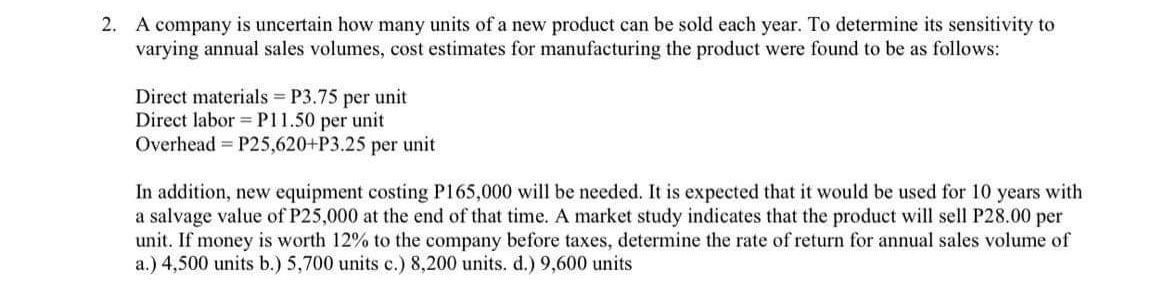

2. A company is uncertain how many units of a new product can be sold each year. To determine its sensitivity to varying annual sales volumes, cost estimates for manufacturing the product were found to be as follows: Direct materials P3.75 per unit Direct labor =P11.50 per unit Overhead = P25,620+P3.25 per unit In addition, new equipment costing P165,000 will be needed. It is expected that it would be used for 10 years with a salvage value of P25,000 at the end of that time. A market study indicates that the product will sell P28.00 per unit. If money is worth 12% to the company before taxes, determine the rate of return for annual sales volume of a.) 4,500 units b.) 5,700 units c.) 8,200 units. d.) 9,600 units

2. A company is uncertain how many units of a new product can be sold each year. To determine its sensitivity to varying annual sales volumes, cost estimates for manufacturing the product were found to be as follows: Direct materials P3.75 per unit Direct labor =P11.50 per unit Overhead = P25,620+P3.25 per unit In addition, new equipment costing P165,000 will be needed. It is expected that it would be used for 10 years with a salvage value of P25,000 at the end of that time. A market study indicates that the product will sell P28.00 per unit. If money is worth 12% to the company before taxes, determine the rate of return for annual sales volume of a.) 4,500 units b.) 5,700 units c.) 8,200 units. d.) 9,600 units

Chapter10: Short-term Decision Making

Section: Chapter Questions

Problem 1PB: Variety Artisans has a bottleneck in their production that occurs within the engraving department....

Related questions

Question

Transcribed Image Text:2. A company is uncertain how many units of a new product can be sold each year. To determine its sensitivity to

varying annual sales volumes, cost estimates for manufacturing the product were found to be as follows:

Direct materials P3.75 per unit

Direct labor =P11.50 per unit

Overhead = P25,620+P3.25 per unit

In addition, new equipment costing P165,000 will be needed. It is expected that it would be used for 10 years with

a salvage value of P25,000 at the end of that time. A market study indicates that the product will sell P28.00 per

unit. If money is worth 12% to the company before taxes, determine the rate of return for annual sales volume of

a.) 4,500 units b.) 5,700 units c.) 8,200 units. d.) 9,600 units

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub