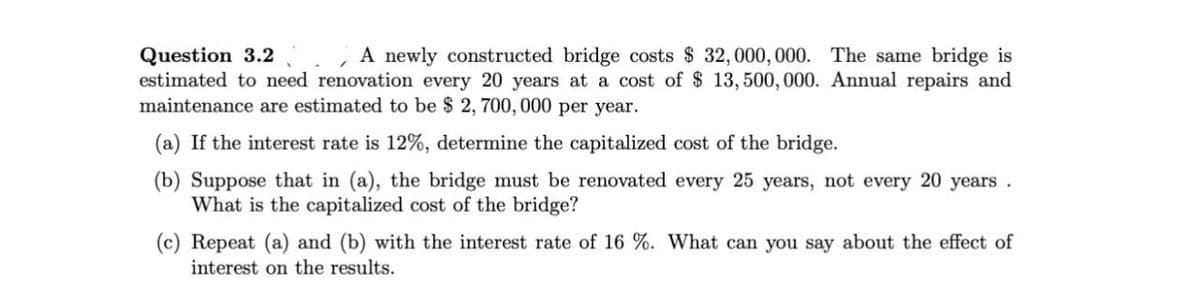

Question 3.2 A newly constructed bridge costs $ 32,000,000. The same bridge is estimated to need renovation every 20 years at a cost of $ 13,500,000. Annual repairs and maintenance are estimated to be $2,700,000 per year. (a) If the interest rate is 12%, determine the capitalized cost of the bridge. (b) Suppose that in (a), the bridge must be renovated every 25 years, not every 20 years. What is the capitalized cost of the bridge? (c) Repeat (a) and (b) with the interest rate of 16 %. What can you say about the effect of interest on the results.

Question 3.2 A newly constructed bridge costs $ 32,000,000. The same bridge is estimated to need renovation every 20 years at a cost of $ 13,500,000. Annual repairs and maintenance are estimated to be $2,700,000 per year. (a) If the interest rate is 12%, determine the capitalized cost of the bridge. (b) Suppose that in (a), the bridge must be renovated every 25 years, not every 20 years. What is the capitalized cost of the bridge? (c) Repeat (a) and (b) with the interest rate of 16 %. What can you say about the effect of interest on the results.

Managerial Economics: A Problem Solving Approach

5th Edition

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Chapter5: Investment Decisions: Look Ahead And Reason Back

Section: Chapter Questions

Problem 5.4IP

Related questions

Question

None

Transcribed Image Text:Question 3.2

A newly constructed bridge costs $ 32,000,000. The same bridge is

estimated to need renovation every 20 years at a cost of $ 13,500,000. Annual repairs and

maintenance are estimated to be $2,700,000 per year.

(a) If the interest rate is 12%, determine the capitalized cost of the bridge.

(b) Suppose that in (a), the bridge must be renovated every 25 years, not every 20 years.

What is the capitalized cost of the bridge?

(c) Repeat (a) and (b) with the interest rate of 16 %. What can you say about the effect of

interest on the results.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning