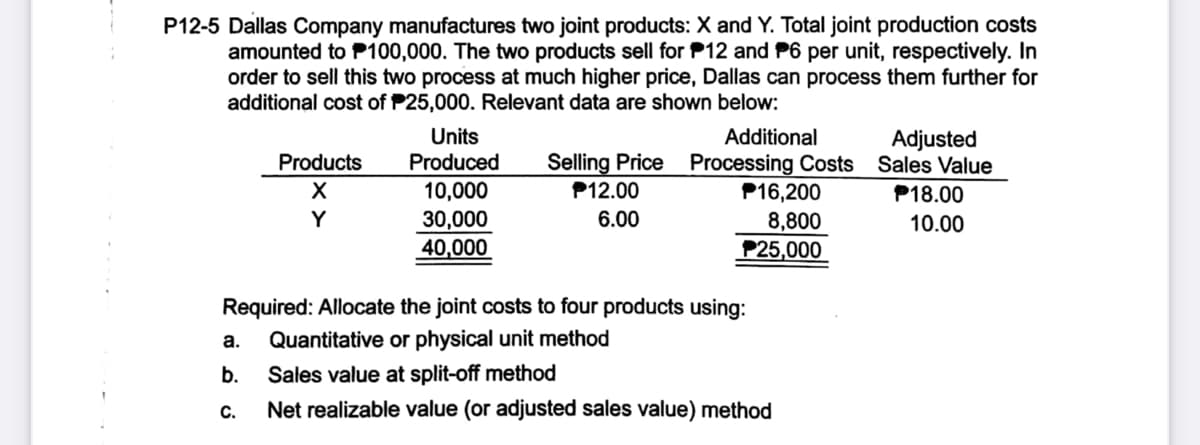

Dallas Company manufactures two joint products: X and Y. Total joint production costs amounted to P100,000. The two products sell for P12 and P6 per unit, respectively. In order to sell this two process at much higher price, Dallas can process them further for additional cost of P25,000. Relevant data are shown below: Units Produced Additional Adjusted Selling Price Processing Costs Sales Value P16,200 8,800 P25,000 Products 10,000 30,000 40,000 P12.00 P18.00 Y 6.00 10.00 Required: Allocate the joint costs to four products using: a. Quantitative or physical unit method b. Sales value at split-off method c. Net realizable value (or adjusted sales value) method

Dallas Company manufactures two joint products: X and Y. Total joint production costs amounted to P100,000. The two products sell for P12 and P6 per unit, respectively. In order to sell this two process at much higher price, Dallas can process them further for additional cost of P25,000. Relevant data are shown below: Units Produced Additional Adjusted Selling Price Processing Costs Sales Value P16,200 8,800 P25,000 Products 10,000 30,000 40,000 P12.00 P18.00 Y 6.00 10.00 Required: Allocate the joint costs to four products using: a. Quantitative or physical unit method b. Sales value at split-off method c. Net realizable value (or adjusted sales value) method

Financial And Managerial Accounting

15th Edition

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:WARREN, Carl S.

Chapter19: Support Department And Joint Cost Allocation

Section: Chapter Questions

Problem 4CMA: Tucariz Company processes Duo into two joint products, Big and Mini. Duo is purchased in...

Related questions

Question

100%

Transcribed Image Text:P12-5 Dallas Company manufactures two joint products: X and Y. Total joint production costs

amounted to P100,000. The two products sell for P12 and P6 per unit, respectively. In

order to sell this two process at much higher price, Dallas can process them further for

additional cost of P25,000. Relevant data are shown below:

Units

Additional

Adjusted

Sales Value

Produced

10,000

30,000

Products

Selling Price

Processing Costs

P16,200

P12.00

P18.00

Y

6.00

8,800

P25,000

10.00

40,000

Required: Allocate the joint costs to four products using:

Quantitative or physical unit method

а.

b.

Sales value at split-off method

С.

Net realizable value (or adjusted sales value) method

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 5 images

Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning