Question 13 45 XYZ Ltd operate two production lines. One was installed in April 2017 at a cost of €200,000. The other was Installed in February 2019 at a cost of €340,000. They charge depreciation using the straight-line method at a rate of 15% pa for an estimated useful economic life of 5 years, charging a full year in the year of acquisition. As at the year ended 31 Dec 2020, the production manager has filed a report noting that the residual value of the production lines is now expected to be only 5% of original cost. The Directors want to reflect this change in the accounts for the year ending 31 Dec 2020. What should be the depreciation charge for the year? (132,200 (140,200 Oa79,000 C185,000

Question 13 45 XYZ Ltd operate two production lines. One was installed in April 2017 at a cost of €200,000. The other was Installed in February 2019 at a cost of €340,000. They charge depreciation using the straight-line method at a rate of 15% pa for an estimated useful economic life of 5 years, charging a full year in the year of acquisition. As at the year ended 31 Dec 2020, the production manager has filed a report noting that the residual value of the production lines is now expected to be only 5% of original cost. The Directors want to reflect this change in the accounts for the year ending 31 Dec 2020. What should be the depreciation charge for the year? (132,200 (140,200 Oa79,000 C185,000

Fundamentals of Financial Management (MindTap Course List)

14th Edition

ISBN:9781285867977

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter12: Cash Flow Estimation And Risk Analysis

Section: Chapter Questions

Problem 10P: REPLACEMENT ANALYSIS The Dauten Toy Corporation currently uses an injection molding machine that was...

Related questions

Question

Transcribed Image Text:Question 13 45

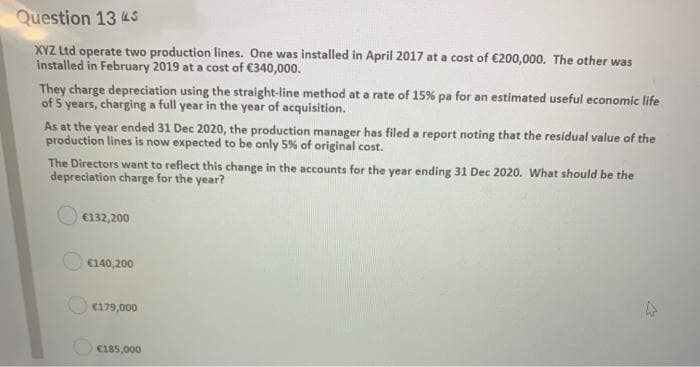

XYZ Ltd operate two production lines. One was installed in April 2017 at a cost of €200,000. The other was

installed in February 2019 at a cost of €340,000.

They charge depreciation using the straight-line method at a rate of 15% pa for an estimated useful economic life

of 5 years, charging a full year in the year of acquisition.

As at the year ended 31 Dec 2020, the production manager has filed a report noting that the residual value of the

production lines is now expected to be only 5% of original cost.

The Directors want to reflect this change in the accounts for the year ending 31 Dec 2020. What should be the

depreciation charge for the year?

€132,200

€140,200

(179,000

C185,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning