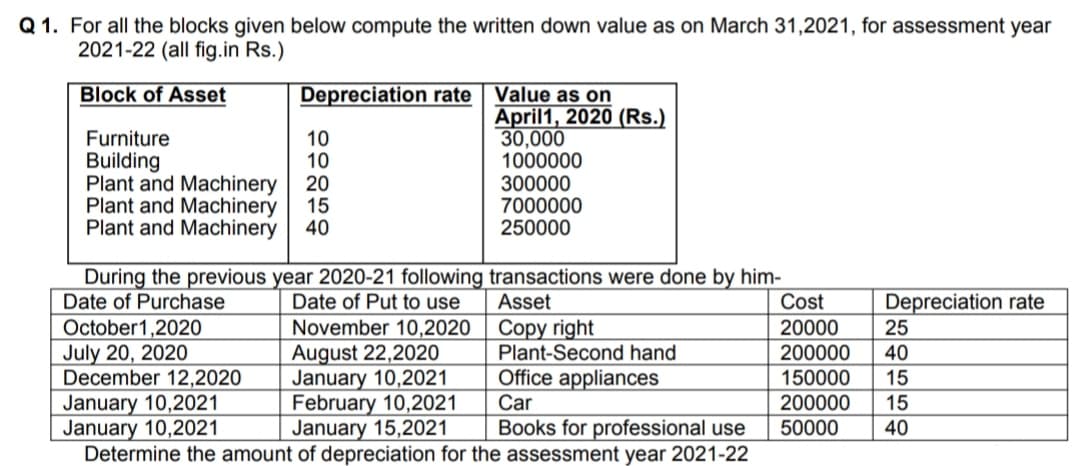

Q 1. For all the blocks given below compute the written down value as on March 31,2021, for assessment year 2021-22 (all fig.in Rs.) Block of Asset Depreciation rate Value as on April1, 2020 (Rs.) 30,000 1000000 300000 7000000 250000 Furniture Building 10 10 Plant and Machinery 20 Plant and Machinery 15 Plant and Machinery 40 During the previous year 2020-21 following transactions were done by him- Date of Purchase October1,2020 July 20, 2020 December 12,2020 Date of Put to use Asset Cost Depreciation rate Copy right Plant-Second hand November 10,2020 August 22,2020 January 10,2021 February 10,2021 January 15,2021 Determine the amount of depreciation for the assessment year 2021-22 20000 25 200000 40 Office appliances Car 150000 200000 15 January 10,2021 January 10,2021 15 Books for professional use 50000 40

Q 1. For all the blocks given below compute the written down value as on March 31,2021, for assessment year 2021-22 (all fig.in Rs.) Block of Asset Depreciation rate Value as on April1, 2020 (Rs.) 30,000 1000000 300000 7000000 250000 Furniture Building 10 10 Plant and Machinery 20 Plant and Machinery 15 Plant and Machinery 40 During the previous year 2020-21 following transactions were done by him- Date of Purchase October1,2020 July 20, 2020 December 12,2020 Date of Put to use Asset Cost Depreciation rate Copy right Plant-Second hand November 10,2020 August 22,2020 January 10,2021 February 10,2021 January 15,2021 Determine the amount of depreciation for the assessment year 2021-22 20000 25 200000 40 Office appliances Car 150000 200000 15 January 10,2021 January 10,2021 15 Books for professional use 50000 40

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter11: Depreciation, Depletion, Impairment, And Disposal

Section: Chapter Questions

Problem 14RE: (Appendix 11.1) Auburn Company purchased an asset on January 1, Year 1, for 150,000. The asset has a...

Related questions

Question

100%

Accurate and detailed solution

Transcribed Image Text:Q 1. For all the blocks given below compute the written down value as on March 31,2021, for assessment year

2021-22 (all fig.in Rs.)

Block of Asset

Depreciation rate Value as on

April1, 2020 (Rs.)

30,000

1000000

300000

7000000

250000

Furniture

10

10

20

Building

Plant and Machinery

Plant and Machinery

15

Plant and Machinery

40

During the previous year 2020-21 following transactions were done by him-

Cost

20000

Depreciation rate

Date of Put to use

November 10,2020

August 22,2020

January 10,2021

February 10,2021

January 15,2021

Determine the amount of depreciation for the assessment year 2021-22

Asset

Copy right

Plant-Second hand

Office appliances

Date of Purchase

October1,2020

July 20, 2020

December 12,2020

January 10,2021

January 10,2021

25

200000

40

150000

200000

15

Car

15

Books for professional use

50000

40

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning