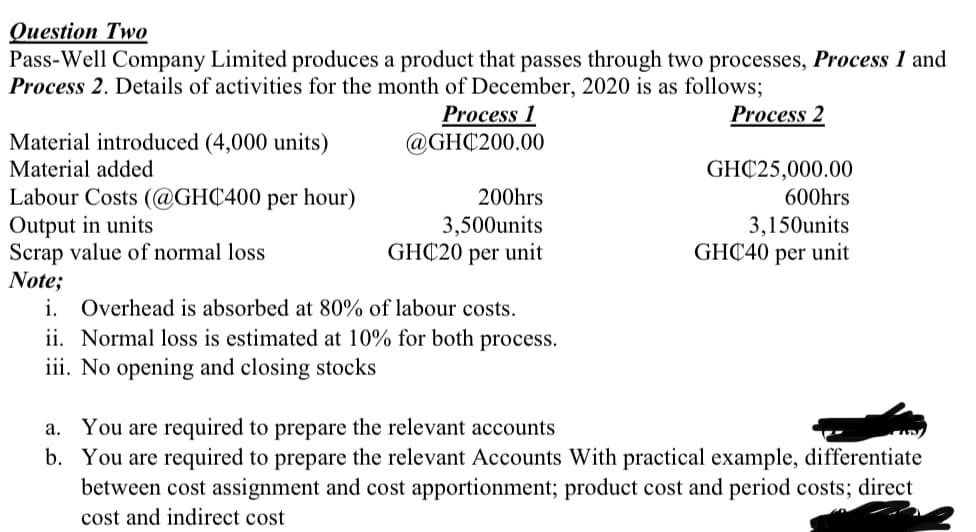

Question Two Pass-Well Company Limited produces a product that passes through two processes, Process 1 and Process 2. Details of activities for the month of December, 2020 is as follows; Process 1 @GH¢200.00 Process 2 Material introduced (4,000 units) Material added GHC25,000.00 Labour Costs (@GHC400 per hour) Output in units Scrap value of normal loss Note; i. Overhead is absorbed at 80% of labour costs. ii. Normal loss is estimated at 10% for both process. iii. No opening and closing stocks 200hrs 600hrs 3,500units GHC20 per unit 3,150units GHC40 per unit a. You are required to prepare the relevant accounts b. You are required to prepare the relevant Accounts With practical example, differentiate between cost assignment and cost apportionment; product cost and period costs; direct cost and indirect cost

Question Two Pass-Well Company Limited produces a product that passes through two processes, Process 1 and Process 2. Details of activities for the month of December, 2020 is as follows; Process 1 @GH¢200.00 Process 2 Material introduced (4,000 units) Material added GHC25,000.00 Labour Costs (@GHC400 per hour) Output in units Scrap value of normal loss Note; i. Overhead is absorbed at 80% of labour costs. ii. Normal loss is estimated at 10% for both process. iii. No opening and closing stocks 200hrs 600hrs 3,500units GHC20 per unit 3,150units GHC40 per unit a. You are required to prepare the relevant accounts b. You are required to prepare the relevant Accounts With practical example, differentiate between cost assignment and cost apportionment; product cost and period costs; direct cost and indirect cost

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter6: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 2E: Identify cost graphs The following cost graphs illustrate various types of cost behavior: For each...

Related questions

Question

100%

Transcribed Image Text:Question Two

Pass-Well Company Limited produces a product that passes through two processes, Process 1 and

Process 2. Details of activities for the month of December, 2020 is as follows;

Process 2

Process 1

@GHC200.00

Material introduced (4,000 units)

Material added

GHC25,000.00

Labour Costs (@GHC400 per hour)

Output in units

Scrap value of normal loss

Note;

i. Overhead is absorbed at 80% of labour costs.

ii. Normal loss is estimated at 10% for both process.

iii. No opening and closing stocks

200hrs

600hrs

3,500units

GHC20 per unit

3,150units

GHC40 per unit

a. You are required to prepare the relevant accounts

b. You are required to prepare the relevant Accounts With practical example, differentiate

between cost assignment and cost apportionment; product cost and period costs; direct

cost and indirect cost

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning