Question 5 Suppose you are thinking about investing in three stocks, X. Y and Z You consider three possibie future states of the world: A high growth expansion (Boom), a moderate growth expansion (normal), and a mild contraction (Recession). You are not yet ready to estimate returns in each state of the economy, but you are able to state whether realised returns are equal to, higher than. or lower than expected returns. With this information what can we say about the correlation and covariance of these assets? Scenario Stock X Stock Y Stock Z Recession Ss. IZ.Recession) Normal Nar Erxl YNu= Elryl Boom SSr.X.Boom) = Elryl FZom > Elrzl L The covariance between stocks X and Y is zero. I. The covariance between stocks X and Z is negative I. The covariance between stocks Y and Z is positive. O l only Ol and only I and i only

Question 5 Suppose you are thinking about investing in three stocks, X. Y and Z You consider three possibie future states of the world: A high growth expansion (Boom), a moderate growth expansion (normal), and a mild contraction (Recession). You are not yet ready to estimate returns in each state of the economy, but you are able to state whether realised returns are equal to, higher than. or lower than expected returns. With this information what can we say about the correlation and covariance of these assets? Scenario Stock X Stock Y Stock Z Recession Ss. IZ.Recession) Normal Nar Erxl YNu= Elryl Boom SSr.X.Boom) = Elryl FZom > Elrzl L The covariance between stocks X and Y is zero. I. The covariance between stocks X and Z is negative I. The covariance between stocks Y and Z is positive. O l only Ol and only I and i only

Algebra & Trigonometry with Analytic Geometry

13th Edition

ISBN:9781133382119

Author:Swokowski

Publisher:Swokowski

Chapter10: Sequences, Series, And Probability

Section10.2: Arithmetic Sequences

Problem 67E

Related questions

Concept explainers

Contingency Table

A contingency table can be defined as the visual representation of the relationship between two or more categorical variables that can be evaluated and registered. It is a categorical version of the scatterplot, which is used to investigate the linear relationship between two variables. A contingency table is indeed a type of frequency distribution table that displays two variables at the same time.

Binomial Distribution

Binomial is an algebraic expression of the sum or the difference of two terms. Before knowing about binomial distribution, we must know about the binomial theorem.

Topic Video

Question

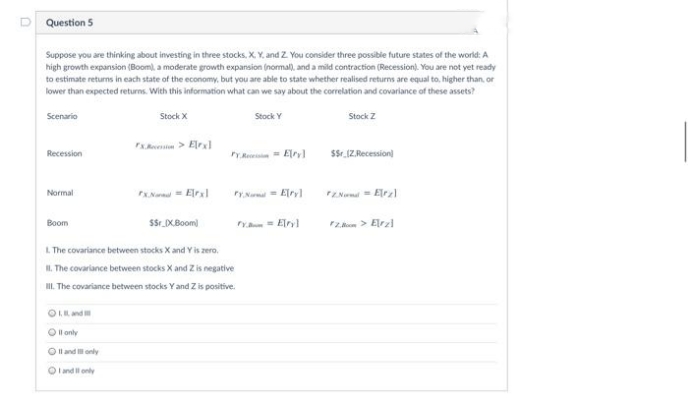

Transcribed Image Text:Question 5

Suppose you are thinking about investing in three stocks, X Y, and Z You consider three possibie future states of the world: A

high growth expansion (Boom), a moderate growth expansion (normal), and a mild contraction (Recession). You are not yet ready

to estimate returns in each state of the economy, but you are able to state whether realised returns are equal to, higher than, or

lower than expected returns. With this information what can we say about the correlation and covariance of these assets?

Scenario

Stock X

Stock Y

Stock Z

Recession

Y Re = Elryrl

r.IZ.Recession)

Normal

Nar Elrxl

YNu= Elryl

S$r. X.Boom)

Boom

= Elryl

FZm > Elrzl

L The covariance between stocks X and Y is zero,

II. The covariance between stocks X and Z is negative

I. The covariance between stocks Y and Z is positive.

Ol only

O l and only

and only

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, statistics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Algebra & Trigonometry with Analytic Geometry

Algebra

ISBN:

9781133382119

Author:

Swokowski

Publisher:

Cengage

Elementary Linear Algebra (MindTap Course List)

Algebra

ISBN:

9781305658004

Author:

Ron Larson

Publisher:

Cengage Learning

Linear Algebra: A Modern Introduction

Algebra

ISBN:

9781285463247

Author:

David Poole

Publisher:

Cengage Learning

Algebra & Trigonometry with Analytic Geometry

Algebra

ISBN:

9781133382119

Author:

Swokowski

Publisher:

Cengage

Elementary Linear Algebra (MindTap Course List)

Algebra

ISBN:

9781305658004

Author:

Ron Larson

Publisher:

Cengage Learning

Linear Algebra: A Modern Introduction

Algebra

ISBN:

9781285463247

Author:

David Poole

Publisher:

Cengage Learning

Trigonometry (MindTap Course List)

Trigonometry

ISBN:

9781337278461

Author:

Ron Larson

Publisher:

Cengage Learning