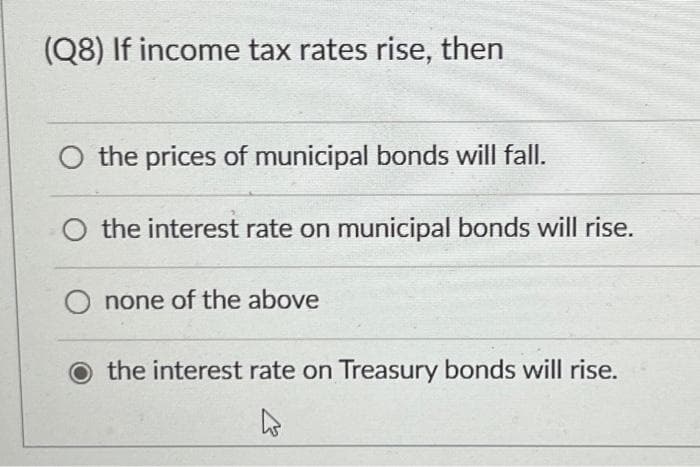

(Q8) If income tax rates rise, then O the prices of municipal bonds will fall. O the interest rate on municipal bonds will rise. O none of the above O the interest rate on Treasury bonds will rise.

Q: Scales and Weights Ltd manufactures three ranges of scales for use in weighing - Paper, Food and…

A: Cost which are avoidable are considered to be relevant for decision making and costs which are not…

Q: Cupola Fan Corporation issued 12%, $520,000, 10-year bonds for $493,000 on June 30, 2021. Debt issue…

A: A journal entry is a form of accounting entry that is used to report a business transaction in a…

Q: HomeLife Life Insurance Company has two service departments (actuarial and premium rating) and two…

A: The overhead costs comprise the indirect production costs. The various methods for the allocation…

Q: Joe's Company produces a single product and has prepared this standard cost sheet for one unit of…

A: The variance is the difference between standard data of production and actual costs incurred for…

Q: Better Corp. completed the following transactions during 2016: 1. Purchased land for $5,000 cash. 2.…

A: The journal entries are prepared to record the transactions on regular basis. The accounting…

Q: Exercise 4-9 (Algo) Equivalent Units and Cost per Equivalent Unit-Weighted-Average Method [LO4-2,…

A: Weighted average method is one of the method of process costing, under which equivalent units means…

Q: In preparing its May 31, 2025 bank reconciliation, Sage Hill Co. has the following information…

A: The organization will compare electronic cash book with e passbook in Bank reconciliation process,…

Q: 14 Sapped Selling price per unit Direct materials Direct labor Variable manufacturing overhead…

A: Contribution margin is the difference between sales and variable cost, which means it is a measure…

Q: Gary manages an electronics store where customers can purchase phones, tablets, or accessories for…

A: ANSWER ;-Total Sales Mix100%Less: Sales mix of Tablet25%Sales mix of Phone & accessories75%Let…

Q: On August 1, Year 3, Carleton Ltd. ordered machinery from a supplier in Hong Kong for HK$500,000.…

A: Hedging is a process of mitigating risk due to the fluctuation of foreign exchange rates. Hedging is…

Q: Match the 10 system failures with a control plan that would best prevent the system failure from…

A: Internal controls are the steps a business takes to safeguard its assets, ensure the reliability and…

Q: Kathy Perry opens a web consulting business called Perry Consulting and completes the following…

A: A journal entry means records a business transaction in the accounting system for an organization.

Q: The Regal Cycle Company manufactures three types of bicycles-a dirt bike, a mountain bike, and a…

A: Relevant cost can be defined as cost which varies under the two alternatives or which is avoidable…

Q: The straight-line method Question: Cost $134,400 Estimated Residual Value $12,500 Estimated Useful…

A: Straight Line Method of depreciation:In this this method, a fixed amount of depreciation would be…

Q: Dividends Per Share Windborn Company has 10,000 shares of cumulative preferred 1% stock, $150 par…

A: Preferred Dividend :— It is calculated by multiplying face value of preferred stock with dividend…

Q: During the current year, OutlyTech Corp. expected to sell 22,500 telephone switches. Fixed costs for…

A: At Break-evenpoint Total contribution margin will be equal to total fixed cost. Margin of safety in…

Q: The following information for Dorado Corporation relates to the three-month period ending September…

A: The last in first out is an inventory valuation method, according to this method, the cost of goods…

Q: On July 1, Indiana Corporation's charter provided for 600,000 shares of $18 par value common stock.…

A: When the company sold its own common stock it is called as issuance of common stock.

Q: Exercise 13-32 (LO. 5) Andrea is an employee of Fern Corporation and single. She also has her own…

A: The total Payroll is required to be computed to reach the amount of net pay received by the employee…

Q: Q1- What is an audit? According to definition, what are the essential feat Or Define auditing as per…

A: Answer:- ISA 200:- The independent auditor's goals are outline in ISA 200, along with the type and…

Q: In Blossom partnership, capital balances are Jason $50,400 and Gary $63,000. The partners share…

A: The difference between share of interest and 45% capital bought by new partner will be considered as…

Q: Haitek Bhd manufactures and sells home-freezer and uses standard costing. Actual data relating to…

A: S.NoMarginal CostingAbsorption Costing1As the name suggest itself variable cost is considered in…

Q: Haitek Bhd manufactures and sells home-freezer and uses standard costing. Actual data relating to…

A: Absorption costing:Absorption costing is compulsory under Generally Accepted Accounting Principles…

Q: Exercise 6-13 Estimating ending inventory-retail method LO6 During 2023, Harmony Co. sold $525,000…

A: The cost to retail ratio is used to measure the inventory at cost using retail method. The ending…

Q: Tulsa Company, (a merchandising Co.) has the following data pertaining to the year ended December…

A: Cost of goods sold (COGS) : Cost of goods sold budget shows the expenses incurred for producing a…

Q: What would be the maximum transfer price per unit?

A: Current Capacity: 100% utilisedSale Price: $111per unitVariable Cost: $81 per unitNew Product…

Q: Lakeland Chemical manufactures a product called Zing. Direct materials are added at the beginning of…

A: Under weighted average method, cost per equivalent unit is calculated by adding the beginning work…

Q: The Regal Cycle Company manufactures three types of bicycles—a dirt bike, a mountain bike, and a…

A: Note: Depreciation of Special Machinery is the irrelevant fixed cost for the Decision making.

Q: The following data is provided for Garcon Company and Pepper Company for the year ended December 31.…

A: The cost of goods manufactured includes the cost of goods that are finished during the period. The…

Q: After closing the revenue and expense accounts, the profit for the year ended December 31, 2024, of…

A: Lets understand the basics.Partnership is an agreement between two or more person who works togather…

Q: On Jan. 1, Year 1, Foxcroft Inc. issued 100 bonds with a face value of $1,000 each for $104,000. The…

A: Journal Entry: Journal entry is the act of keeping records of transactions in an accounting journal.…

Q: The accounting staff of Lambert Company has assembled the following information for the year ended…

A: Answer:- Cash flow statement meaning:- To calculate the net cash flow from the business operations,…

Q: Due to erratic sales of its sole product-a high-capacity battery for laptop computers-PEM, Inc., has…

A: Contribution margin is the difference between the selling price and the variable cost. Break-even…

Q: Andretti Company has a single product called a Dak. The company normally produces and sells 60,000…

A: 1.Determine the incremental net operating income.

Q: Staley Co. manufactures computer monitors. The following is a summary of its basic cost and revenue…

A: CVP analysis is used to identify the changes in costs and volume affect a company's operating…

Q: which it sells to sporting goods stores and golf shops throughout the world. EZ Carry sells a…

A: CVP analysis is used to identify the changes in costs and volume affect a company's operating…

Q: Trevor Mills produces agricultural feed at its only plant. Materials are added at the beginning of…

A: Equivalent units of production means converting the work-in-progress of incomplete units into…

Q: The cost of the automobile is $20,000 including HST. The car is driven for a total of 26,000 km…

A: To calculate the minimum taxable benefit for the employee's personal use of the car, we need to…

Q: Marian Plunket owns her own business and is considering an investment. If she undertakes the…

A: Net present value refers to the method of capital budgeting used for estimating the viability of the…

Q: Cole England operates The Herbal Center, a marijuana dispensary, in Sacramento, California, as a…

A: Schedule C is used to report Profit or Loss from a sole proprietorship business or a profession in a…

Q: Bellingham Company produces a product that requires 2.3 standard pounds per unit. The standard price…

A: Direct Material Price Variance :— It is the difference between the actual quantity of direct…

Q: The records for Carla Vista Company showed the following for 2025: Unearned revenue Accrued revenue…

A: The accrued revenue is the revenue earned but not received in cash.The unearned revenue is the…

Q: What is accrual accounting and why is it the preferred method for most organisations?

A: The following are two methods used for financial reporting as follows under:-.Cash accountingAccrual…

Q: Father Bernard, a self-employed married man with two children who both attend private Universities…

A: After all allowable deductions and allowances have been removed from the gross income, the remaining…

Q: I need to make the income statement. On December 1, 2022, Ivanhoe Distributing Company had the…

A: Income statement is a statement showing the revenue and expenses to calculate the net profit from…

Q: Adger Corporation is a service company that measures its output based on the number of customers…

A: Revenue variance is the difference between the actual revenue and the flexible budget revenue. If…

Q: Shortt Company has been approached by a customer who is offering a one-time-only special order to…

A: To analyze the special order, we need to consider the relevant costs and compare them to the…

Q: 3. The standard material cost for a normal mix of one tonne of Urea fertilizer is based on Chemical…

A: Material Price variance = It means difference between Standard material Price for actual material…

Q: a) What should the company record as the cost of the new asset? b) How much gain is recognized? c)…

A: Cost of Old Asset = $455,000Accumulated Depreciation = $172,000Fair Value of New Asset =…

Q: Daniels Company is owned and operated by Thomas Daniels. The following selected transactions were…

A: Lets understand the basics.As per accounting equation, total assets are always equals to total…

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

- If the U.S. Treasury deposits income tax receipts into its account at the Federal Reserve, then a. the money multiplier will decrease b. the money multiplier will increase c. the monetary base will decrease d. the monetary base will increase Expected inflation can be estimated as a. the return on a TIPS bond b. the return on a Treasury bond c. the return on a TIPS bond minus the return on a Treasury bond d. the return on a Treasury bond minus the return on a TIPS bond A decrease in the expected return on stocks will a. shift the demand curve for bonds leftwards b. shift the demand curve for bonds rightwards c. shift the supply curve for bonds leftwards d. shift the supply curve for bonds rightwards Which of the following is part of M2? a. Small time deposits b. Money market mutual funds c. Currency held by foreigners d. All of the aboveyour professor has taught you that because municipal bonds (or any other tax-saving) bond would offer a tax saving on the interest income, the interest rate offered by such bonds may be even lower than the treasury bonds. while what your professor has told you is correct, imagine a situation where income tax rates are reduced. describe the effect of a reduction in income tax rates on the interest rates of municipal bonds? would interest rates on Treasury bonds be affected as well? how?The Federal Reserve decided to buy bonds in order to bring the economy back to full employment. This must mean that the Federal Reserve believes that the full employment level of output is a not enough information b below 1 million c exactly 1 million d above 1 million

- If the municipal bond rate is 6% and the corporate bond rate is 8%, what is the marginal tax rate, assuming investors are indifferent between the two bonds?Do you agree or disagree with the statement? Explain your answer. When the Treasury of the United States issues bonds and sells them to the public to finance the deficit, the money supply remains unchanged because every dollar of money taken in by the Treasury goes right back into circulation through government spending. This is not true when the Fed sells bonds to the public.If the cost of debt after tax for Sohar Textiles is 0.17 and its tax rate is 0.219 then what is the cost of debt? Select one: a. None of the options b. 0.2072 c. 0.2177 d. 0.1328 e. 0.1395

- All other things being equal, which of the following would cause interest rates to rise? a. The economy slides into a recession. b. The federal government's budget deficit declines. c. The rate of inflation decreases. d. The Federal Reserve contracts the money supply.2. Which of the following is a reason why zero-coupon bonds are the best way for high-income taxpayers to extract maximum value from tax-exempt state and local government bonds? a.The investments pay interest continually. b.The interest earned on the accumulated principal and interest is not tax-exempt. c.Zero-coupon bonds are high-risk, high-reward bonds. d.Zero-coupon bonds include more transaction fees. e.Zero-coupon bonds allow the investor to make additional tax-exempt investments.Assuming the government is selling a government bond to fight COVID-19, and at the same time, ASHANTI Goldfields Company is selling a corporate bond to increase its production. Under what conditions will the production-linked corporate bond be oversubscribed at the expense of the government bond. Explore all possible scenarios. [Not more than one-page]

- The federal budget deficit has been growing over the past several years. What impact will this fiscal change have on the supply of Treasury bonds? A. Bond supply does not change B. Bond supply increases C. Bond supply declinesWhich of the following statement is true? Interest rates on Municipal bonds are on average Question 24 options: lower than those of the U.S. government bonds with the same terms to maturity because municipal bonds are not as liquid as the U.S. government bonds . higher than those of the U.S. government bonds with the same terms to maturity because municipal bonds are not as risky as the U.S. government bonds . lower than those of the U.S. government bonds with the same terms to maturity because municipal bonds are not as risky as the U.S. government bonds . lower than those of the U.S. government bonds with the same terms to maturity because many local business prefers municipal bonds. higher than those of the U.S. government bonds with the same terms to maturity because municipal bonds are not as liquid as the U.S. government bonds .H10. Assume that initially, the risk premium, ρ = 0 and that the domestic and foreign interest rates are given by R = .06, R* = .05. Suppose that the risk premium depends linearly on the difference between domestic government debt, B, and domestic assets of the central bank, A, i.e., ρ = ρ (B-A) Find the new domestic interest rate if a sterilized purchase of foreign assets adjusts A s.t. (a) B - A = -.01/ ρ0 (b) B - A = .03/ ρ0