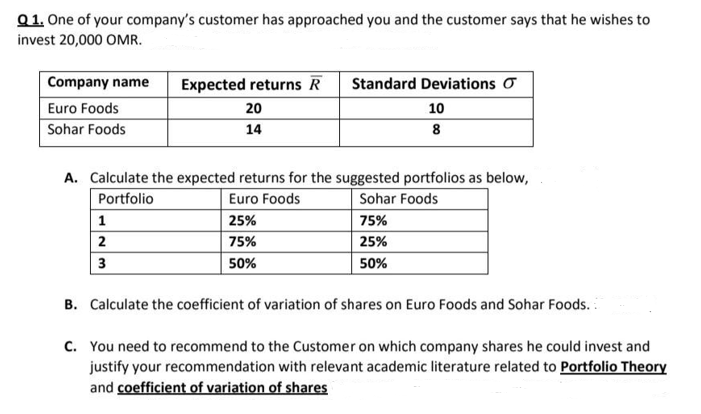

Q1. One of your company's customer has approached you and the customer says that he wishes to invest 20,000 OMR. Company name Expected returns R Standard Deviations O Euro Foods 20 10 Sohar Foods 14 8 A. Calculate the expected returns for the suggested portfolios as below, Portfolio Euro Foods Sohar Foods 1 25% 75%

Q1. One of your company's customer has approached you and the customer says that he wishes to invest 20,000 OMR. Company name Expected returns R Standard Deviations O Euro Foods 20 10 Sohar Foods 14 8 A. Calculate the expected returns for the suggested portfolios as below, Portfolio Euro Foods Sohar Foods 1 25% 75%

Chapter2: The Domestic And International Financial Marketplace

Section: Chapter Questions

Problem 1P

Related questions

Question

Please help me .....

Transcribed Image Text:Q1. One of your company's customer has approached you and the customer says that he wishes to

invest 20,000 OMR.

Company name

Expected returns R

Standard Deviations O

Euro Foods

20

10

Sohar Foods

14

8

A. Calculate the expected returns for the suggested portfolios as below,

Portfolio

Euro Foods

Sohar Foods

1

25%

75%

2

75%

25%

3

50%

50%

B. Calculate the coefficient of variation of shares on Euro Foods and Sohar Foods.

c. You need to recommend to the Customer on which company shares he could invest and

justify your recommendation with relevant academic literature related to Portfolio Theory

and coefficient of variation of shares

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub