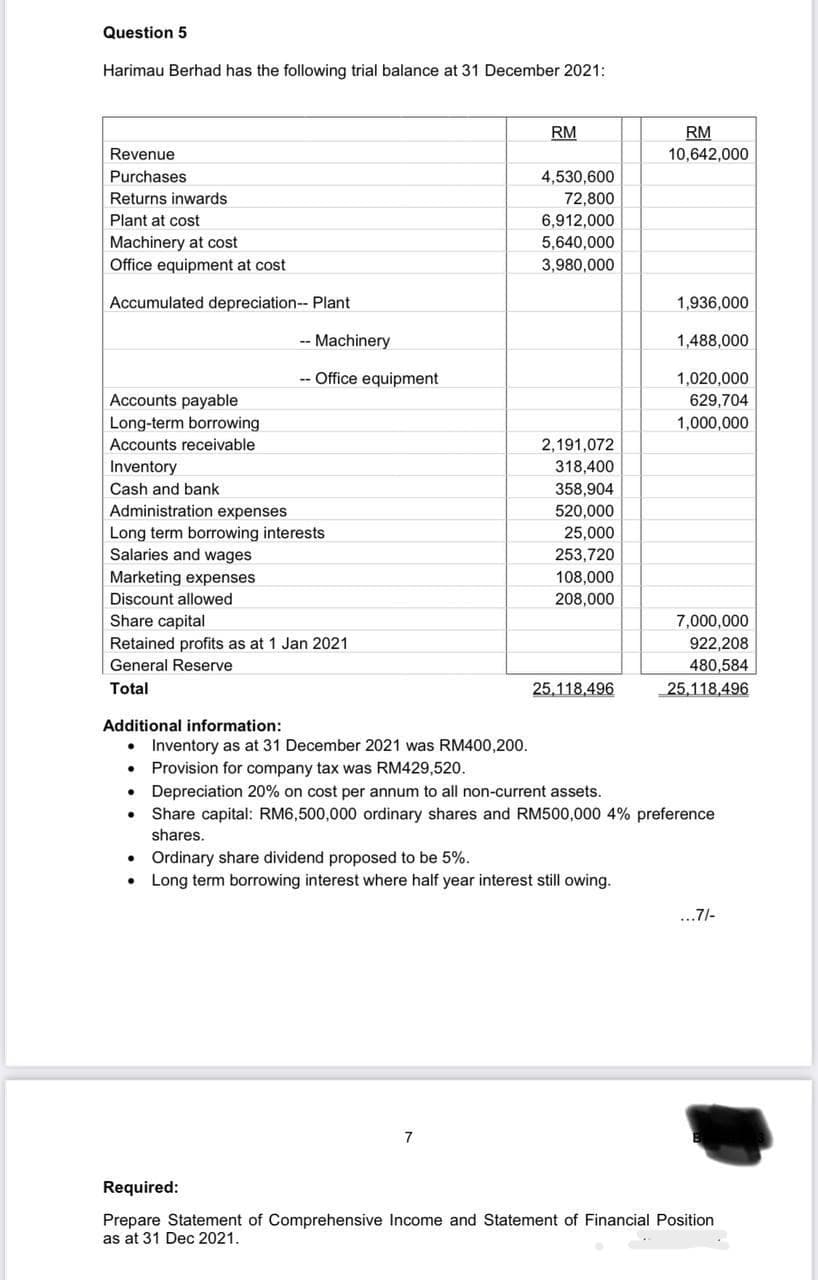

Question 5 Harimau Berhad has the following trial balance at 31 December 2021: Revenue Purchases Returns inwards Plant at cost Machinery at cost Office equipment at cost Accumulated depreciation-- Plant Accounts payable Long-term borrowing Accounts receivable Inventory -- Machinery -- Office equipment Cash and bank Administration expenses Long term borrowing interests Salaries and wages Marketing expenses Discount allowed Share capital Retained profits as at 1 Jan 2021 General Reserve Total Additional information: • Inventory as at 31 December 2021 was RM400,200. • Provision for company tax was RM429,520. RM 4,530,600 72,800 6,912,000 5,640,000 3,980,000 2,191,072 318,400 358,904 520,000 25,000 253,720 108,000 208,000 25,118,496 RM 10,642,000 • Ordinary share dividend proposed to be 5%. . • Long term borrowing interest where half year interest still owing. 1,936,000 1,488,000 1,020,000 629,704 1,000,000 7,000,000 922,208 480,584 25,118,496 • Depreciation 20% on cost per annum to all non-current assets. • Share capital: RM6,500,000 ordinary shares and RM500,000 4% preference shares. 71

Question 5 Harimau Berhad has the following trial balance at 31 December 2021: Revenue Purchases Returns inwards Plant at cost Machinery at cost Office equipment at cost Accumulated depreciation-- Plant Accounts payable Long-term borrowing Accounts receivable Inventory -- Machinery -- Office equipment Cash and bank Administration expenses Long term borrowing interests Salaries and wages Marketing expenses Discount allowed Share capital Retained profits as at 1 Jan 2021 General Reserve Total Additional information: • Inventory as at 31 December 2021 was RM400,200. • Provision for company tax was RM429,520. RM 4,530,600 72,800 6,912,000 5,640,000 3,980,000 2,191,072 318,400 358,904 520,000 25,000 253,720 108,000 208,000 25,118,496 RM 10,642,000 • Ordinary share dividend proposed to be 5%. . • Long term borrowing interest where half year interest still owing. 1,936,000 1,488,000 1,020,000 629,704 1,000,000 7,000,000 922,208 480,584 25,118,496 • Depreciation 20% on cost per annum to all non-current assets. • Share capital: RM6,500,000 ordinary shares and RM500,000 4% preference shares. 71

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter5: Risk Analysis

Section: Chapter Questions

Problem 22PC

Related questions

Question

do not give answer in image format

Transcribed Image Text:Question 5

Harimau Berhad has the following trial balance at 31 December 2021:

Revenue

Purchases

Returns inwards

Plant at cost

Machinery at cost

Office equipment at cost

Accumulated depreciation-- Plant

Accounts payable

Long-term borrowing

Accounts receivable

Inventory

Cash and bank

Administration expenses

Long term borrowing interests

Salaries and wages

Marketing expenses

Discount allowed

Share capital

Retained profits as at 1 Jan 2021

General Reserve

Total

Additional information:

●

.

●

-- Machinery

-- Office equipment

.

●

RM

4,530,600

72,800

7

6,912,000

5,640,000

3,980,000

2,191,072

318,400

358,904

520,000

25,000

253,720

108,000

208,000

25,118,496

• Ordinary share dividend proposed to be 5%.

Long term borrowing interest where half year interest still owing.

RM

10,642,000

1,936,000

1,488,000

1,020,000

629,704

1,000,000

Inventory as at 31 December 2021 was RM400,200.

Provision for company tax was RM429,520.

Depreciation 20% on cost per annum to all non-current assets.

Share capital: RM6,500,000 ordinary shares and RM500,000 4% preference

shares.

7,000,000

922,208

480,584

25,118,496

...7/-

Required:

Prepare Statement of Comprehensive Income and Statement of Financial Position

as at 31 Dec 2021.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning