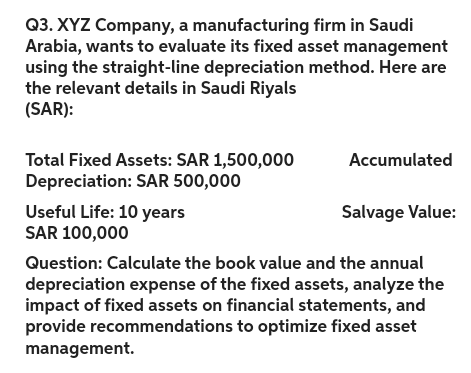

Q3. XYZ Company, a manufacturing firm in Saudi Arabia, wants to evaluate its fixed asset management using the straight-line depreciation method. Here are the relevant details in Saudi Riyals (SAR): Total Fixed Assets: SAR 1,500,000 Depreciation: SAR 500,000 Useful Life: 10 years SAR 100,000 Accumulated Salvage Value: Question: Calculate the book value and the annual depreciation expense of the fixed assets, analyze the impact of fixed assets on financial statements, and provide recommendations to optimize fixed asset management.

Q3. XYZ Company, a manufacturing firm in Saudi Arabia, wants to evaluate its fixed asset management using the straight-line depreciation method. Here are the relevant details in Saudi Riyals (SAR): Total Fixed Assets: SAR 1,500,000 Depreciation: SAR 500,000 Useful Life: 10 years SAR 100,000 Accumulated Salvage Value: Question: Calculate the book value and the annual depreciation expense of the fixed assets, analyze the impact of fixed assets on financial statements, and provide recommendations to optimize fixed asset management.

College Accounting, Chapters 1-27 (New in Accounting from Heintz and Parry)

22nd Edition

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:James A. Heintz, Robert W. Parry

Chapter18: Accounting For Long-term Assets

Section: Chapter Questions

Problem 3CE

Related questions

Question

Transcribed Image Text:Q3. XYZ Company, a manufacturing firm in Saudi

Arabia, wants to evaluate its fixed asset management

using the straight-line depreciation method. Here are

the relevant details in Saudi Riyals

(SAR):

Total Fixed Assets: SAR 1,500,000

Depreciation: SAR 500,000

Useful Life: 10 years

SAR 100,000

Accumulated

Salvage Value:

Question: Calculate the book value and the annual

depreciation expense of the fixed assets, analyze the

impact of fixed assets on financial statements, and

provide recommendations to optimize fixed asset

management.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning