Profitability, Liquidity, and Solvency Ratios Shannon Corporation gathered the following information from its financial statements: Net sales $180,000 Net income 25,200 Current assets 40,500 Current liabilities 27,000 Total assets 130,000 Total liabilities 97,500 Using the above data, calculate the following: (1) profit margin, (2) current ratio, (3) debt-to-total assets ratio, and (4) return on assets ratio. Note: Round answers to one decimal place. Profit margin 0 % Current ratio Debt-to-total assets ratio 0 % Return on assets ratio 0 %

Profitability, Liquidity, and Solvency Ratios Shannon Corporation gathered the following information from its financial statements: Net sales $180,000 Net income 25,200 Current assets 40,500 Current liabilities 27,000 Total assets 130,000 Total liabilities 97,500 Using the above data, calculate the following: (1) profit margin, (2) current ratio, (3) debt-to-total assets ratio, and (4) return on assets ratio. Note: Round answers to one decimal place. Profit margin 0 % Current ratio Debt-to-total assets ratio 0 % Return on assets ratio 0 %

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter9: Metric-analysis Of Financial Statements

Section: Chapter Questions

Problem 9.4.10P: Twenty metrics of liquidity, solvency, and profitability The comparative financial statements of...

Related questions

Question

How do I solve this?

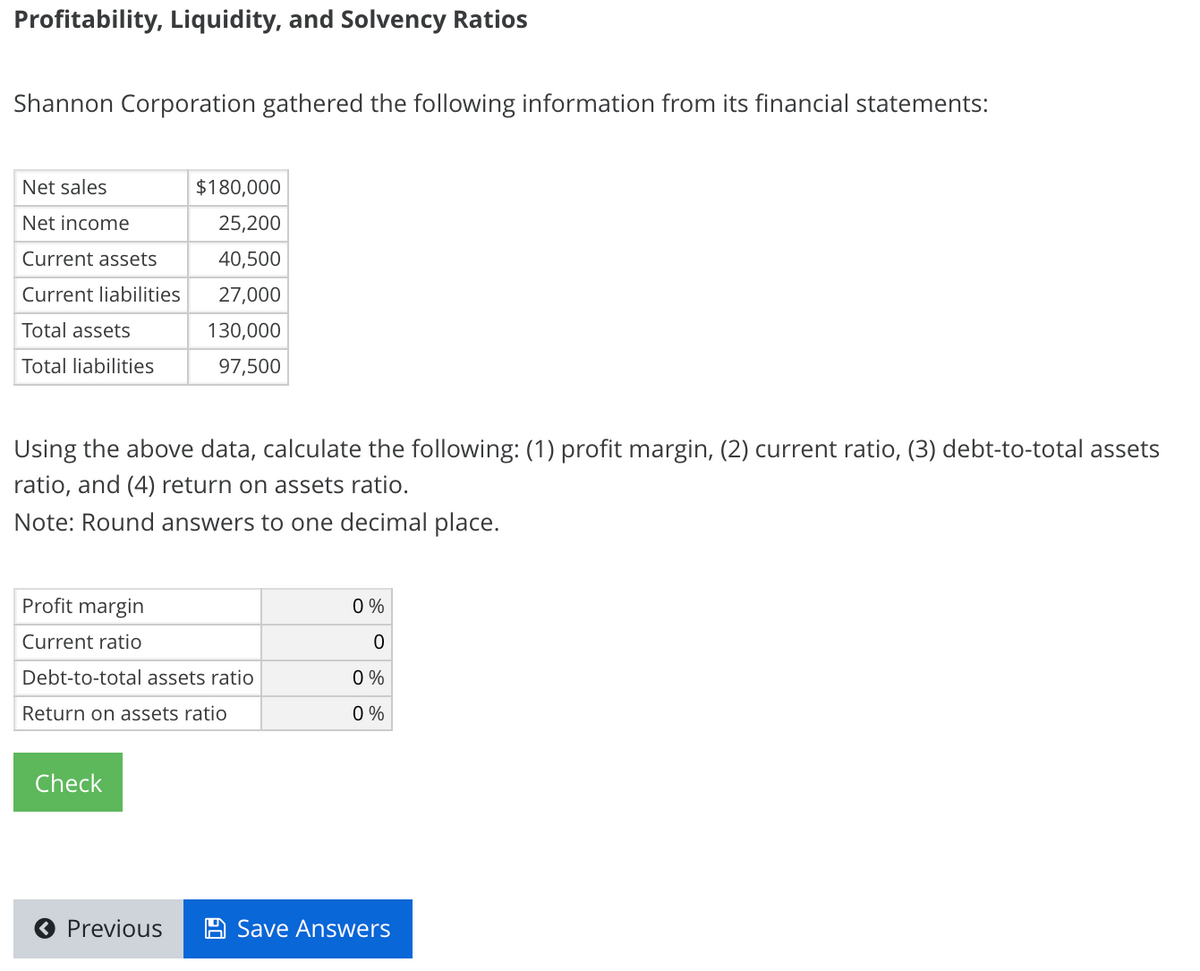

Transcribed Image Text:Profitability, Liquidity, and Solvency Ratios

Shannon Corporation gathered the following information from its financial statements:

Net sales

$180,000

Net income

25,200

Current assets

40,500

Current liabilities

27,000

Total assets

130,000

Total liabilities

97,500

Using the above data, calculate the following: (1) profit margin, (2) current ratio, (3) debt-to-total assets

ratio, and (4) return on assets ratio.

Note: Round answers to one decimal place.

Profit margin

0 %

Current ratio

Debt-to-total assets ratio

0 %

Return on assets ratio

0 %

Check

O Previous

Save Answers

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning