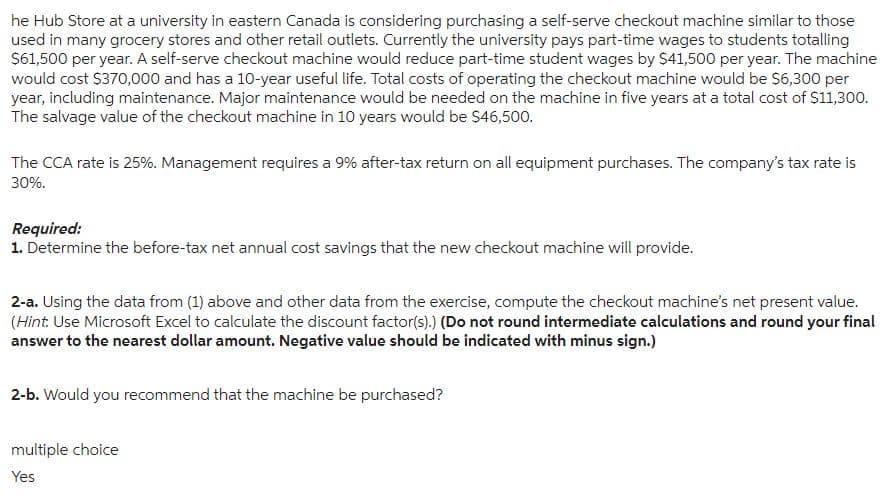

he Hub Store at a university in eastern Canada is considering purchasing a self-serve checkout machine similar to those used in many grocery stores and other retail outlets. Currently the university pays part-time wages to students totalling $61,500 per year. A self-serve checkout machine would reduce part-time student wages by $41,500 per year. The machine would cost $370,000 and has a 10-year useful life. Total costs of operating the checkout machine would be $6,300 per year, including maintenance. Major maintenance would be needed on the machine in five years at a total cost of $11,300. The salvage value of the checkout machine in 10 years would be $46,500. The CCA rate is 25%. Management requires a 9% after-tax return on all equipment purchases. The company's tax rate is 30%. Required: 1. Determine the before-tax net annual cost savings that the new checkout machine will provide. 2-a. Using the data from (1) above and other data from the exercise, compute the checkout machine's net present value. (Hint: Use Microsoft Excel to calculate the discount factor(s).) (Do not round intermediate calculations and round your final answer to the nearest dollar amount. Negative value should be indicated with minus sign.) 2-b. Would you recommend that the machine be purchased? multiple choice Yes

he Hub Store at a university in eastern Canada is considering purchasing a self-serve checkout machine similar to those used in many grocery stores and other retail outlets. Currently the university pays part-time wages to students totalling $61,500 per year. A self-serve checkout machine would reduce part-time student wages by $41,500 per year. The machine would cost $370,000 and has a 10-year useful life. Total costs of operating the checkout machine would be $6,300 per year, including maintenance. Major maintenance would be needed on the machine in five years at a total cost of $11,300. The salvage value of the checkout machine in 10 years would be $46,500. The CCA rate is 25%. Management requires a 9% after-tax return on all equipment purchases. The company's tax rate is 30%. Required: 1. Determine the before-tax net annual cost savings that the new checkout machine will provide. 2-a. Using the data from (1) above and other data from the exercise, compute the checkout machine's net present value. (Hint: Use Microsoft Excel to calculate the discount factor(s).) (Do not round intermediate calculations and round your final answer to the nearest dollar amount. Negative value should be indicated with minus sign.) 2-b. Would you recommend that the machine be purchased? multiple choice Yes

Principles of Cost Accounting

17th Edition

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Edward J. Vanderbeck, Maria R. Mitchell

Chapter10: Cost Analysis For Management Decision Making

Section: Chapter Questions

Problem 11P: Emerald Island Company is considering building a manufacturing plant in County Kerry. Predicting...

Related questions

Question

165.

Subject :- Accounting

Transcribed Image Text:he Hub Store at a university in eastern Canada is considering purchasing a self-serve checkout machine similar to those

used in many grocery stores and other retail outlets. Currently the university pays part-time wages to students totalling

$61,500 per year. A self-serve checkout machine would reduce part-time student wages by $41,500 per year. The machine

would cost $370,000 and has a 10-year useful life. Total costs of operating the checkout machine would be $6,300 per

year, including maintenance. Major maintenance would be needed on the machine in five years at a total cost of $11,300.

The salvage value of the checkout machine in 10 years would be $46,500.

The CCA rate is 25%. Management requires a 9% after-tax return on all equipment purchases. The company's tax rate is

30%.

Required:

1. Determine the before-tax net annual cost savings that the new checkout machine will provide.

2-a. Using the data from (1) above and other data from the exercise, compute the checkout machine's net present value.

(Hint: Use Microsoft Excel to calculate the discount factor(s).) (Do not round intermediate calculations and round your final

answer to the nearest dollar amount. Negative value should be indicated with minus sign.)

2-b. Would you recommend that the machine be purchased?

multiple choice

Yes

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 2 images

Recommended textbooks for you

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Essentials Of Business Analytics

Statistics

ISBN:

9781285187273

Author:

Camm, Jeff.

Publisher:

Cengage Learning,

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT