Question 2 The comparative income statement of Zalora Company appears below: Zalora Company Comparative Statements of Comprehensive Income for the years ended 31 December 2020 (RM) 2019 (RM) Net sales 750,000 650,000 Less: Expenses Cost of goods sold Selling expenses Interest expense 388,000 330,000 108,000 96,000 10,000 10,000

Question 2 The comparative income statement of Zalora Company appears below: Zalora Company Comparative Statements of Comprehensive Income for the years ended 31 December 2020 (RM) 2019 (RM) Net sales 750,000 650,000 Less: Expenses Cost of goods sold Selling expenses Interest expense 388,000 330,000 108,000 96,000 10,000 10,000

Accounting (Text Only)

26th Edition

ISBN:9781285743615

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter17: Financial Statement Analysis

Section: Chapter Questions

Problem 17.1EX

Related questions

Question

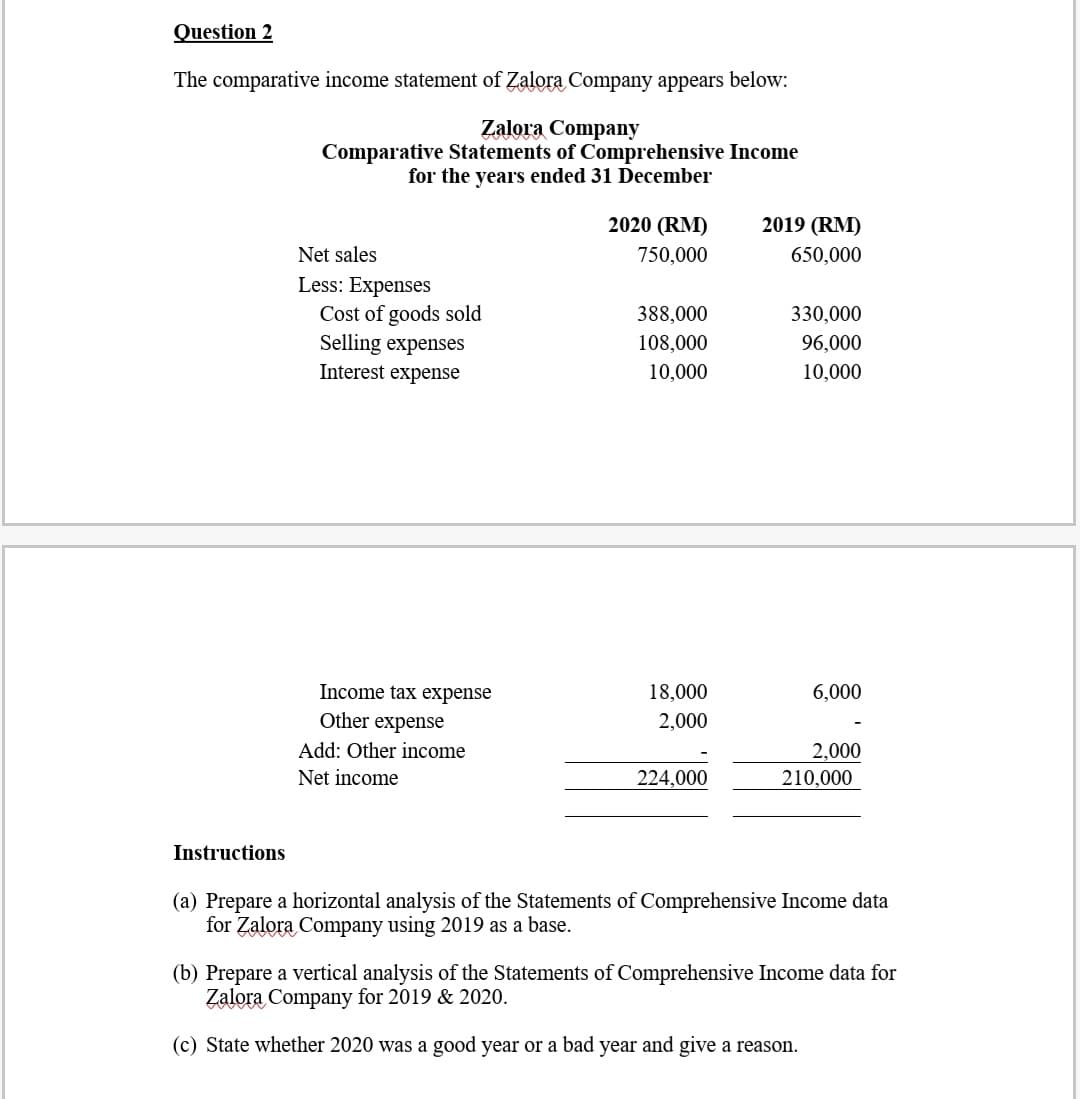

Transcribed Image Text:Question 2

The comparative income statement of Zalora Company appears below:

Zalora Company

Comparative Statements of Comprehensive Income

for the years ended 31 December

2020 (RM)

2019 (RM)

Net sales

750.000

650,000

Less: Expenses

Cost of goods sold

Selling expenses

Interest expense

388,000

330,000

108,000

96,000

10,000

10,000

Income tax expense

18,000

6,000

Other expense

2,000

Add: Other income

2,000

Net income

224,000

210,000

Instructions

(a) Prepare a horizontal analysis of the Statements of Comprehensive Income data

for Zalora Company using 2019 as a base.

(b) Prepare a vertical analysis of the Statements of Comprehensive Income data for

Zalora Company for 2019 & 2020.

(c) State whether 2020 was a good year or a bad year and give a reason.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning