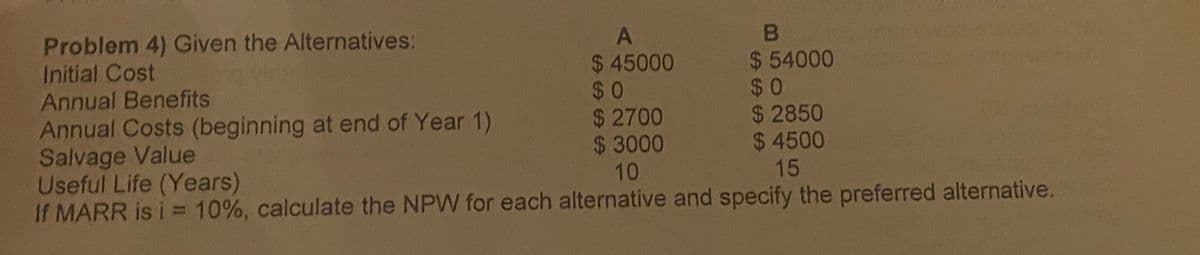

Problem 4) Given the Alternatives: Initial Cost Annual Benefits Annual Costs (beginning at end of Year 1) Salvage Value Useful Life (Years) $ 45000 $0 $ 2700 $ 3000 10 $ 54000 $0 $ 2850 $ 4500 15

Q: Is the following statement TRUE or FALSE? Please provide reason for the answer. The aggregate suppl...

A: Aggregate supply is defined as the total amount of supply of goods and services in the economy in a ...

Q: In the summer of 2018, you took a vacation and visited several destinations in France, including the...

A: The balance of trade, also known as the commercial balance or net exports, is the monetary value dif...

Q: 11. In a Bertrand duopoly with homogenous goods and symmetric and identical constant marginal cost f...

A: The term "Bertrand competition" was coined by Joseph Louis François Bertrand (1822–1900) to describe...

Q: 10. In the short run, the central bank's actions to fight inflation shift the aggregate demand curve...

A: In an economy, the problem of inflation arises when there is excess demand for goods and services as...

Q: This set of questions concern indirect pricing. (versioning) Use the attached image to answer quest...

A: The given matrix can be interpreted as the prices for each bundles of both high and low values of th...

Q: Year GPP Incomedflst Tale Incame &f Ind Terale Inom edt 3rd Terat 1950 a tilap,4Trillion 10.6 Trilli...

A: Here, the given table provides information about the GDP in 1950 and 2020 on quintile basis.

Q: The price p (in dollars) and the quantity q sold of a certain product obey the demand equation q = 8...

A: Answer: Given, Demand equation: q=800-20p and 0≤p≤40 First of all, let us find the range of q usin...

Q: Over the past 30 years, the government has offered a wide variety of incentives for people to instal...

A: GIVEN Over the past 30 years, the government has offered a wide variety of incentives for people t...

Q: An example of technology is a) earning plumbing certification Ob) new patent c) degree in finance Od...

A: Technology is a scientific method and knowledge which is used for the practical purposes.

Q: In the Heckscher Ohlin two good (food and cloth), two factor (capital and labour) model suppose that...

A: We use c as suffix to denote cloth and f as suffix to denote food. a. The capital constraint is Kc+...

Q: |Use the graph below to answer the following: 20 15 10 10 15 20 Quantity (units) Consider a marginal...

A: When there is negative externality, it creates an external cost. This leads to marginal damage to th...

Q: The Imitation Gap Theorem should be discarded as a practical explanation of trade pattern. Discuss.

A: In the international market, the imitation gap theorem beleives in the gap between the availability ...

Q: Consider the mean cost of getting a four-year college degree. The middle interval which captures 95...

A: In this question we have to find out the population mean cost of getting a college degree with the h...

Q: Match the words from the list below to complete the following statement A firm will maximise by sele...

A: Marginal cost refers to the total costs which arise when the the quantity produced increases by one ...

Q: Consider the above table for the market for oranges. A deep frost destroys many or the orange juice ...

A: The curve that depicts the quantities that are being demanded by individuals at various levels of pr...

Q: Explain why you think that maintaining a well functioning financial system is important and suggest ...

A: By collecting and combining cash from multiple sources, financial systems enable the transfer of sav...

Q: Explain the impact of higher corn prices on consumers. Draw a graph and upload your graph on canvas ...

A: Impact of higher corn prices on consumer:- Increase in price of corn will decrease the quantity dem...

Q: 2015 2018 2018 2018 Commodity Price QD (in kg.) Price QD (in kg.) Beef Cabbage Carrots Chayote Chick...

A: Price elasticity of demand is the ratio of percentage change in demand of a commodity and percentage...

Q: Which is NOT true about globalization? A. Globalization has competing definitions and importance B. ...

A: Trade is defined as the exchange of commodities and services across the boundary of the country. In...

Q: Assume that the following details apply to the U.S. economy: Government budget deficit: $150 ...

A: G - T = Government budget deficit = $150 billion. S = Domestic Savings = $2,000 billion I = Domestic...

Q: Consider the household production model. An individual produces some of their meals using precooked ...

A: We know that demand for a good is influenced by several factors, which together are called Determina...

Q: The economy of Ashenvale is currently in a long-run equilibrium, depicted by point E, on the graph. ...

A: The given question is related to the aggregate demand-aggregate supply macroeconomics model.

Q: Find the EAR in each of the cases. Use 365 days a year- Do not round intermediate calculations and r...

A: Given APR 8%, 16, 12, 15 compounded as quarterly, monthly, daily, infinitely. To calculate:- EAR=? P...

Q: Andrew and Ben own and live in condominium apartments in the same building. Ben's condo is directly ...

A: Given:Andrew ability to smoke marijuana inside his condo=$100 per monthBen value fresh air in his co...

Q: According to Adam Smith, how were changes in production at the pin factory an example of how capital...

A: Capitalism is an economic system based on the private ownership of productive assets and their profi...

Q: I is economy IS In a recessIonary yap wrieı ure aciuai GUP IS Delow pouu DIIIIUI. b. Explain why wag...

A: Philips curve shows the relationship between inflation and unemployment and it is downward sloping c...

Q: how the shortage of semiconductor chips has shifted the production possibilities curve inward for au...

A: Production possibility curve: - it is the graphical representation of different combinations of two ...

Q: Ana, Emma, and Greta are deciding what to do on a weekend getaway. They each suggest a first choice ...

A: Given: 1st Choice 2nd Choice 3rd Choice Ana Beach Mountain Biking Canoeing Emma ...

Q: Question 4. Suppose that the bank of Canada uses money to buy bonds in financial markets during a re...

A: GIVEN Suppose that the bank of Canada uses money to buy bonds in financial markets during a recess...

Q: What is the likelihood that firms would enter the market in the short run. (Use Covid 19 as a market...

A: The market condition during covid-19 has been considered uneven because lockdown has increased the b...

Q: How are you influenced by the media as a consumer and content-maker? You may base your examples on y...

A: When a particular product is manufactured, cost takes place for producing that particular good and ...

Q: 6. When Karen uses money to buy her breakfast, she is showing the use of money as a unit of account....

A: In an economy, money is used for different purposes, which explains different functions of money at ...

Q: Price controls decrease the innovation rate for drugs but make existing drugs more affordable. True ...

A: In economics, price controls are government-imposed restrictions that ensure that goods and services...

Q: Why a cashless society destory the international finance system?

A: Cashless economy is, when there is no cash flow within an economy, all transactions must be conducte...

Q: Travel Time Each Way Price of a Dress Store (Minutes) (Dollars per dress) Local Department Store 15 ...

A: The opportunity cost is the next best-forgone alternative. It is the loss of the cost of an activity...

Q: Create a Graphical Presentation of the Demand Curve and give Interpretations

A: Demand for the good refers to the quantity of the good which consumers want to purchase at different...

Q: the equilibrium exchange rate bêtween and Japanese yen is currently the exchange rate is $0.009 = 1 ...

A: The equilibrium exchange rate is the long-term exchange rate that equals the purchasing power parity...

Q: Using the data you entered in the previous table, calculate the tax burden that falls on buyers and ...

A: We can see these values directly from the graph and fill the table to be: QUANTITY PRICE BUYERS...

Q: Greg has the following utility function: u = x x51. He has an income of $75.00, and he faces these p...

A: Given Greg utility function u=x10.49x20.51 .... (1) The equation of B=budget constraint...

Q: 1.What is the relationship among property rights, corruption, and economic progress? How important a...

A: Disclaimer :- As you posted multiple questions we are supposed to solve only the first one as per ou...

Q: Complete each statement below about the demand and supply of t-shirts using the dropdown list. In ea...

A: Hi! Thank you for the question, As per the honor code, we are allowed to answer three sub-parts at a...

Q: Find the marginal revenue function for the total revenue function given by 1 TR(Q) = 500Q- Find the ...

A: a)TR(Q)=500Q-13Q3Now,MR=∂TR∂QMR=∂(500Q-13Q3)∂QMR=500-33Q3-1MR=500-Q2

Q: An economy, Delta exported goods worth $30 billion and services worth another $10 billion in 2020. ...

A: A country's current account tracks the value of its exports and imports of commodities and services,...

Q: A consumer's preferences over gambles is represented by the expected utility function U (W,, W2, 1 –...

A: utility function is an important concept that measures preferences over a set of goods and services....

Q: 14. Let 7; (xi,x-i) denote the twice differentiable profit function for firm i as a function of the ...

A: Strategic complement is the concept in the game theory where 2 players mutually support each other. ...

Q: What is the current unemployment rate in the United States as of January 2021? What was the unemploy...

A: Unemployment rate The unemployment rate basically refers to the percentage of the workforce that is ...

Q: Given Cost and Revenue functions C(q)=q3−10q2+52q+5000 and R(q)=−3q2+2400q, what cost is incurred...

A: Marginal profit means for a unit change in quantity how much profit will change . It is the profit ...

Q: Country A is a large Importer of good 1. If country A imposes a sighifficant import tariff on good O...

A: Trade is defined as the exchange of commodities and services across the boundary of the country. In...

Q: Refer to the market demand and supply functions below: Qd=71,000 – 2,000P Qs = - 25,000 +25,000P Wha...

A: Qd = 71,000 - 2,000P Qs = -25,000 + 25,000P

Q: 38. The ways to increase labor productivity include a. increasing the capital-labor ratio; b. increa...

A: Hi! Thank you for the question As per the honor code, We’ll answer the first question since the exac...

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

- A county in Tennessee is considering the following public interest project. Initial Cost $22.5M Annual Maintenance Cost $525K EUAB $3.3M Given a useful life of 12 years and an interest rate of 4%, the benefit /cost ratio is _____________________. Group of answer choices 1.01 1.13 1.51 1.67 1.48A proposed project has the following costs and benefits. Using linear interpolation, the project’s discounted payback period (use i=10%) is _____________. Year Costs Benefits 0 $4,000 1 $1,200 2 $1,200 3 1,000 4 1,000 5 3,000 6 2,000 A. 6.35 years B. 5.82 years C. 4.24 years D. 3.37 yearsAn untreated wooden pole that will last 10 years under a certain soil condition costs P 12,000. If a treated pole will last for 20 years, what is the maximum justifiable amount that can be paid for the treated pole? Assume 1% tax of the first cost for the treated pole and 12% interest rate. Use annual cost method. Select one: a. P 17,848 b. P 15,595 c. P 13,926 d. P 16,224

- Three alternative proposals are suggested for a project with the following cash flows. Choose the best alternative based on IRR. MARR = 15%. The life of alternatives is 10 years. Alternatives I II IIIInitialInvestment $350,000 $150,000 $220,000Net Income/ year $35,000 $20,0000 $22,000Salvage Value $100,000 $15,000 $50,000A major equipment purchase is being considered by Metro Atlanta. The initial cost is determined to be $1,000,000. It is estimated that this new equipment will save $100,000 the first year and increase gradually by $50,000 every year for the next 6 years. MARR=10% a. Using Benefit- Cost analysis, what is the Benefit/Cost ratio for this equipment purchase? b. Based on the Benefit/Cost analysis should Metro Atlanta purchase the equipment?A manufacturer with a MARR of 20% is considering the installation of one of three packaging machines. The economic parameters of each machine are as follows: Packaging machine: X Y Z Initial cost ($) 20,000 40,000 15,000 Uniform annual benefit ($) 120,000 180,000 100,000 Uniform annual O&M cost ($) 70,000 50,000 70,000 Service life (years) 6 3 12 Salvage value end of life ($) 2,000 4,000 2,000 The present worth (PW) for machine X over the 12 years analysis period is:

- Alternative 3 is incorrect EUAC=( Equivalent Annaul COst of Initial Investment)+ (Expected Moderate annaual flood damage cost )+ (expected severe annaual flood cost )An investment firm plans to erect 200 wind turbines at a cost of $1.69 million each. The following input information is available:• Power capacity per turbine: 1,550 kW• Project life: 20 years• Salvage value after 20 years: 0• Annual maintenance: $16,300 per turbine• Selling price: $0.034 /kWh• Tax credit: $0.018 /kWh• MARR: 10%• Average load factor: 35%A. Calculate the IRRB. Calculate the NPVC. Will the company proceedCalculate the annual net benefit from the given project summary. Capital Costs = $43,000; Revenue = $16,000/year; Operation and Maintenance Costs = $7,800/year Salvage Value = $19,000; Project Lifetime = 6 years; Effective Interest Rate = 0.09.

- A machine has a first cost of $10,000 and annual costs of $3500. There is no salvage value, and interest is 10%. If the project’s useful life is described by the following data, what is the annual worth of costs? Useful Life (years) 4 5 6 7 Prob. of life (%) 5 22 41 32 (a) $3500 (b) $5127 (c) $5554 (d) $5796Engineering economy - ENGR 3322 The International Parcel Service has installed a new radio frequency identification system to help reduce the number of packages that are incorrectly delivered. The capital investment in the system is $65,000, and the projected annual savings are tabled below. The system’s market value at the EOY five is negligible, and the MARR is 18% per year. Calculate the return on investment of the project a. 35% b. 36% c. 37% d. None of the choicesThe Company purchased a lot for P250k on which they will construct a building with 3 estimates tabulated below. Determine which alterative should be selected using Benefit Cost Analysis at 10%: Building Height 4 stories 8 stories 12 stories Cost of Building P650k P1.5M P2.4M Resale Value at the end of 30 yrs 350k 720k 1M Net Annual Income 120k 250k 340k What is the value of B-C of the 4 story. a. P62,656.413 b. P26,656.413 c. P276,656.413 d. P6,656.413