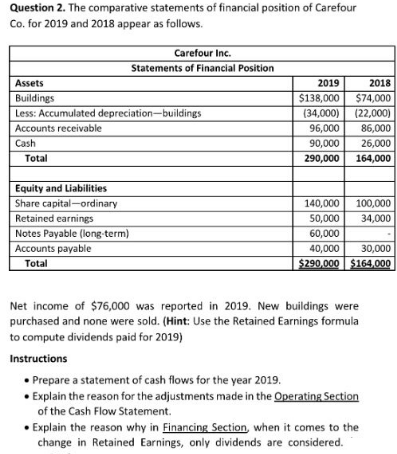

Question 2. The comparative statements of financial position of Carefour Co. for 2019 and 2018 appear as follows. Carefour Inc. Statements of Financial Position Assets 2019 2018 $138,000 Buildings Less: Accumulated depreciation-buildings $74,000 (34,000) (22,000) Accounts receivable 96,000 86,000 Cash 90,000 26,000 Total 290,000 164,000 Equity and Liabilities Share capital-ordinary 140,000 100,000 Retained earnings 50,000 34,000 Notes Payable (long-term) Accounts payable 60,000 40,000 30,000 Total $290,000 $164,000 Net income of $76,000 was reported in 2019. New buildings were purchased and none were sold. (Hint: Use the Retained Earnings formula to compute dividends paid for 2019) Instructions • Prepare a statement of cash flows for the year 2019. • Explain the reason for the adjustments made in the Operating Section of the Cash Flow Statement. • Explain the reason why in Financing Section, when it comes to the change in Retained Earnings, only dividends are considered.

Question 2. The comparative statements of financial position of Carefour Co. for 2019 and 2018 appear as follows. Carefour Inc. Statements of Financial Position Assets 2019 2018 $138,000 Buildings Less: Accumulated depreciation-buildings $74,000 (34,000) (22,000) Accounts receivable 96,000 86,000 Cash 90,000 26,000 Total 290,000 164,000 Equity and Liabilities Share capital-ordinary 140,000 100,000 Retained earnings 50,000 34,000 Notes Payable (long-term) Accounts payable 60,000 40,000 30,000 Total $290,000 $164,000 Net income of $76,000 was reported in 2019. New buildings were purchased and none were sold. (Hint: Use the Retained Earnings formula to compute dividends paid for 2019) Instructions • Prepare a statement of cash flows for the year 2019. • Explain the reason for the adjustments made in the Operating Section of the Cash Flow Statement. • Explain the reason why in Financing Section, when it comes to the change in Retained Earnings, only dividends are considered.

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter1: Accounting As A Form Of Communication

Section: Chapter Questions

Problem 1.2DC: Reading and Interpreting Chipotles Financial Statements Refer to the financial statements for...

Related questions

Question

Transcribed Image Text:Question 2. The comparative statements of financial position of Carefour

Co. for 2019 and 2018 appear as follows.

Carefour Inc.

Statements of Financial Position

Assets

2019

2018

$138,000

Buildings

Less: Accumulated depreciation-buildings

$74,000

(34,000)

(22,000)

Accounts receivable

96,000

86,000

Cash

90,000

26,000

Total

290,000

164,000

Equity and Liabilities

Share capital-ordinary

140,000

100,000

Retained earnings

50,000

34,000

Notes Payable (long-term)

Accounts payable

60,000

40,000

30,000

Total

$290,000 $164,000

Net income of $76,000 was reported in 2019. New buildings were

purchased and none were sold. (Hint: Use the Retained Earnings formula

to compute dividends paid for 2019)

Instructions

• Prepare a statement of cash flows for the year 2019.

• Explain the reason for the adjustments made in the Operating Section

of the Cash Flow Statement.

• Explain the reason why in Financing Section, when it comes to the

change in Retained Earnings, only dividends are considered.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning