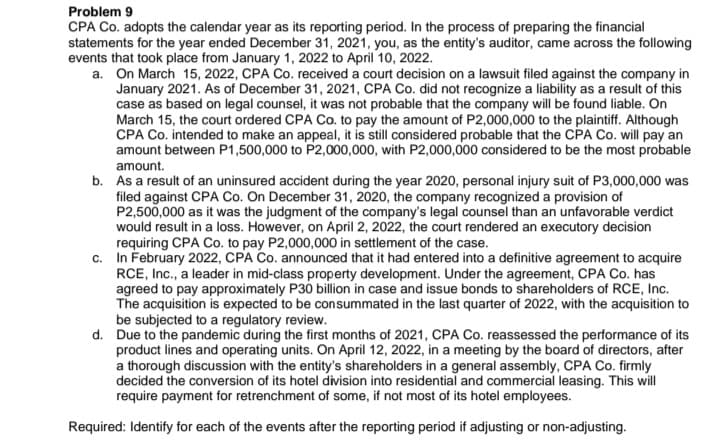

Problem 9 CPA Co. adopts the calendar year as its reporting period. In the process of preparing the financial statements for the year ended December 31, 2021, you, as the entity's auditor, came across the following events that took place from January 1, 2022 to April 10, 2022. a. On March 15, 2022, CPA Co. received a court decision on a lawsuit filed against the company in January 2021. As of December 31, 2021, CPA Co. did not recognize a liability as a result of this case as based on legal counsel, it was not probable that the company will be found liable. On March 15, the court ordered CPA Co. to pay the amount of P2,000,000 to the plaintiff. Although CPA Co. intended to make an appeal, it is still considered probable that the CPA Co. will pay an amount between P1,500,000 to P2,000,000, with P2,000,000 considered to be the most probable amount. b. As a result of an uninsured accident during the year 2020, personal injury suit of P3,000,000 was filed against CPA Co. On December 31, 2020, the company recognized a provision of P2,500,000 as it was the judgment of the company's legal counsel than an unfavorable verdict would result in a loss. However, on April 2, 2022, the court rendered an executory decision requiring CPA Co. to pay P2,000,000 in settlement of the case. c. In February 2022, CPA Co. announced that it had entered into a definitive agreement to acquire RCE, Inc., a leader in mid-class property development. Under the agreement, CPA Co. has agreed to pay approximately P30 billion in case and issue bonds to shareholders of RCE, Inc. The acquisition is expected to be consummated in the last quarter of 2022, with the acquisition to be subjected to a regulatory review. d. Due to the pandemic during the first months of 2021, CPA Co. reassessed the performance of its product lines and operating units. On April 12, 2022, in a meeting by the board of directors, after a thorough discussion with the entity's shareholders in a general assembly, CPA Co. firmly decided the conversion of its hotel division into residential and commercial leasing. This will require payment for retrenchment of some, if not most of its hotel employees. Required: Identify for each of the events after the reporting period if adjusting or non-adjusting.

Problem 9 CPA Co. adopts the calendar year as its reporting period. In the process of preparing the financial statements for the year ended December 31, 2021, you, as the entity's auditor, came across the following events that took place from January 1, 2022 to April 10, 2022. a. On March 15, 2022, CPA Co. received a court decision on a lawsuit filed against the company in January 2021. As of December 31, 2021, CPA Co. did not recognize a liability as a result of this case as based on legal counsel, it was not probable that the company will be found liable. On March 15, the court ordered CPA Co. to pay the amount of P2,000,000 to the plaintiff. Although CPA Co. intended to make an appeal, it is still considered probable that the CPA Co. will pay an amount between P1,500,000 to P2,000,000, with P2,000,000 considered to be the most probable amount. b. As a result of an uninsured accident during the year 2020, personal injury suit of P3,000,000 was filed against CPA Co. On December 31, 2020, the company recognized a provision of P2,500,000 as it was the judgment of the company's legal counsel than an unfavorable verdict would result in a loss. However, on April 2, 2022, the court rendered an executory decision requiring CPA Co. to pay P2,000,000 in settlement of the case. c. In February 2022, CPA Co. announced that it had entered into a definitive agreement to acquire RCE, Inc., a leader in mid-class property development. Under the agreement, CPA Co. has agreed to pay approximately P30 billion in case and issue bonds to shareholders of RCE, Inc. The acquisition is expected to be consummated in the last quarter of 2022, with the acquisition to be subjected to a regulatory review. d. Due to the pandemic during the first months of 2021, CPA Co. reassessed the performance of its product lines and operating units. On April 12, 2022, in a meeting by the board of directors, after a thorough discussion with the entity's shareholders in a general assembly, CPA Co. firmly decided the conversion of its hotel division into residential and commercial leasing. This will require payment for retrenchment of some, if not most of its hotel employees. Required: Identify for each of the events after the reporting period if adjusting or non-adjusting.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter1: Accounting And The Financial Statements

Section: Chapter Questions

Problem 54E

Related questions

Question

Transcribed Image Text:Problem 9

CPA Co. adopts the calendar year as its reporting period. In the process of preparing the financial

statements for the year ended December 31, 2021, you, as the entity's auditor, came across the following

events that took place from January 1, 2022 to April 10, 2022.

a. On March 15, 2022, CPA Co. received a court decision on a lawsuit filed against the company in

January 2021. As of December 31, 2021, CPA Co. did not recognize a liability as a result of this

case as based on legal counsel, it was not probable that the company will be found liable. On

March 15, the court ordered CPA Co. to pay the amount of P2,000,000 to the plaintiff. Although

CPA Co. intended to make an appeal, it is still considered probable that the CPA Co. will pay an

amount between P1,500,000 to P2,000,000, with P2,000,000 considered to be the most probable

amount.

b. As a result of an uninsured accident during the year 2020, personal injury suit of P3,000,000 was

filed against CPA Co. On December 31, 2020, the company recognized a provision of

P2,500,000 as it was the judgment of the company's legal counsel than an unfavorable verdict

would result in a loss. However, on April 2, 2022, the court rendered an executory decision

requiring CPA Co. to pay P2,000,000 in settlement of the case.

c. In February 2022, CPA Co. announced that it had entered into a definitive agreement to acquire

RCE, Inc., a leader in mid-class property development. Under the agreement, CPA Co. has

agreed to pay approximately P30 billion in case and issue bonds to shareholders of RCE, Inc.

The acquisition is expected to be consummated in the last quarter of 2022, with the acquisition to

be subjected to a regulatory review.

d. Due to the pandemic during the first months of 2021, CPA Co. reassessed the performance of its

product lines and operating units. On April 12, 2022, in a meeting by the board of directors, after

a thorough discussion with the entity's shareholders in a general assembly, CPA Co. firmly

decided the conversion of its hotel division into residential and commercial leasing. This will

require payment for retrenchment of some, if not most of its hotel employees.

Required: Identify for each of the events after the reporting period if adjusting or non-adjusting.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning