Question #2 Gloria's a food manufacturer is trying to make an assessment of its operations for the past year. The entity operates a standard marginal costing system and manufactures one product, the blaster for which the following standard revenue and cost data per unit of product is available: Selling price Direct material A $24.00 2.5 kg at $3.40 per kg 1.5 kg at $2.40 per kg 0.45 hrs. at $12.00 per hour Direct material B Direct labour Actual data for the twelve-month period was as follows: Sales and production 48,000 units of the blaster were produced and sold for $1,161,600 Direct material A Direct material B 121,950 kg were used at a cost of $402,435 67,200 kg were used at a cost of $168,000 Employees worked for 18,900 hours, but 19,200 hours were paid at a cost of $234,240 Direct labour Budgeted sales for the period were 50,000 units of Product Blaster. A recession last year meant that the market for the product declined by 5%. Required: (a) Calculate the following variances. (i) Sales volume variance. (ii) Planning and operational variances for sales volume. (iii) Price, mix and yield variances for each material. (b) Suggest two possible explanations for the material price and yield variances calculated in part (a).

Question #2 Gloria's a food manufacturer is trying to make an assessment of its operations for the past year. The entity operates a standard marginal costing system and manufactures one product, the blaster for which the following standard revenue and cost data per unit of product is available: Selling price Direct material A $24.00 2.5 kg at $3.40 per kg 1.5 kg at $2.40 per kg 0.45 hrs. at $12.00 per hour Direct material B Direct labour Actual data for the twelve-month period was as follows: Sales and production 48,000 units of the blaster were produced and sold for $1,161,600 Direct material A Direct material B 121,950 kg were used at a cost of $402,435 67,200 kg were used at a cost of $168,000 Employees worked for 18,900 hours, but 19,200 hours were paid at a cost of $234,240 Direct labour Budgeted sales for the period were 50,000 units of Product Blaster. A recession last year meant that the market for the product declined by 5%. Required: (a) Calculate the following variances. (i) Sales volume variance. (ii) Planning and operational variances for sales volume. (iii) Price, mix and yield variances for each material. (b) Suggest two possible explanations for the material price and yield variances calculated in part (a).

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter11: Differential Analysis And Product Pricing

Section: Chapter Questions

Problem 22E: Total cost method of product pricing Based on the data presented in Exercise 17, assume that Smart...

Related questions

Question

Please help me

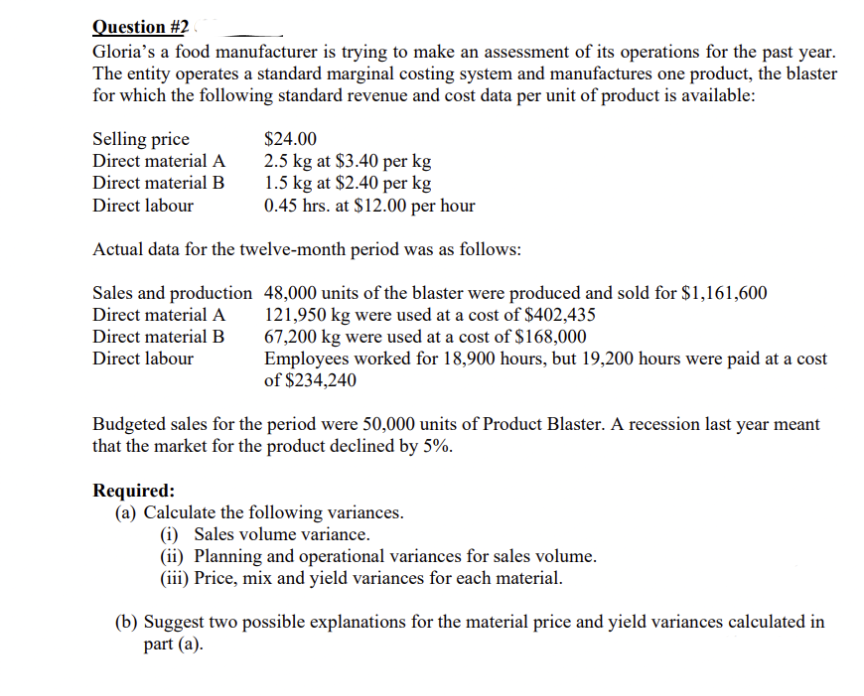

Transcribed Image Text:Question #2

Gloria's a food manufacturer is trying to make an assessment of its operations for the past year.

The entity operates a standard marginal costing system and manufactures one product, the blaster

for which the following standard revenue and cost data per unit of product is available:

$24.00

Selling price

Direct material A

2.5 kg at $3.40 per kg

1.5 kg at $2.40 per kg

0.45 hrs. at $12.00 per hour

Direct material B

Direct labour

Actual data for the twelve-month period was as follows:

Sales and production 48,000 units of the blaster were produced and sold for $1,161,600

121,950 kg were used at a cost of $402,435

67,200 kg were used at a cost of $168,000

Employees worked for 18,900 hours, but 19,200 hours were paid at a cost

of $234,240

Direct material A

Direct material B

Direct labour

Budgeted sales for the period were 50,000 units of Product Blaster. A recession last year meant

that the market for the product declined by 5%.

Required:

(a) Calculate the following variances.

(i) Sales volume variance.

(ii) Planning and operational variances for sales volume.

(iii) Price, mix and yield variances for each material.

(b) Suggest two possible explanations for the material price and yield variances calculated in

part (a).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning