Question 20 Hide Correct Answer Show Responses Suppose there is a negative output gap of 12 (the output gap is the difference between current output and desired output). The current real interest rate, r, is 0.05 and the investment function reads 1 = 20-200r. The mpc is 0.5. By how much should the central bank decrease the real rate to close the output gap? Answer up to two decimal points

Question 20 Hide Correct Answer Show Responses Suppose there is a negative output gap of 12 (the output gap is the difference between current output and desired output). The current real interest rate, r, is 0.05 and the investment function reads 1 = 20-200r. The mpc is 0.5. By how much should the central bank decrease the real rate to close the output gap? Answer up to two decimal points

Chapter10: Kenesian Macroeconomics And Economic Instability: A Critique Of The Self Regulating Economy

Section: Chapter Questions

Problem 11QP

Related questions

Question

Can I have easy explanations to these please. I do not understand.

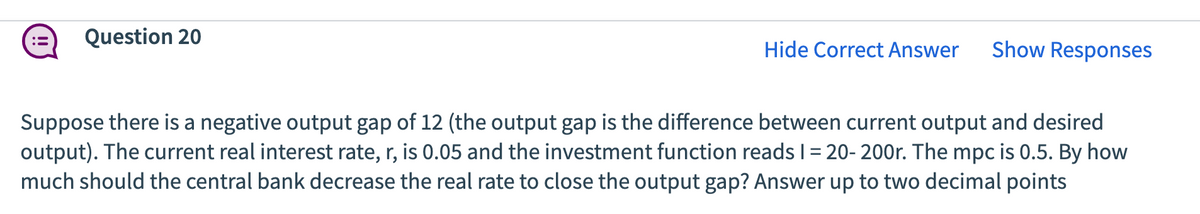

Transcribed Image Text:Question 20

Hide Correct Answer

Show Responses

Suppose there is a negative output gap of 12 (the output gap is the difference between current output and desired

output). The current real interest rate, r, is 0.05 and the investment function reads 1 = 20-200r. The mpc is 0.5. By how

much should the central bank decrease the real rate to close the output gap? Answer up to two decimal points

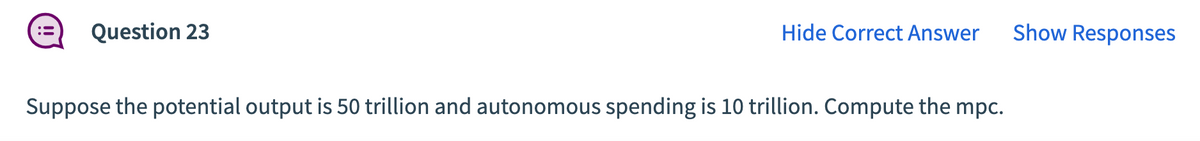

Transcribed Image Text:Question 23

Hide Correct Answer Show Responses

Suppose the potential output is 50 trillion and autonomous spending is 10 trillion. Compute the mpc.

Expert Solution

Step 1

potential output level means that economy is producing at full capacity and beyond that production cannot be done with same resources and technology.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning