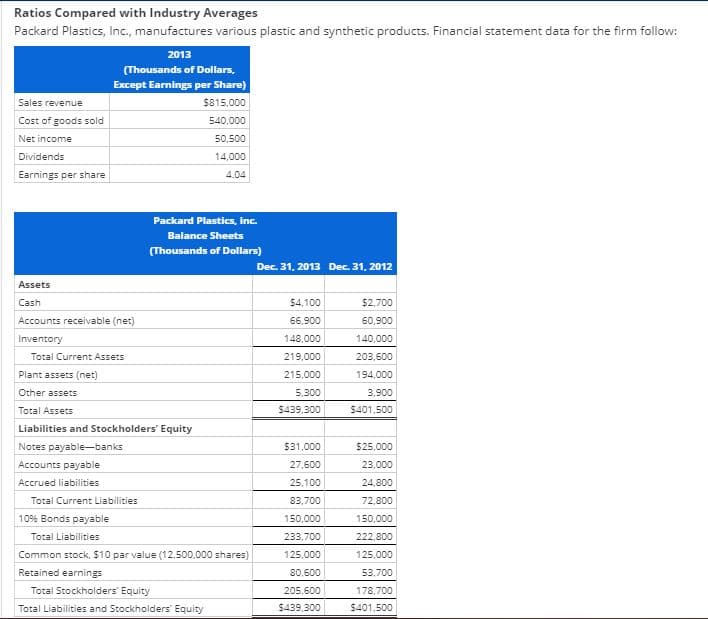

Ratios Compared with Industry Averages Packard Plastics, Inc., manufactures various plastic and synthetic products. Financial statement data for the firm follow: 2013 (Thousands of Dollars, Except Earnings per Share) Sales revenue $815,000 Cost of goods sold 540,000 Net income 50,500 Dividends 14,000 Earnings per share 4.04 Packard Plastics, inc. Balance Sheets (Thousands of Dollars) Dec. 31, 2013 Dec. 31, 2012 Assets Cash 54,100 $2,700 Accounts receivable (net) 66.900 60,900 Inventory 148,000 140,000 Total Current Assets 219,000 203,600 Plant assets (net) 215,000 194,000 Other assets 5.300 3,900 Total Assets $439.300 $401,500 Liabilities and Stockholders' Equity Notes payable-banks 531,000 $25.000 Accounts payable 27,600 23,000 Accrued liabilities 25.100 24,800 Total Current Liabilities 83,700 72,800 10% Bonds payable 150,000 150,000 Total Liabilities 233,700 222,800 Common stock, $10 par value (12,500.000 shares) 125.000 125,000 Retained earnings 80,600 53,700 Total Stockholders' Equity 205,600 178,700 Total Liabilities and Stockholders Equity $439,300 $401,500

Ratios Compared with Industry Averages Packard Plastics, Inc., manufactures various plastic and synthetic products. Financial statement data for the firm follow: 2013 (Thousands of Dollars, Except Earnings per Share) Sales revenue $815,000 Cost of goods sold 540,000 Net income 50,500 Dividends 14,000 Earnings per share 4.04 Packard Plastics, inc. Balance Sheets (Thousands of Dollars) Dec. 31, 2013 Dec. 31, 2012 Assets Cash 54,100 $2,700 Accounts receivable (net) 66.900 60,900 Inventory 148,000 140,000 Total Current Assets 219,000 203,600 Plant assets (net) 215,000 194,000 Other assets 5.300 3,900 Total Assets $439.300 $401,500 Liabilities and Stockholders' Equity Notes payable-banks 531,000 $25.000 Accounts payable 27,600 23,000 Accrued liabilities 25.100 24,800 Total Current Liabilities 83,700 72,800 10% Bonds payable 150,000 150,000 Total Liabilities 233,700 222,800 Common stock, $10 par value (12,500.000 shares) 125.000 125,000 Retained earnings 80,600 53,700 Total Stockholders' Equity 205,600 178,700 Total Liabilities and Stockholders Equity $439,300 $401,500

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter5: Risk Analysis

Section: Chapter Questions

Problem 1AIC: Compute the values of each of the ratios in Exhibit 5.27 for Starbucks for 2012. Starbucks had 749.3...

Related questions

Question

Please help. Thanks

Transcribed Image Text:Ratios Compared with Industry Averages

Packard Plastics, Inc, manufactures various plastic and synthetic products. Financial statement data for the firm follow:

2013

(Thousands of Dollars,

Except Earnings per Share)

Sales revenue

$815.000

Cost of goods sold

540,000

Net income

50,500

Dividends

14,000

Earnings per share

4.04

Packard Plastics, inc.

Balance Sheets

(Thousands of Dollars)

Dec. 31, 2013 Dec. 31, 2012

Assets

Cash

$4,100

$2,700

Accounts receivable (net)

66.900

60,900

Inventory

148,000

140,000

Total Current Assets

219,000

203,600

Plant assets (net)

215.000

194,000

Other assets

5.300

3,900

Total Assets

$439.300

$401,500

Liabilities and Stockholders' Equity

Notes payable--banks

531,000

$25,000

Accounts payable

27,600

23,000

Accrued liabilities

25,100

24,800

Total Current Liabilities

83,700

72,800

10% Bonds payable

150,000

150,000

Total Liabilities

233,700

222,800

Common stock, $10 par value (12,500.000 shares)

125.000

125.000

Retained earnings

80,600

53,700

Total Stockholders' Equity

205,600

178,700

Total Liabilities and Stockholders' Equity

$439,300

$401,500

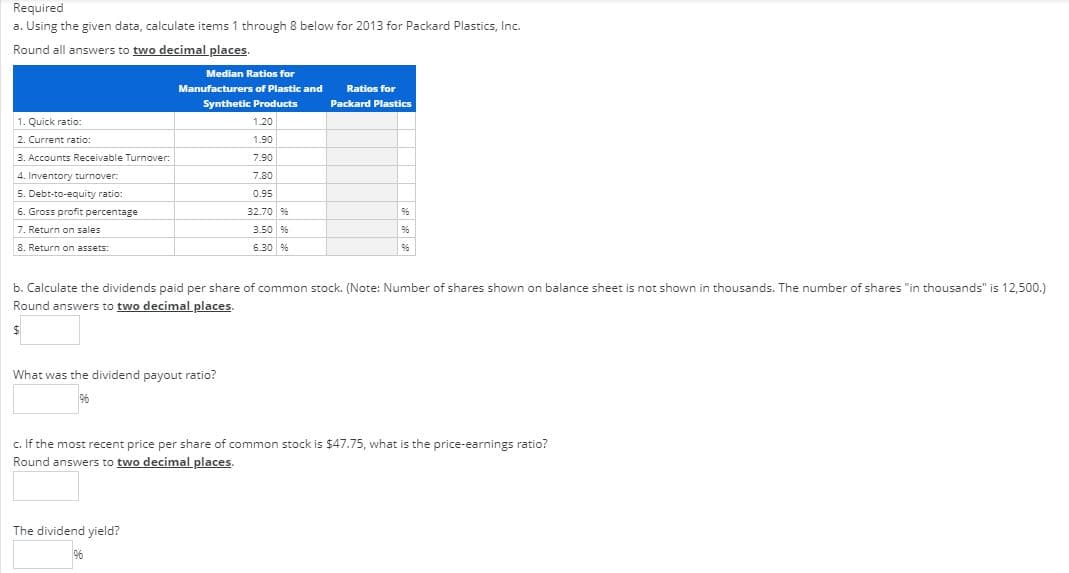

Transcribed Image Text:Required

a. Using the given data, calculate items 1 through 8 below for 2013 for Packard Plastics, Inc.

Round all answers to two decimal places.

Median Ratios for

Manufacturers of Plastic and

Ratios for

Synthetic Products

Packard Plastics

1. Quick ratio:

1.20

2. Current ratio:

1.90

3. Accounts Receivable Turnover:

7.90

4. Inventory turnover:

7.80

5. Debt-to-equity ratio:

0.95

6. Gross profit percentage

32.70 96%

9%

7. Return on sales

3.50 96%

96

8. Return on assets:

6.30 %

96

b. Calculate the dividends paid per share of common stock. (Note: Number of shares shown on balance sheet is not shown in thousands. The number of shares "in thousands" is 12,500.)

Round answers to two decimal places

What was the dividend payout ratio?

96

c. If the most recent price per share of common stock is $47.75, what is the price-earnings ratio?

Round answers

two decimalplaces.

The dividend yield?

96

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT