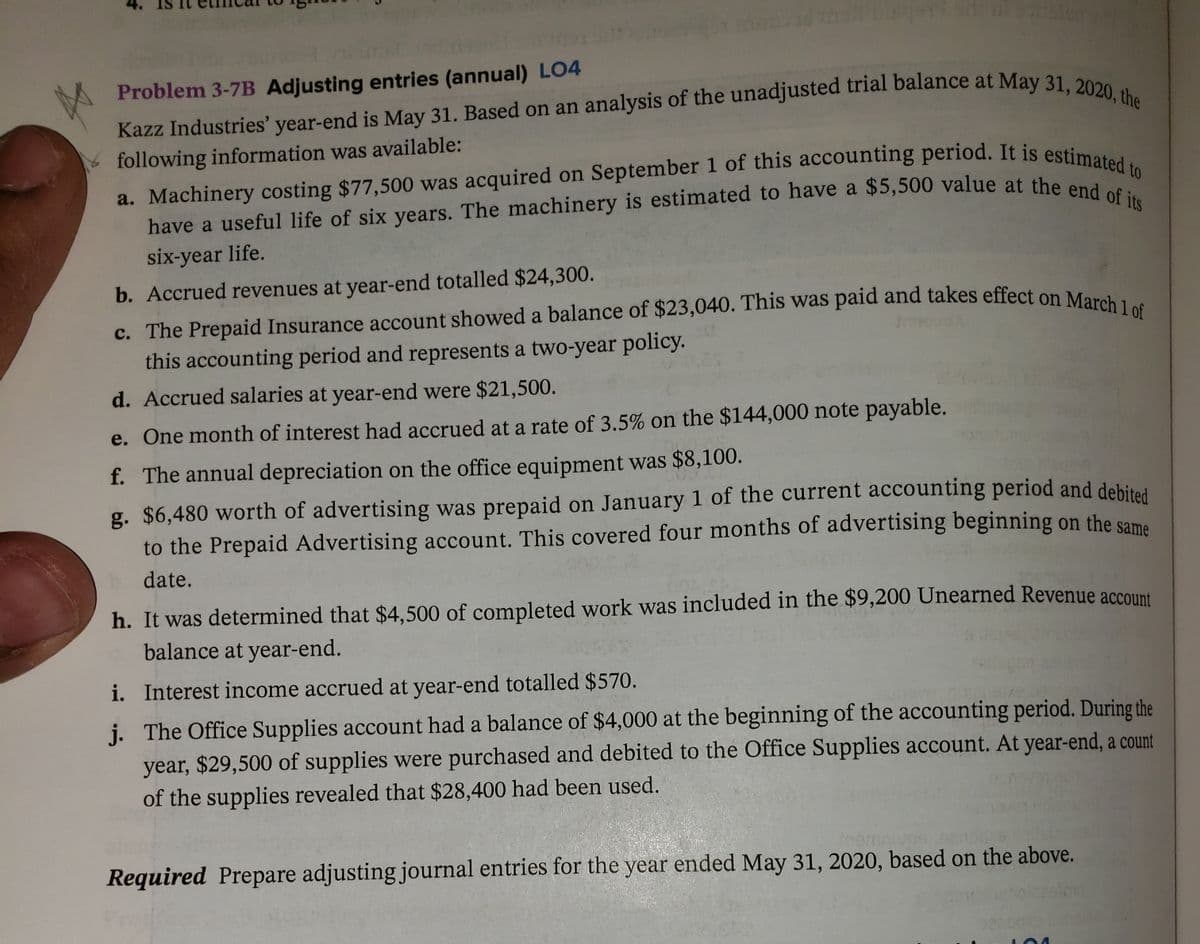

Transcribed Image Text:Problem 3-7B Adjusting entries (annual) LO4

Kazz Industries' year-end is May 31. Based on an analysis of the unadjusted trial balance at May 31 200

following information was available:

a. Machinery costing $77,500 was acquired on September 1 of this accounting period. It is estimes

have a useful life of six years. The machinery is estimated to have a $5,500 value at the endu to

six-year life.

b. Accrued revenues at year-end totalled $24,300.

this accounting period and represents a two-year policy.

d. Accrued salaries at year-end were $21,500.

e. One month of interest had accrued at a rate of 3.5% on the $144,000 note payable.

f. The annual depreciation on the office equipment was $8,100.

g. $6,480 worth of advertising was prepaid on January 1 of the current accounting period and debited

to the Prepaid Advertising account. This covered four months of advertising beginning on the same

date.

h. It was determined that $4,500 of completed work was included in the $9,200 Unearned Revenue account

balance at year-end.

i. Interest income accrued at year-end totalled $570.

j. The Office Supplies account had a balance of $4,000 at the beginning of the accounting period. During the

year, $29,500 of supplies were purchased and debited to the Office Supplies account. At year-end, a count

of the supplies revealed that $28,400 had been used.

Required Prepare adjusting journal entries for the year ended May 31, 2020, based on the above.

pen

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning