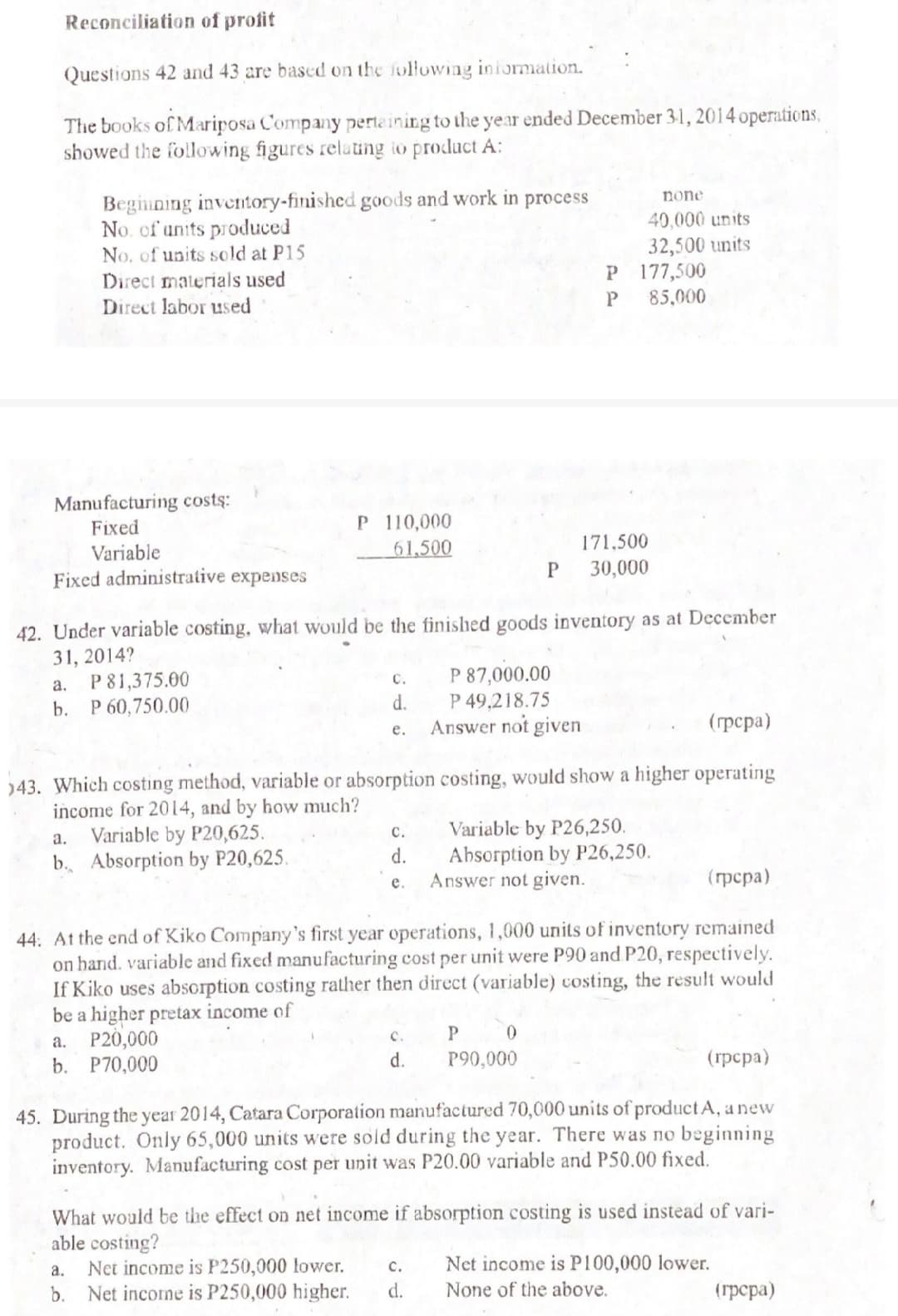

Questions 42 and 43 are based on the following iniormation. The books of Mariposa Company pertaining to the year ended December 31, 2014 operations, showed the following figures relating io product A: Beginning inventory-finished goods and work in process No. of units produced No. of units sold at P15 Direct materials used Direct labor used none 40,000 units 32,500 units P 177,500 85,000

Questions 42 and 43 are based on the following iniormation. The books of Mariposa Company pertaining to the year ended December 31, 2014 operations, showed the following figures relating io product A: Beginning inventory-finished goods and work in process No. of units produced No. of units sold at P15 Direct materials used Direct labor used none 40,000 units 32,500 units P 177,500 85,000

Principles of Cost Accounting

17th Edition

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Edward J. Vanderbeck, Maria R. Mitchell

Chapter10: Cost Analysis For Management Decision Making

Section: Chapter Questions

Problem 4E: The following production data came from the records of Olympic Enterprises for the year ended...

Related questions

Question

#42 and 43

ANSWER NUMBERS 42 AND 43 ONLY!!!!

Please show your complete solution and answer. Thank you!

Transcribed Image Text:Reconciliation of profit

Questions 42 and 43 are based on the following iniormation.

The books of Mariposa Company pertaining to the year ended December 31, 2014 operations,

showed the following figures relating io product A:

Beginning inventory-finished goods and work in process

No. of units produced

No. of units sold at P15

Direct materials used

Direct labor used

none

40,000 units

32,500 units

P 177,500

85,000

Manufacturing costs:

Fixed

P 110,000

Variable

61,500

171.500

30,000

Fixed administrative expenses

42. Under variable costing, what would be the finished goods inventory as at December

31, 2014?

P81,375.00

P 60,750.00

P 87,000.00

P 49,218.75

Answer not given

с.

а.

b.

d.

(грера)

е.

)43. Which costing method, variable or absorption costing, would show a higher operating

income for 2014, and by how much?

Variable by P20,625.

b. Absorption by P20,625.

Variable by P26,250.

Absorption by P26,250.

Answer not given.

с.

a.

d.

(грера)

e.

44. At the end of Kiko Company's first year operations, 1,000 units of inventory remained

on hand. variable and fixed manufacturing cost per unit were P90 and P20, respectively.

If Kiko uses absorption costing rather then direct (variable) costing, the result would

be a higher pretax income of

a. P20,000

b. P70,000

P 0

P90,000

с.

d.

(трсра)

45. During the year 2014, Catara Corporation manufactured 70,000 units of product A, a new

product. Only 65,000 units were sold during the year. There was no beginning

inventory. Manufacturing cost per unit was P20.00 variable and P50.00 fixed.

What would be the effect on net income if absorption costing is used instead of vari-

able costing?

Net income is P250,000 lower.

b. Net income is P250,000 higher.

Net income is P100,000 lower.

None of the above.

a.

c.

d.

(грсра)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,