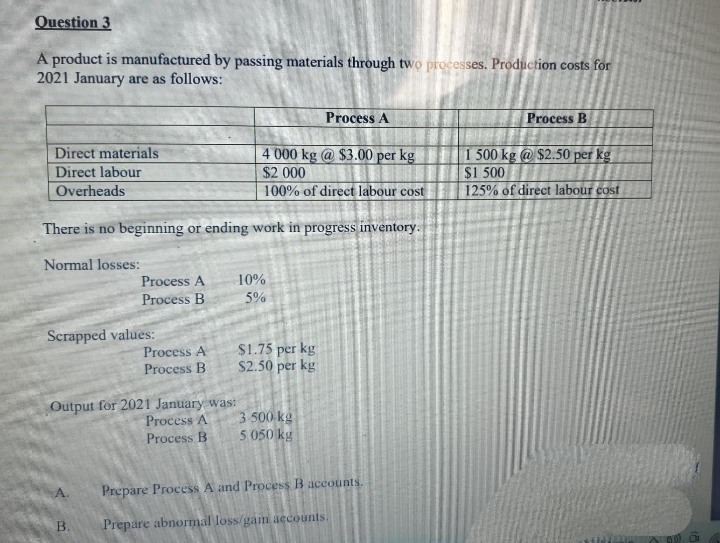

Question 3 A product is manufactured by passing materials through two processes. Production costs for 2021 January are as follows: Direct materials Direct labour Overheads There is no beginning or ending work in progress inventory. Normal losses: Process A 4 000 kg @ $3.00 per kg $2.000 100% of direct labour cost Process A Process B 10% 5% Process B 1 500 kg @ $2.50 per kg $1.500 125% of direct labour cost

Question 3 A product is manufactured by passing materials through two processes. Production costs for 2021 January are as follows: Direct materials Direct labour Overheads There is no beginning or ending work in progress inventory. Normal losses: Process A 4 000 kg @ $3.00 per kg $2.000 100% of direct labour cost Process A Process B 10% 5% Process B 1 500 kg @ $2.50 per kg $1.500 125% of direct labour cost

Financial & Managerial Accounting

13th Edition

ISBN:9781285866307

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter27: Lean Principles, Lean Accounting, And Activity Analysis

Section: Chapter Questions

Problem 27.7EX: Calculate lead time Williams Optical Inc. is considering a new lean product cell. The present...

Related questions

Question

Transcribed Image Text:Question 3

A product is manufactured by passing materials through two processes. Production costs for

2021 January are as follows:

Direct materials

Direct labour

Overheads

4 000 kg @ $3.00 per kg

$2.000

100% of direct labour cost

There is no beginning or ending work in progress inventory.

Normal losses:

Process A

Process B

Scrapped values:

B.

Process A

Process B

Output for 2021 January was:

Process A

Process B

10%

5%

$1.75 per kg

$2.50 per kg

Process A

3-500 kg

5.050 kg

Prepare Process A and Process B accounts.

Prepare abnormal loss/gain accounts.

Process B

1 500 kg @ $2.50 per kg

$1.500

125% of direct labour cost

& a

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning