QUESTION 22 The value of land (as diannot trom human improvements to landi is oreated by nature and sodiety. In adolion, the supply of land is perfectiy inelastio. Iam a strong advooate of raising taxes on land and other natural resourcee, but also reducing tax improvemernts (eg. buldingn). Which of the folkowing statements about siting taxes from buidrgs to land is FALSE? on human The supply of buidrgs woud increase, eupecialy where land values are high None of the land tax inorease woud be pased on to reriers The tax shit would reduce speoulation in land The tax sit would create a dead weight los of ecoromic surplus The tax ohit should reduce urban aprawl

QUESTION 22 The value of land (as diannot trom human improvements to landi is oreated by nature and sodiety. In adolion, the supply of land is perfectiy inelastio. Iam a strong advooate of raising taxes on land and other natural resourcee, but also reducing tax improvemernts (eg. buldingn). Which of the folkowing statements about siting taxes from buidrgs to land is FALSE? on human The supply of buidrgs woud increase, eupecialy where land values are high None of the land tax inorease woud be pased on to reriers The tax shit would reduce speoulation in land The tax sit would create a dead weight los of ecoromic surplus The tax ohit should reduce urban aprawl

Microeconomics: Principles & Policy

14th Edition

ISBN:9781337794992

Author:William J. Baumol, Alan S. Blinder, John L. Solow

Publisher:William J. Baumol, Alan S. Blinder, John L. Solow

Chapter18: Pricing The Factors Of Production

Section: Chapter Questions

Problem 4TY

Related questions

Question

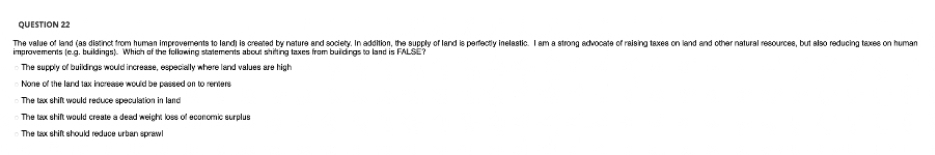

Transcribed Image Text:QUESTION 22

The value of land (as distinct from human improvements to landi is created by nature and society. In adoltion, the supply of land is perfectly inelastic. I am a strong advocate of raising taxes on land and other natural resourcee, but also reducing taxes on human

improvements (eg. buildings). Which of the feloning statements about shiting taxes from buidrgs to land is FALSE?

-The supply of buildings would increase, especially where land values are high

None of the land lax inerease woud be pased on to reriers

The tax shilt would reduce speculation in land

The tax shift would create a dead weight loss of economic surplus

The tax ehift should reduce urban sprawl

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Microeconomics: Principles & Policy

Economics

ISBN:

9781337794992

Author:

William J. Baumol, Alan S. Blinder, John L. Solow

Publisher:

Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Microeconomics: Principles & Policy

Economics

ISBN:

9781337794992

Author:

William J. Baumol, Alan S. Blinder, John L. Solow

Publisher:

Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Microeconomics (MindTap Course List)

Economics

ISBN:

9781305971493

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax