u1 EXERCISE 4.7 Preparing Various g Adjusting Entries Sweeney & Associates, a large marketing firm, adjusts its accounts at the end of each month. The following information is available for the year ending December 31, 2009: A bank loan had been obtained on December 1. Accrued interest on the loan at Dccember 31 amounts to $1,200. No interest expense has yet been recorded. 1. 2. Depreciation of the firm's office building is based on an estimated life of 25 years. The build- ing was purchased in 2005 for $330,000. 3. Accrued, but unbilled, revenue during December amounts to $64,000. 17 On March 1, the firm pnid $1,800 to renew a 12-month insurance policy. The entire amount Wns recorded as Prepaid Insurnnce. 5. 4. The firm reccived $14,0XXI from King Biscuit Conpany in advance of developing : six-nionth marketing canpaign. The entire anount was initially recorded as Unearned Revenue. At December 31, $3,500 had actually been earned by the firm. The company's policy is to pay its employees cvery Friday. Since December 31 fell on a Wednesday, there was an accrued liability for salaries amounting to $2,400. Record the necessary adjusting journal entries on December 31, 2009. 6. a. By how much did Sweeney & Associates's net incomc increase or decrease as a result of the Bdiusting entrics performed in part a? (Ignore income taxes.) b.

u1 EXERCISE 4.7 Preparing Various g Adjusting Entries Sweeney & Associates, a large marketing firm, adjusts its accounts at the end of each month. The following information is available for the year ending December 31, 2009: A bank loan had been obtained on December 1. Accrued interest on the loan at Dccember 31 amounts to $1,200. No interest expense has yet been recorded. 1. 2. Depreciation of the firm's office building is based on an estimated life of 25 years. The build- ing was purchased in 2005 for $330,000. 3. Accrued, but unbilled, revenue during December amounts to $64,000. 17 On March 1, the firm pnid $1,800 to renew a 12-month insurance policy. The entire amount Wns recorded as Prepaid Insurnnce. 5. 4. The firm reccived $14,0XXI from King Biscuit Conpany in advance of developing : six-nionth marketing canpaign. The entire anount was initially recorded as Unearned Revenue. At December 31, $3,500 had actually been earned by the firm. The company's policy is to pay its employees cvery Friday. Since December 31 fell on a Wednesday, there was an accrued liability for salaries amounting to $2,400. Record the necessary adjusting journal entries on December 31, 2009. 6. a. By how much did Sweeney & Associates's net incomc increase or decrease as a result of the Bdiusting entrics performed in part a? (Ignore income taxes.) b.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter3: Accrual Accounting

Section: Chapter Questions

Problem 20CE: Cornerstone Exercise 3-20 Deferred Expense Adjusting Entries Best Company had the following items...

Related questions

Question

financial accounting

please give me the answer of this question thnaks

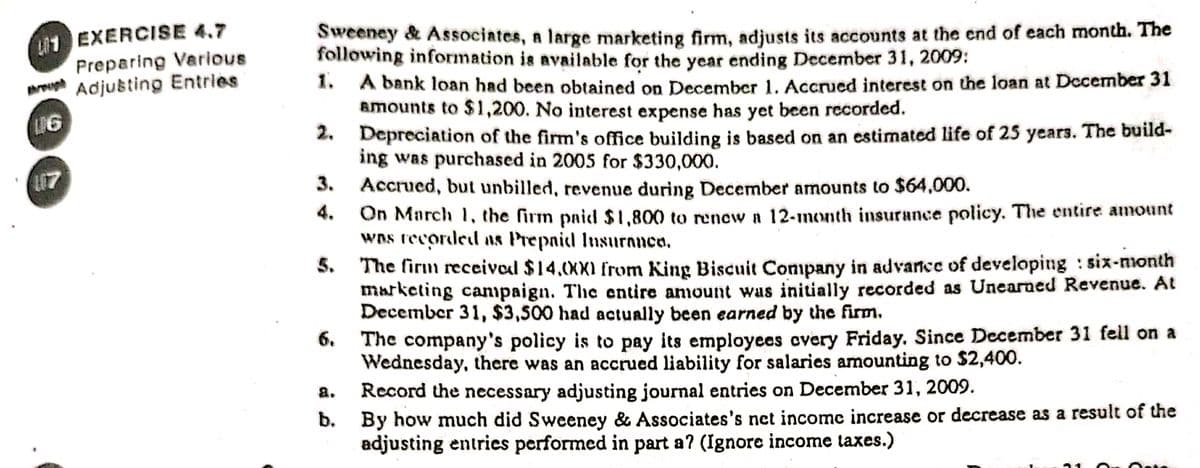

Transcribed Image Text:1 EXERCISE 4.7

Preparing Various

rough Adjusting Entries

Sweeney & Associates, a large marketing firm, adjusts its accounts at the end of each month. The

following information is available for the year ending December 31, 2009:

1. A bank loan had been obtained on December 1. Accrued interest on the loan at December 31

amounts to $1,200. No interest expense has yet been recorded.

2. Depreciation of the firm's office building is based on an estimated life of 25 years. The build-

ing was purchased in 2005 for $330,000.

Accrued, but unbilled, revenue during December amounts to $64,000.

On March 1, the firm paid $ 1,800 to renew a 12-month insurance policy. The entire amount

wns recorded as Prepaid Insuranco.

The firm receival $14,(XXI from King Biscuit Company in advarce of developing : six-month

marketing campaign. The entire anount was initially recorded as Unearned Revenue. At

December 31, $3,500 had actually been earned by the firm.

The company's policy is to pay its employces overy Friday. Since December 31 fell on a

Wednesday, there was an accrued liability for salaries amounting to $2,400.

Record the necessary adjusting journal entries on December 31, 2009.

b. By how much did Sweeney & Associates's net income increase or decrease as a result of the

adjusting entrics performed in part a? (Ignore income taxes.)

L17

3.

4.

6.

a.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning