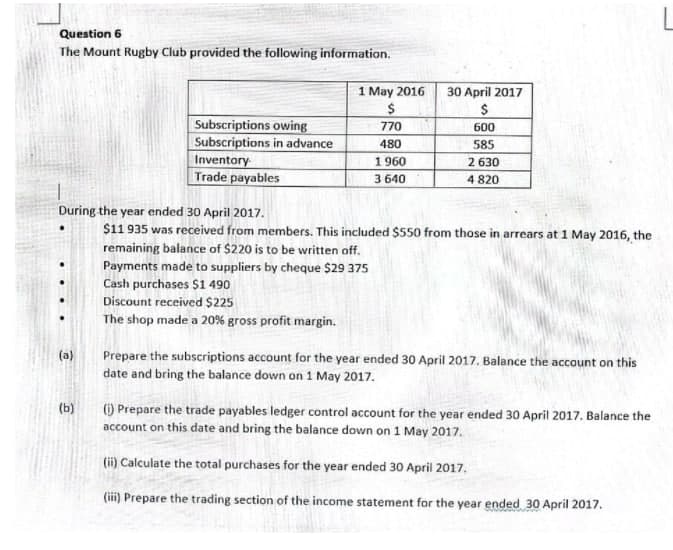

Question 6 The Mount Rugby Club provided the following information. 1 May 2016 30 April 2017 Subscriptions owing Subscriptions in advance Inventory Trade payables 770 600 480 585 1960 2 630 3 640 4 820 During the year ended 30 April 2017. $11 935 was received from members. This included $550 from those in arrears at 1 May 2016, the remaining balance of $220 is to be written off. Payments made to suppliers by cheque $29 375 Cash purchases $1 490 Discount received $225 The shop made a 20% gross profit margin. (a) Prepare the subscriptions account for the year ended 30 April 2017. Balance the account on this date and bring the balance down on 1 May 2017. ) Prepare the trade payables ledger control account for the year ended 30 April 2017. Balance the account on this date and bring the balance down on 1 May 2017. (b) (i) Calculate the total purchases for the year ended 30 April 2017. (iii) Prepare the trading section of the income statement for the year ended 30 April 2017.

Question 6 The Mount Rugby Club provided the following information. 1 May 2016 30 April 2017 Subscriptions owing Subscriptions in advance Inventory Trade payables 770 600 480 585 1960 2 630 3 640 4 820 During the year ended 30 April 2017. $11 935 was received from members. This included $550 from those in arrears at 1 May 2016, the remaining balance of $220 is to be written off. Payments made to suppliers by cheque $29 375 Cash purchases $1 490 Discount received $225 The shop made a 20% gross profit margin. (a) Prepare the subscriptions account for the year ended 30 April 2017. Balance the account on this date and bring the balance down on 1 May 2017. ) Prepare the trade payables ledger control account for the year ended 30 April 2017. Balance the account on this date and bring the balance down on 1 May 2017. (b) (i) Calculate the total purchases for the year ended 30 April 2017. (iii) Prepare the trading section of the income statement for the year ended 30 April 2017.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter8: Current And Contingent Liabilities

Section: Chapter Questions

Problem 75APSA: Note Payable and Accrued Interest Fairbome Company borrowed $60,000 on an 8%, interest-bearing note...

Related questions

Question

Transcribed Image Text:Question 6

The Mount Rugby Club provided the following information.

1 May 2016

$

30 April 2017

Subscriptions owing

Subscriptions in advance

770

600

480

585

Inventory

Trade payables

1 960

3 640

2 630

4 820

During the year ended 30 April 2017.

$11 935 was received from members. This included $550 from those in arrears at 1 May 2016, the

remaining balance of $220 is to be written off.

Payments made to suppliers by cheque $29 375

Cash purchases $1 490

Discount received $225

The shop made a 20% gross profit margin.

Prepare the subscriptions account for the year ended 30 April 2017. Balance the account on this

date and bring the balance down on 1 May 2017.

(a)

) Prepare the trade payables ledger control account for the year ended 30 April 2017. Balance the

account on this date and bring the balance down on 1 May 2017.

(b)

(ii) Calculate the total purchases for the year ended 30 April 2017,

(iii) Prepare the trading section of the income statement for the year ended 30 April 2017.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning