Provide a accounting problem, For that problem, there should be 3 requirements or questions then write a short narrative of your analysis of the problem. Explain what theories/ concepts apply, how, and why. Then present the solution/computation. Write a short narrative explaining the meaning of the final answer - its implication to the firm. Write a short recommendation/conclusion based on the analysis and solutions. You solved a current problem only. How can you provide for the future? What about contingencies that may arise? What proactive measures can you take? And the attached photo is an example of accounting problem.

Provide a accounting problem, For that problem, there should be 3 requirements or questions then write a short narrative of your analysis of the problem. Explain what theories/ concepts apply, how, and why. Then present the solution/computation. Write a short narrative explaining the meaning of the final answer - its implication to the firm. Write a short recommendation/conclusion based on the analysis and solutions. You solved a current problem only. How can you provide for the future? What about contingencies that may arise? What proactive measures can you take? And the attached photo is an example of accounting problem.

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Topic Video

Question

Provide a accounting problem, For that problem, there should be 3 requirements or questions then write a short narrative of your analysis of the problem. Explain what theories/ concepts apply, how, and why. Then present the solution/computation. Write a short narrative explaining the meaning of the final answer - its implication to the

firm. Write a short recommendation/conclusion based on the analysis and solutions. You solved a current problem only. How can you provide for the future? What about contingencies that may arise? What proactive measures can you take? And the attached photo is an example of accounting problem.

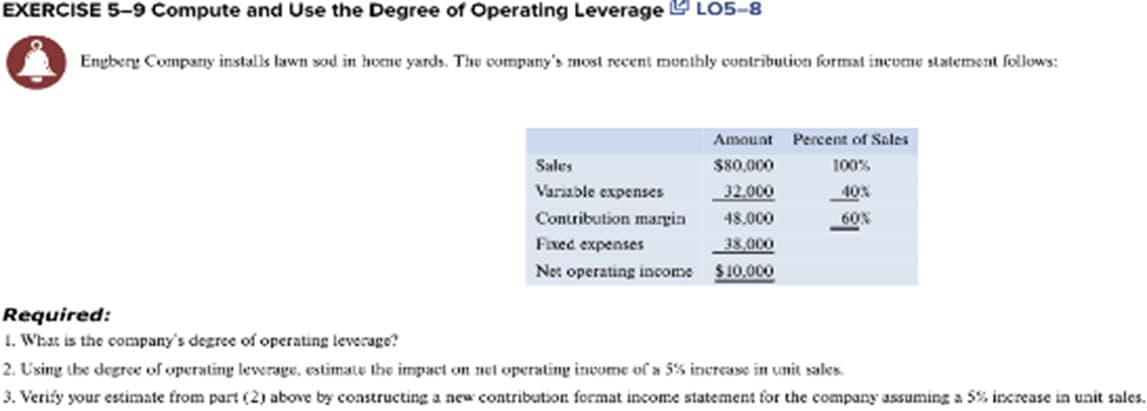

Transcribed Image Text:EXERCISE 5-9 Compute and Use the Degree of Operating Leverage LO5-8

Engbery Company installs lawn sod in hone yards. The company's most recent monthly contribution format income statement follows:

Sales

Variable expenses

Contribution margin

Fixed expenses

Net operating income

Amount Percent of Sales

$80,000

100%

32,000

48,000

38,000

$10.000

60%

Required:

1. What is the company's degree of operating leverage?

2. Using the degree of operating leverage, estimate the impact on net operating income of a 5% increase in unit sales.

3. Verify your estimate from part (2) above by constructing a new contribution format income statement for the company assuming a 5% increase in unit sales.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education