Provide FOUR objectives of the internal control that should be exercised over a wages system.

Provide FOUR objectives of the internal control that should be exercised over a wages system.

Chapter2: Computing Wages And Salaries

Section: Chapter Questions

Problem 11PB: Costa, Inc., recently converted from a 5-day, 40-hour workweek to a 4-day, 40-hour workweek, with...

Related questions

Question

Provide FOUR objectives of the internal control that should be exercised over a wages system.

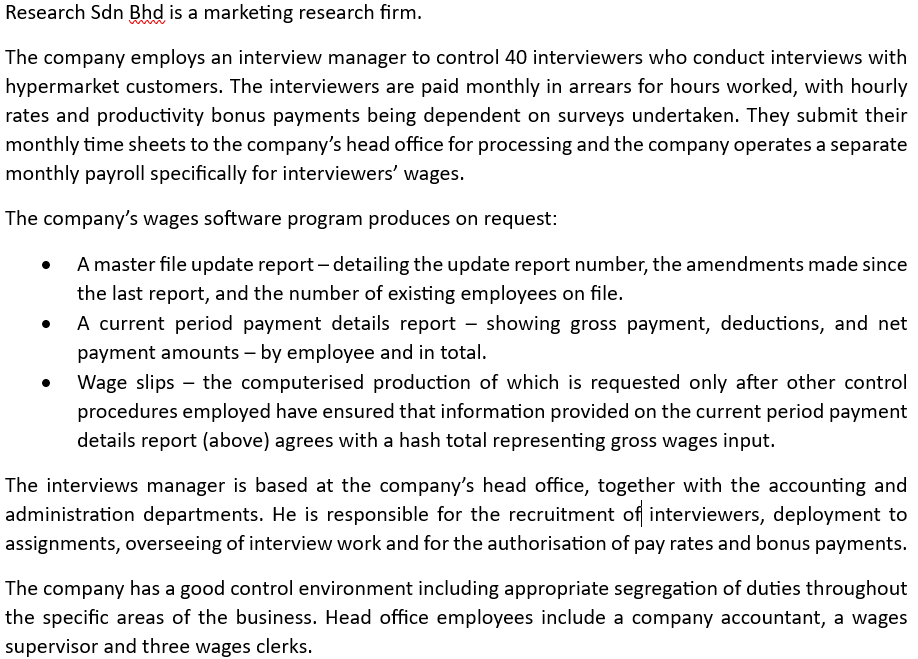

Transcribed Image Text:Research Sdn Bhd is a marketing research firm.

The company employs an interview manager to control 40 interviewers who conduct interviews with

hypermarket customers. The interviewers are paid monthly in arrears for hours worked, with hourly

rates and productivity bonus payments being dependent on surveys undertaken. They submit their

monthly time sheets to the company's head office for processing and the company operates a separate

monthly payroll specifically for interviewers' wages.

The company's wages software program produces on request:

A master file update report - detailing the update report number, the amendments made since

the last report, and the number of existing employees on file.

●

A current period payment details report showing gross payment, deductions, and net

payment amounts - by employee and in total.

Wage slips the computerised production of which is requested only after other control

procedures employed have ensured that information provided on the current period payment

details report (above) agrees with a hash total representing gross wages input.

The interviews manager is based at the company's head office, together with the accounting and

administration departments. He is responsible for the recruitment of interviewers, deployment to

assignments, overseeing of interview work and for the authorisation of pay rates and bonus payments.

The company has a good control environment including appropriate segregation of duties throughout

the specific areas of the business. Head office employees include a company accountant, a wages

supervisor and three wages clerks.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning