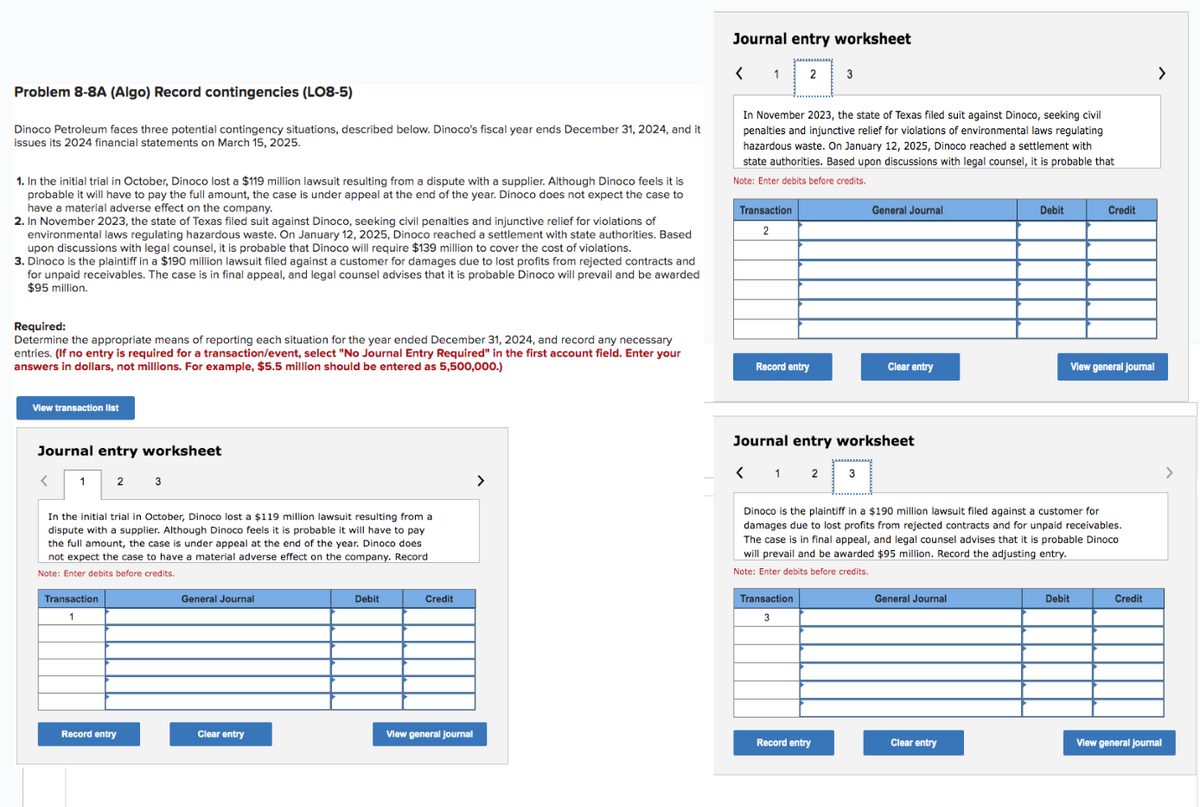

Problem 8-8A (Algo) Record contingencies (LO8-5) Dinoco Petroleum faces three potential contingency situations, described below. Dinoco's fiscal year ends December 31, 2024, and it issues its 2024 financial statements on March 15, 2025. 1. In the initial trial in October, Dinoco lost a $119 million lawsuit resulting from a dispute with a supplier. Although Dinoco feels it is probable it will have to pay the full amount, the case is under appeal at the end of the year. Dinoco does not expect the case to have a material adverse effect on the company. 2. In November 2023, the state of Texas filed suit against Dinoco, seeking civil penalties and injunctive relief for violations of environmental laws regulating hazardous waste. On January 12, 2025, Dinoco reached a settlement with state authorities. Based upon discussions with legal counsel, it is probable that Dinoco will require $139 million to cover the cost of violations. 3. Dinoco is the plaintiff in a $190 million lawsuit filed against a customer for damages due to lost profits from rejected contracts and for unpaid receivables. The case is in final appeal, and legal counsel advises that it is probable Dinoco will prevail and be awarded $95 million. Required: Determine the appropriate means of reporting each situation for the year ended December 31, 2024, and record any necessary entries. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field. Enter your answers in dollars, not millions. For example, $5.5 million should be entered as 5,500,000.) View transaction list Journal entry worksheet 1 2 3 < In the initial trial in October, Dinoco lost a $119 million lawsuit resulting from a dispute with a supplier. Although Dinoco feels it is probable it will have to pay the full amount, the case is under appeal at the end of the year. Dinoco does not expect the case to have a material adverse effect on the company. Record Note: Enter debits before credits. Transaction 1 Record entry General Journal Clear entry Debit Credit View general Journal Journal entry worksheet < 1 2 3 In November 2023, the state of Texas filed suit against Dinoco, seeking civil penalties and injunctive relief for violations of environmental laws regulating hazardous waste. On January 12, 2025, Dinoco reached a settlement with state authorities. Based upon discussions with legal counsel, it is probable that Note: Enter debits before credits. Transaction 2 Record entry General Journal Journal entry worksheet < 1 2 3 Transaction 3 Clear entry Record entry Dinoco is the plaintiff in a $190 million lawsuit filed against a customer for damages due to lost profits from rejected contracts and for unpaid receivables. The case is in final appeal, and legal counsel advises that it is probable Dinoco will prevail and be awarded $95 million. Record the adjusting entry. Note: Enter debits before credits. General Journal Debit Clear entry Credit View general journal Debit Credit View general journal

Problem 8-8A (Algo) Record contingencies (LO8-5) Dinoco Petroleum faces three potential contingency situations, described below. Dinoco's fiscal year ends December 31, 2024, and it issues its 2024 financial statements on March 15, 2025. 1. In the initial trial in October, Dinoco lost a $119 million lawsuit resulting from a dispute with a supplier. Although Dinoco feels it is probable it will have to pay the full amount, the case is under appeal at the end of the year. Dinoco does not expect the case to have a material adverse effect on the company. 2. In November 2023, the state of Texas filed suit against Dinoco, seeking civil penalties and injunctive relief for violations of environmental laws regulating hazardous waste. On January 12, 2025, Dinoco reached a settlement with state authorities. Based upon discussions with legal counsel, it is probable that Dinoco will require $139 million to cover the cost of violations. 3. Dinoco is the plaintiff in a $190 million lawsuit filed against a customer for damages due to lost profits from rejected contracts and for unpaid receivables. The case is in final appeal, and legal counsel advises that it is probable Dinoco will prevail and be awarded $95 million. Required: Determine the appropriate means of reporting each situation for the year ended December 31, 2024, and record any necessary entries. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field. Enter your answers in dollars, not millions. For example, $5.5 million should be entered as 5,500,000.) View transaction list Journal entry worksheet 1 2 3 < In the initial trial in October, Dinoco lost a $119 million lawsuit resulting from a dispute with a supplier. Although Dinoco feels it is probable it will have to pay the full amount, the case is under appeal at the end of the year. Dinoco does not expect the case to have a material adverse effect on the company. Record Note: Enter debits before credits. Transaction 1 Record entry General Journal Clear entry Debit Credit View general Journal Journal entry worksheet < 1 2 3 In November 2023, the state of Texas filed suit against Dinoco, seeking civil penalties and injunctive relief for violations of environmental laws regulating hazardous waste. On January 12, 2025, Dinoco reached a settlement with state authorities. Based upon discussions with legal counsel, it is probable that Note: Enter debits before credits. Transaction 2 Record entry General Journal Journal entry worksheet < 1 2 3 Transaction 3 Clear entry Record entry Dinoco is the plaintiff in a $190 million lawsuit filed against a customer for damages due to lost profits from rejected contracts and for unpaid receivables. The case is in final appeal, and legal counsel advises that it is probable Dinoco will prevail and be awarded $95 million. Record the adjusting entry. Note: Enter debits before credits. General Journal Debit Clear entry Credit View general journal Debit Credit View general journal

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter9: Current Liabilities, Contingencies, And The Time Value Of Money

Section: Chapter Questions

Problem 9.10MCP

Related questions

Question

Transcribed Image Text:Problem 8-8A (Algo) Record contingencies (LO8-5)

Dinoco Petroleum faces three potential contingency situations, described below. Dinoco's fiscal year ends December 31, 2024, and it

issues its 2024 financial statements on March 15, 2025.

1. In the initial trial in October, Dinoco lost a $119 million lawsuit resulting from a dispute with a supplier. Although Dinoco feels it is

probable it will have to pay the full amount, the case is under appeal at the end of the year. Dinoco does not expect the case to

have a material adverse effect on the company.

2. In November 2023, the state of Texas filed suit against Dinoco, seeking civil penalties and injunctive relief for violations of

environmental laws regulating hazardous waste. On January 12, 2025, Dinoco reached a settlement with state authorities. Based

upon discussions with legal counsel, it is probable that Dinoco will require $139 million to cover the cost of violations.

3. Dinoco is the plaintiff in a $190 million lawsuit filed against a customer for damages due to lost profits from rejected contracts and

for unpaid receivables. The case is in final appeal, and legal counsel advises that it is probable Dinoco will prevail and be awarded

$95 million.

Required:

Determine the appropriate means of reporting each situation for the year ended December 31, 2024, and record any necessary

entries. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field. Enter your

answers in dollars, not millions. For example, $5.5 million should be entered as 5,500,000.)

View transaction list

Journal entry worksheet

1 2

<

In the initial trial in October, Dinoco lost a $119 million lawsuit resulting from a

dispute with a supplier. Although Dinoco feels it is probable it will have to pay

the full amount, the case is under appeal at the end of the year. Dinoco does

not expect the case to have a material adverse effect on the company. Record

Note: Enter debits before credits.

Transaction

1

3

Record entry

General Journal

Clear entry

Debit

Credit

View general Journal

>

Journal entry worksheet

<

1

Transaction

2

AAAAAAAAAA

In November 2023, the state of Texas filed suit against Dinoco, seeking civil

penalties and injunctive relief for violations of environmental laws regulating

hazardous waste. On January 12, 2025, Dinoco reached a settlement with

state authorities. Based upon discussions with legal counsel, it is probable that

Note: Enter debits before credits.

2

Record entry

< 1

3

Transaction

3

Journal entry worksheet

12 3

General Journal

Record entry

Clear entry

Dinoco is the plaintiff in a $190 million lawsuit filed against a customer for

damages due to lost profits from rejected contracts and for unpaid receivables.

The case is in final appeal, and legal counsel advises that it is probable Dinoco

will prevail and be awarded $95 million. Record the adjusting entry.

Note: Enter debits before credits.

General Journal

Debit

Clear entry

Credit

Debit

View general Journal

Credit

>

View general Journal

>

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning