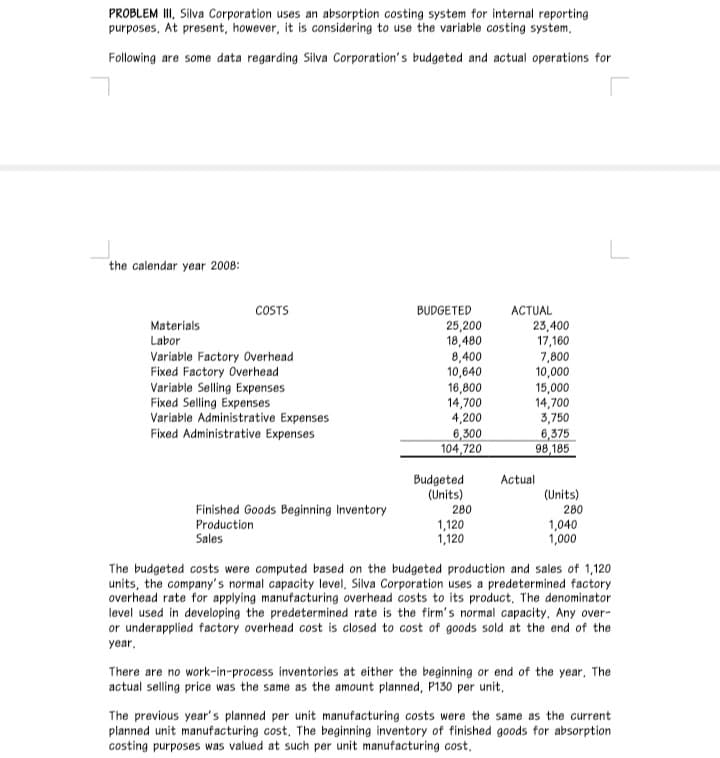

PROBLEM III, Silva Corporation uses an absorption costing system for internal reporting purposes, At present, however, it is considering to use the variable costing system, Following are some data regarding Silva Corporation's budgeted and actual operations for the calendar year 2008: COSTS BUDGETED ACTUAL Materials Labor Variable Factory Overhead Fixed Factory Overhead Variable Selling Expenses Fixed Selling Expenses Variable Administrative Expenses Fixed Administrative Expenses 25,200 18,480 8,400 10,640 23,400 17,160 7,800 10,000 15,000 14,700 3,750 16,800 14,700 4,200 6,300 104,720 6,375 98,185 Budgeted (Units) 280 Actual (Units) 280 Finished Goods Beginning Inventory Production Sales 1,120 1,120 1,040 1,000 The budgeted costs were computed based on the budgeted production and sales of 1,120 units, the company's normal capacity level, Silva Corporation uses a predetermined factory overhead rate for applying manufacturing overhead costs to its product, The denominator level used in developing the predetermined rate is the firm's normal capacity. Any over- or underapplied factory overhead cost is closed to cost of goods sold at the end of the year. There are no work-in-process inventories at either the beginning or end of the year, The actual selling price was the same as the amount planned, Pi30 per unit, The previous year's planned per unit manufacturing costs were the same as the current planned unit manufacturing cost, The beginning inventory of finished goods for absorption costing purposes was valued at such per unit manufacturing cost.

PROBLEM III, Silva Corporation uses an absorption costing system for internal reporting purposes, At present, however, it is considering to use the variable costing system, Following are some data regarding Silva Corporation's budgeted and actual operations for the calendar year 2008: COSTS BUDGETED ACTUAL Materials Labor Variable Factory Overhead Fixed Factory Overhead Variable Selling Expenses Fixed Selling Expenses Variable Administrative Expenses Fixed Administrative Expenses 25,200 18,480 8,400 10,640 23,400 17,160 7,800 10,000 15,000 14,700 3,750 16,800 14,700 4,200 6,300 104,720 6,375 98,185 Budgeted (Units) 280 Actual (Units) 280 Finished Goods Beginning Inventory Production Sales 1,120 1,120 1,040 1,000 The budgeted costs were computed based on the budgeted production and sales of 1,120 units, the company's normal capacity level, Silva Corporation uses a predetermined factory overhead rate for applying manufacturing overhead costs to its product, The denominator level used in developing the predetermined rate is the firm's normal capacity. Any over- or underapplied factory overhead cost is closed to cost of goods sold at the end of the year. There are no work-in-process inventories at either the beginning or end of the year, The actual selling price was the same as the amount planned, Pi30 per unit, The previous year's planned per unit manufacturing costs were the same as the current planned unit manufacturing cost, The beginning inventory of finished goods for absorption costing purposes was valued at such per unit manufacturing cost.

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter7: Allocating Costs Of Support Departments And Joint Products

Section: Chapter Questions

Problem 21E: Refer to the data in Exercise 7.20. The company has decided to use the sequential method of...

Related questions

Question

Transcribed Image Text:PROBLEM III, Silva Corporation uses an absorption costing system for internal reporting

purposes, At present, however, it is considering to use the variable costing system,

Following are some data regarding Silva Corporation's budgeted and actual operations for

the calendar year 2008:

COSTS

BUDGETED

ACTUAL

23,400

17,160

7,800

10,000

15,000

14,700

3,750

Materials

Labor

Variable Factory Overhead

Fixed Factory Overhead

Variable Selling Expenses

Fixed Selling Expenses

Variable Administrative Expenses

Fixed Administrative Expenses

25,200

18,480

8,400

10,640

16,800

14,700

4,200

6,300

104,720

6,375

98,185

Budgeted

(Units)

Actual

(Units)

Finished Goods Beginning Inventory

280

280

Production

Sales

1,120

1,120

1,040

1,000

The budgeted costs were computed based on the budgeted production and sales of 1,120

units, the company's normal capacity level, Silva Corporation uses a predetermined factory

overhead rate for applying manufacturing overhead costs to its product, The denominator

level used in developing the predetermined rate is the firm's normal capacity, Any over-

or underapplied factory overhead cost is closed to cost of goods sold at the end of the

year,

There are no work-in-process inventories at either the beginning or end of the year, The

actual selling price was the same as the amount planned, P130 per unit,

The previous year's planned per unit manufacturing costs were the same as the current

planned unit manufacturing cost, The beginning inventory of finished goods for absorption

costing purposes was valued at such per unit manufacturing cost,

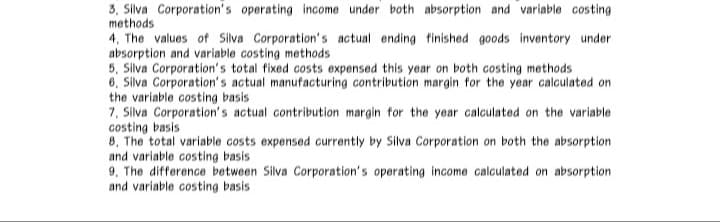

Transcribed Image Text:3, Silva Corporation's operating income under both absorption and variable costing

methods

4, The values of Silva Corporation's actual ending finished goods inventory under

absorption and variable costing methods

5, Silva Corporation's total fixed costs expensed this year on both costing methods

6, Silva Corporation's actual manufacturing contribution margin for the year calculated on

the variable costing basis

7, Silva Corporation's actual contribution margin for the year calculated on the variable

costing basis

8, The total variable costs expensed currently by Silva Corporation on both the absorption

and variable costing basis

9, The difference between Silva Corporation's operating income calculated on absorption

and variable costing basis

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning