profits, q2 = a+ €g, where eg, are random shocks, and they are i.i.d with normal distribution N(0,0). %3D The agent retires at the end of the first period, and his compensation cannot be based on q2. However, his compensation can depend on the stock price P = 2a + Ep, where ep - N(0,0). The agent's utility function is exponential and equal to where i is the agent's income, while his reservation utility is i.' The principal chooses the agent's compen- sation contract t = w+fq +sP to maximize her expected profit, while accounting for the agent's IR and IC constraints. 1. Derive the optimal compensation contract t = w+ fq1 +sP. 2. Discuss how it depends on o and on its relation with o. Offer some intuition?

profits, q2 = a+ €g, where eg, are random shocks, and they are i.i.d with normal distribution N(0,0). %3D The agent retires at the end of the first period, and his compensation cannot be based on q2. However, his compensation can depend on the stock price P = 2a + Ep, where ep - N(0,0). The agent's utility function is exponential and equal to where i is the agent's income, while his reservation utility is i.' The principal chooses the agent's compen- sation contract t = w+fq +sP to maximize her expected profit, while accounting for the agent's IR and IC constraints. 1. Derive the optimal compensation contract t = w+ fq1 +sP. 2. Discuss how it depends on o and on its relation with o. Offer some intuition?

University Physics Volume 1

18th Edition

ISBN:9781938168277

Author:William Moebs, Samuel J. Ling, Jeff Sanny

Publisher:William Moebs, Samuel J. Ling, Jeff Sanny

Chapter8: Potential Energy And Conservation Of Energy

Section: Chapter Questions

Problem 27P: The potential energy function for either one of the two atoms in a diatomic molecule is often...

Related questions

Question

hand write asap

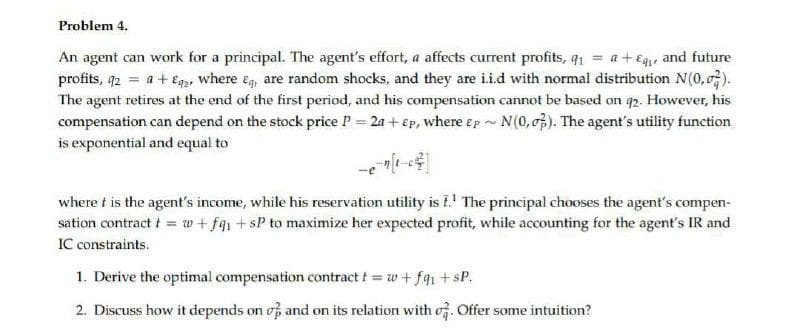

Transcribed Image Text:Problem 4.

An agent can work for a principal. The agent's effort, a affects current profits, q1 = a +Eg, and future

profits, 92 = a + Eqp, where ég, are random shocks, and they are i.i.d with normal distribution N(0, 0).

The agent retires at the end of the first period, and his compensation cannot be based on q2. However, his

compensation can depend on the stock price P = 2a + Ep, where ep - N(0,07). The agent's utility function

is exponential and equal to

where t is the agent's income, while his reservation utility is I.' The principal chooses the agent's compen-

sation contract t = w+ fq1 +sP to maximize her expected profit, while accounting for the agent's IR and

IC constraints.

1. Derive the optimal compensation contract t = w + fq1 +sP.

2. Discuss how it depends on of and on its relation with of. Offer some intuition?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, physics and related others by exploring similar questions and additional content below.Recommended textbooks for you

University Physics Volume 1

Physics

ISBN:

9781938168277

Author:

William Moebs, Samuel J. Ling, Jeff Sanny

Publisher:

OpenStax - Rice University

Classical Dynamics of Particles and Systems

Physics

ISBN:

9780534408961

Author:

Stephen T. Thornton, Jerry B. Marion

Publisher:

Cengage Learning

Physics for Scientists and Engineers: Foundations…

Physics

ISBN:

9781133939146

Author:

Katz, Debora M.

Publisher:

Cengage Learning

University Physics Volume 1

Physics

ISBN:

9781938168277

Author:

William Moebs, Samuel J. Ling, Jeff Sanny

Publisher:

OpenStax - Rice University

Classical Dynamics of Particles and Systems

Physics

ISBN:

9780534408961

Author:

Stephen T. Thornton, Jerry B. Marion

Publisher:

Cengage Learning

Physics for Scientists and Engineers: Foundations…

Physics

ISBN:

9781133939146

Author:

Katz, Debora M.

Publisher:

Cengage Learning