ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

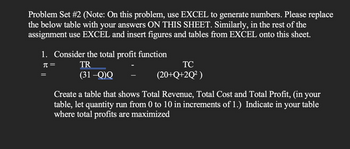

Transcribed Image Text:Problem Set #2 (Note: On this problem, use EXCEL to generate numbers. Please replace

the below table with your answers ON THIS SHEET. Similarly, in the rest of the

assignment use EXCEL and insert figures and tables from EXCEL onto this sheet.

1. Consider the total profit function

π =

TR

(31-Q)Q

=

TC

(20+Q+2Q²)

Create a table that shows Total Revenue, Total Cost and Total Profit, (in your

table, let quantity run from 0 to 10 in increments of 1.) Indicate in

where total profits are maximized

your table

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Question 4 Pizza Inn Company Ltd is a new company in Accra that produces pizza, Lasagna, and Spaghetti Bolognese. The table below shows the production costs for the company. Use the table to answer the questions below Table 1: Cost for Producing Pizza Quantity Total Fixed Total Cost (TFC) Variable Cost (TVC) 1 2 3 4 5 6 60 60 60 60 60 60 Total Cost (TC) (AFC) Average Average Average Marginal Fixed Cost Variable Cost Cost (AC) (MC) 90 100 105 115 135 180 Cost (AVC) a) Fill in the cost table for Pizza Inn Company Ltd b) If the Pizza Inn operates under Perfect Competition and the market price is 20 (i.e. P=Gh20) what is the profit maximizing output level from the table c) Is this firm in the short run or long run and why? d) At the profit maximizing output level (found in A), is the firm making profit or loss; and what is the value of this profit or loss e) From your answer for D, should the firm shut down or continue to operate and why? (5 marks) f) Why is it that the Average Variable…arrow_forwardComplete the following table (6 points): Quantity/Output Total Fixed Cost Average Fixed Cost Total Variable Cost Average Variable Cost Total Cost Average Total Cost Marginal Cost (units) (dollars) TC=FC+VC (dollars) AFC=FC/Q (dollars) (dollars) AVC=VC/Q (dollars) TC=FC+VC (dollars) ATC-TC/Q=AVC+AFC (dollars) MC=DTC/DC 0 $50 $0 $200 10 $50 $20 $70 25 $50 $40 $90 45 $50 $60 $110 60 $50 $80 $130 70 $50 $100 $150arrow_forwardThe WipeOut Ski Company manufactures skis for beginners. Fixed costs are $30. Fill in Table 7.16 for total cost, average variable cost, average total cost, and marginal cost. On two separate sets of axes, draw the Total Cost Curves (TC, TVC, TFC) and the Per-Unit Cost Curves (MC, ATC, AVC). (Please draw the picture) Note that there is no "inflection point" on these curves - why is that?arrow_forward

- I'm not sure if I am doing this correctly.arrow_forward5. Consider the cost for a firm as described by the function: 3000 C(q) = 200 + q². 21 a. What are the fixed cost and variable cost function? b. Derive functions that describe the average cost and the marginal cost of production? c. If the average cost is $300 per unit of output, and 950 units of output are produced what is the cost of production? Show your work.arrow_forwardWith the following data: Quantity=2,000 Variable costs= $2,000 Fixed costs= $10,000 Price= $1 what is the: Total cost= Total revenue= Profit= Marginal Costs=arrow_forward

- 12. A firm’s production is represented by the following function: Q = L0.4 K0.6 . The rental rate of capital (r) is $30 and the wage rate (w) is $5. For a given level of output, what should be the ratio of capital to labor in order to minimize costs? How much capital and labor should be used to produce 600 units of output? What is the total cost? What is the short run total cost if output is decreased to 300 units? What would be the optimal choice of capital and labor in the long run in order to produce 300 units of output? What is the long-run total cost? Does this production function exhibit increasing, decreasing, or constant returns to scale? Please answer based on the cost calculations in parts c and d.arrow_forwardIke's Bikes is a major manufacturer of bicycles. Currently, the company produces bikes using only one factory. However, it is considering expanding production to two or even three factories. The following table shows the company's short-run average total cost each month for various levels of production if it uses one, two, or three factories. (Note: Q equals the total quantity of bikes produced by all factories.) Average Total Cost (Dollars per bike) Number of Factories O = 100 Q = 200 Q = 300 Q = 400 Q = 500 O = 600 1 520 400 320 400 560 800 660 480 320 320 480 660 800 560 400 320 400 520 Suppose Ike's Bikes is currently producing 500 bikes per month in its only factory. Its short-run average total cost is $ per bike. Suppose Ike's Bikes is expecting to produce 500 bikes per month for several years. In this case, in the long run, it would choose to produce bikes using On the following graph, plot the three short-run average total cost curves (SRATC) for Ike's Bikes from the previous…arrow_forwardMonth (m): 4 Day (d): 1 Use the two numbers above, m and d, to complete the cost function for a perfectly competitive firm: Cost (q) = m q2 + d = (30) For a cost function like yours, Marginal Cost (MC) = 2 m q . Specifically, what are the following for the cost function you wrote out above? Fixed Cost = Average Total Cost = Cost (q)/q = Variable Cost = Average Fixed Cost = FC/q = Marginal Cost = 2 m q = Average Variable Cost = VC/q = (15) Fill in the table with your values from your cost function. q Total Cost AVC AFC ATC MC 0 0 0 -- -- -- 1 2 3 4 5 6arrow_forward

- TR = 25Q - 2Q? TC = 32 + 5Q Please create a graph illustrating relationship between the Total Revenue and Total Cost function for 0arrow_forwardUse the information in the graph to the right to find the values for the following at an output level of 50. 100- MC The marginal cost is $ (Enter a numeric response using an integer.) The total cost is $ ATC AVC The variable cost is $ 56: The fixed cost is $ 45... 38...... 0+ 50 Quantity of outputarrow_forward4. Various measures of cost Douglas Fur is a small manufacturer of fake-fur boots in San Francisco. The following table shows the company's total cost of production at various production quantities. Fill in the remaining cells of the following table. Average Variable Cost (Dollars per pair) Average Total Cost (Dollars per pair) Quantity Total Cost Marginal Cost Fixed Cost Variable Cost (Pairs) (Dollars) (Dollars) (Dollars) (Dollars) 120 1 210 2 270 3 315 4 380 5 475 630arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education