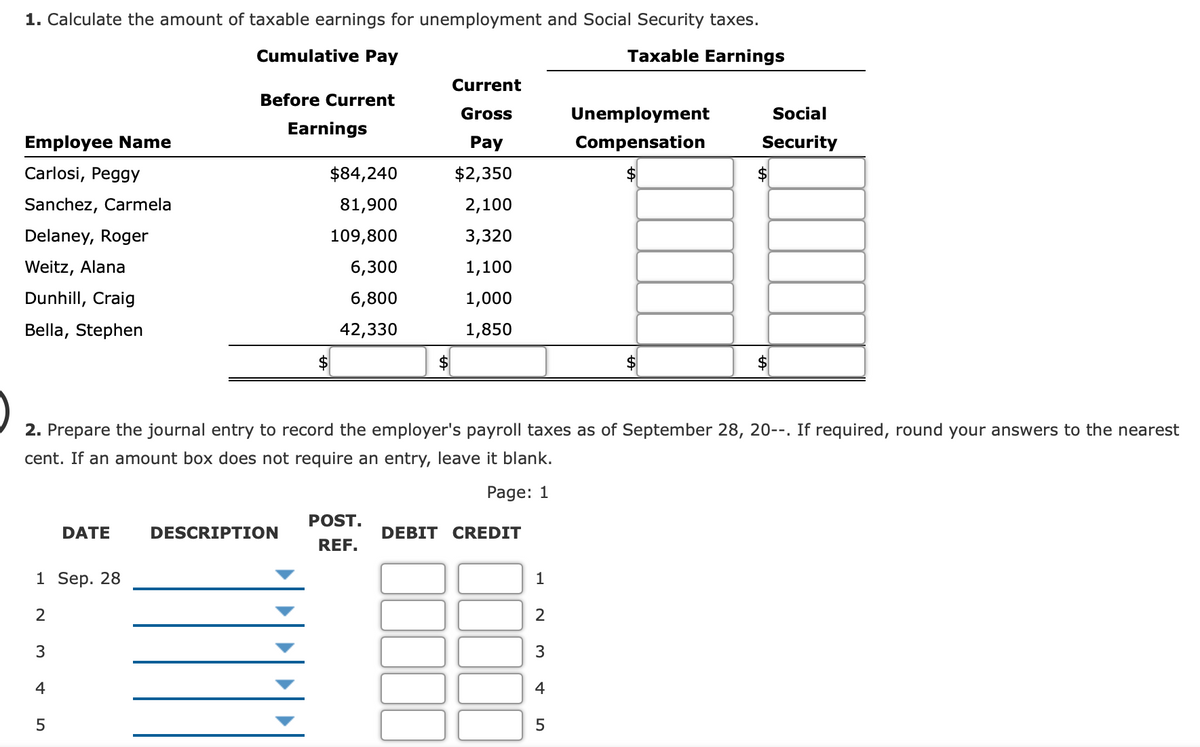

Selected information from the payroll register of Barbara's Stables for the week ended September 28, 20--, is as follows: Social Security tax is 6.2% on the first $128,400 of earnings for each employee. Medicare tax is 1.45% of gross earnings, FUTA tax is 0.8%, and SUTA tax is 5.4% each on the first $7,000 of earnings. Cumulative Pay Current Taxable Earnings Employee Name Before Current Earnings Gross Pay Unemployment Compensation Social Security Carlosi, Peggy $ 84,240 $2,350 Sanchez, Carmela 81,900 2,100 Delaney, Roger 109,800 3,320 Weitz, Alana 6,300 1,100 Dunhill, Craig 6,800 1,000 Bella, Stephen 42,330 1,850

Selected information from the payroll register of Barbara's Stables for the week ended September 28, 20--, is as follows: Social Security tax is 6.2% on the first $128,400 of earnings for each employee. Medicare tax is 1.45% of gross earnings, FUTA tax is 0.8%, and SUTA tax is 5.4% each on the first $7,000 of earnings.

| Cumulative Pay | Current | Taxable Earnings | ||

| Employee Name | Before Current Earnings |

Gross Pay |

Unemployment Compensation |

Social Security |

| Carlosi, Peggy | $ 84,240 | $2,350 | ||

| Sanchez, Carmela | 81,900 | 2,100 | ||

| Delaney, Roger | 109,800 | 3,320 | ||

| Weitz, Alana | 6,300 | 1,100 | ||

| Dunhill, Craig | 6,800 | 1,000 | ||

| Bella, Stephen | 42,330 | 1,850 |

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

R. L. Ybarra employs John Ince at a salary of $53,000 a year. Ybarra is subject to employer Social Security taxes at a rate of 6.2% and Medicare taxes at a rate of 1.45% on John's salary. In addition, Ybarra must pay SUTA tax at a rate of 5.4% and FUTA tax at a rate of 0.8% on the first $7,000 of Ince's salary.

Compute the total cost to Ybarra of employing Ince for the year. Round your answer to the nearest cent.