Question 5 Consider the following total cost schedule for a perfectly competitive firm producing ball-point pens. Output per period TFC ($) TVC ($) 10 20 3 5 30 6 40 10 50 15 TABLE 9-3 Refer to Table 9-3. This firm would produce no output in the short run if the market price of its output dropped below $0.15. dropped below $0.20. dropped below $0.30. dropped below $2.00. dropped below $3.00. O0000

Question 5 Consider the following total cost schedule for a perfectly competitive firm producing ball-point pens. Output per period TFC ($) TVC ($) 10 20 3 5 30 6 40 10 50 15 TABLE 9-3 Refer to Table 9-3. This firm would produce no output in the short run if the market price of its output dropped below $0.15. dropped below $0.20. dropped below $0.30. dropped below $2.00. dropped below $3.00. O0000

Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter11: Price And Output Determination: Monopoly And Dominant Firms

Section: Chapter Questions

Problem 6E

Related questions

Question

1

Transcribed Image Text:Moving to another question will save this response.

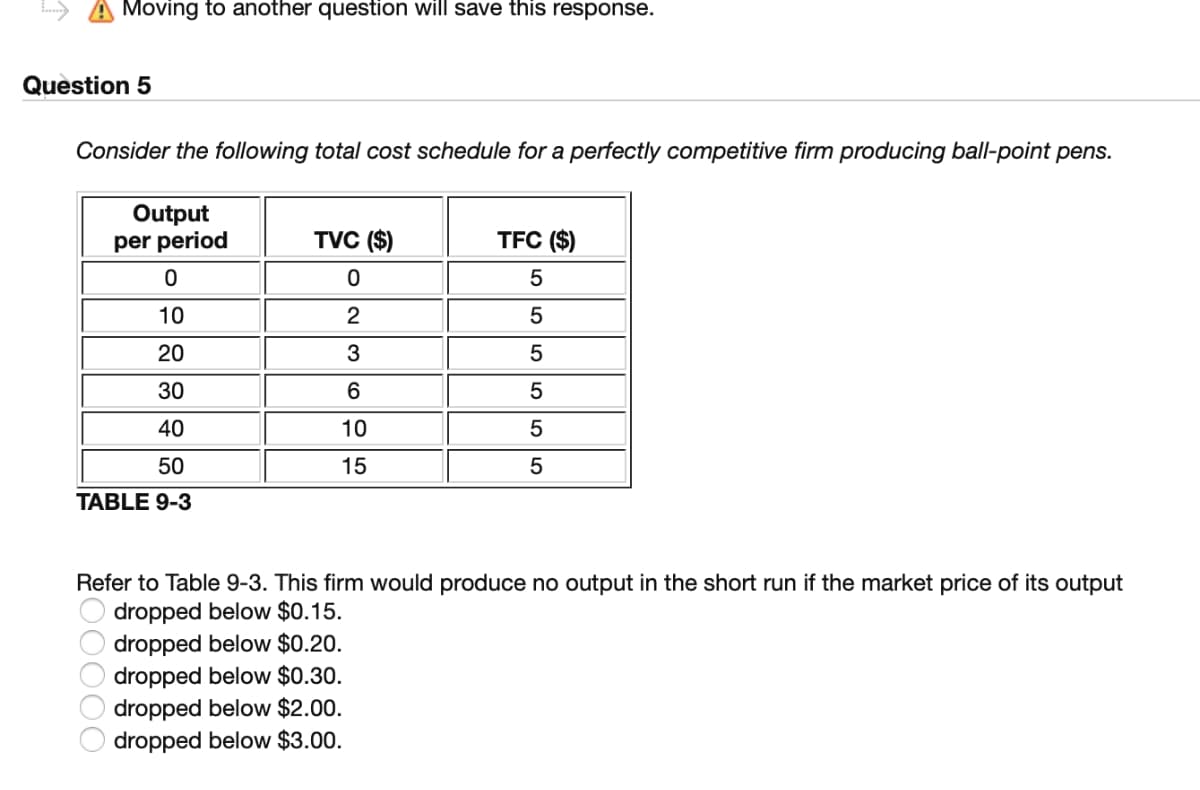

Question 5

Consider the following total cost schedule for a perfectly competitive firm producing ball-point pens.

Output

per period

TVC ($)

TFC ($)

10

2

20

3

5

30

40

10

50

15

5

TABLE 9-3

Refer to Table 9-3. This firm would produce no output in the short run if the market price of its output

dropped below $0.15.

dropped below $0.20.

dropped below $0.30.

dropped below $2.00.

dropped below $3.00.

200000

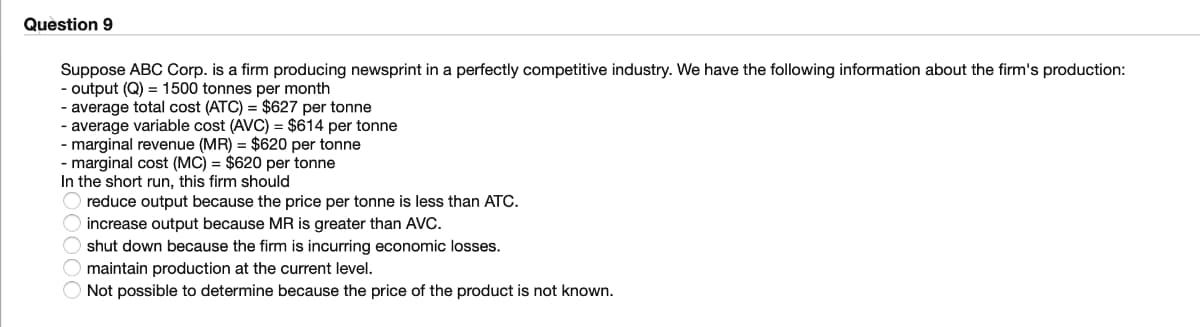

Transcribed Image Text:Quèstion 9

Suppose ABC Corp. is a firm producing newsprint in a perfectly competitive industry. We have the following information about the firm's production:

- output (Q) = 1500 tonnes per month

- average total cost (ATC) = $627 per tonne

- average variable cost (AVC) = $614 per tonne

- marginal revenue (MR) = $620 per tonne

- marginal cost (MC) = $620 per tonne

In the short run, this firm should

reduce output because the price per tonne is less than ATC.

O increase output because MR is greater than AVC.

O shut down because the firm is incurring economic losses.

O maintain production at the current level.

Not possible to determine because the price of the product is not known.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc