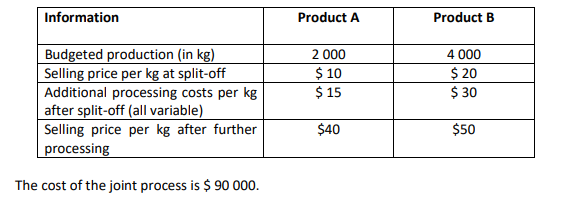

QUIK Manufacturing Company Ltd produces two products from a joint process. Information about the two joint products is as follows: Information Product A Product B Budgeted production (in kg) 2 000 4 000 Selling price per kg at split-off $ 10 $ 20 Additional processing costs per kg after split-off (all variable) $ 15 $ 30 Selling price per kg after further processing $40 $50 The cost of the joint process is $ 90 000. Required: a) Which of QUIK company’s joint products should be sold at split-off point? Please support your answer with the necessary calculations. b) Which of QUIK company’s joint products should be processed further? please answer the same with working allocations

QUIK Manufacturing Company Ltd produces two products from a joint process. Information about the two joint products is as follows: Information Product A Product B Budgeted production (in kg) 2 000 4 000 Selling price per kg at split-off $ 10 $ 20 Additional processing costs per kg after split-off (all variable) $ 15 $ 30 Selling price per kg after further processing $40 $50 The cost of the joint process is $ 90 000. Required: a) Which of QUIK company’s joint products should be sold at split-off point? Please support your answer with the necessary calculations. b) Which of QUIK company’s joint products should be processed further? please answer the same with working allocations

Financial And Managerial Accounting

15th Edition

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:WARREN, Carl S.

Chapter19: Support Department And Joint Cost Allocation

Section: Chapter Questions

Problem 4CMA: Tucariz Company processes Duo into two joint products, Big and Mini. Duo is purchased in...

Related questions

Question

QUIK Manufacturing Company Ltd produces two products from a joint process. Information

about the two joint products is as follows:

Information Product A Product B

Budgeted production (in kg) 2 000 4 000

Selling price per kg at split-off $ 10 $ 20

Additional

after split-off (all variable)

$ 15 $ 30

Selling price per kg after further

processing

$40 $50

The cost of the joint process is $ 90 000.

Required:

a) Which of QUIK company’s joint products should be sold at split-off point? Please support

your answer with the necessary calculations.

b) Which of QUIK company’s joint products should be processed further?

please answer the same with working allocations

Transcribed Image Text:Information

Product A

Product B

Budgeted production (in kg)

Selling price per kg at split-off

Additional processing costs per kg

after split-off (all variable)

2 000

$ 10

$ 15

4 000

$ 20

$ 30

Selling price per kg after further

processing

$40

$50

The cost of the joint process is $ 90 000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning