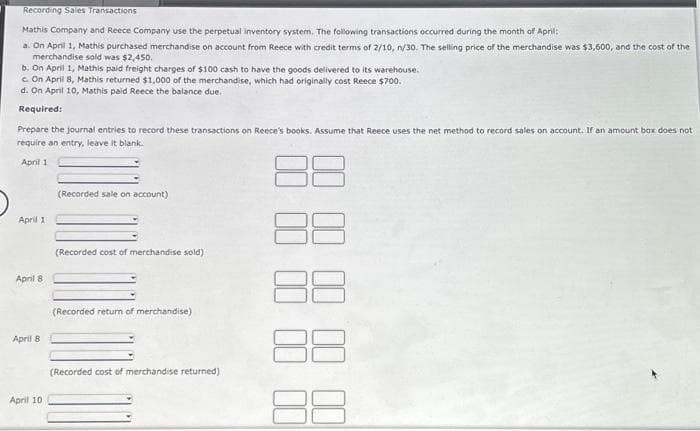

Recording Sales Transactions Mathis Company and Reece Company use the perpetual inventory system. The following transactions occurred during the month of April: a. On April 1, Mathis purchased merchandise on account from Reece with credit terms of 2/10, n/30. The selling price of the merchandise was $3,600, and the cost of the merchandise sold was $2,450. b. On April 1, Mathis paid freight charges of $100 cash to have the goods delivered to its warehouse. c. On April 8, Mathis returned $1,000 of the merchandise, which had originally cost Reece $700. d. On April 10, Mathis paid Reece the balance due. Required: Prepare the journal entries to record these transactions on Reece's books. Assume that Reece uses the net method to record sales on account. If an amount box does no require an entry, leave it blank. April 1

Recording Sales Transactions Mathis Company and Reece Company use the perpetual inventory system. The following transactions occurred during the month of April: a. On April 1, Mathis purchased merchandise on account from Reece with credit terms of 2/10, n/30. The selling price of the merchandise was $3,600, and the cost of the merchandise sold was $2,450. b. On April 1, Mathis paid freight charges of $100 cash to have the goods delivered to its warehouse. c. On April 8, Mathis returned $1,000 of the merchandise, which had originally cost Reece $700. d. On April 10, Mathis paid Reece the balance due. Required: Prepare the journal entries to record these transactions on Reece's books. Assume that Reece uses the net method to record sales on account. If an amount box does no require an entry, leave it blank. April 1

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter11: The Statement Of Cash Flows

Section: Chapter Questions

Problem 37E: Analyzing the Accounts Casey Company uses a perpetual inventory system and engaged in the following...

Related questions

Topic Video

Question

Please do not give solution in image format thanku

Transcribed Image Text:Recording Sales Transactions

Mathis Company and Reece Company use the perpetual inventory system. The following transactions occurred during the month of April:

a. On April 1, Mathis purchased merchandise on account from Reece with credit terms of 2/10, n/30. The selling price of the merchandise was $3,600, and the cost of the

merchandise sold was $2,450.

b. On April 1, Mathis paid freight charges of $100 cash to have the goods delivered to its warehouse.

c. On April 8, Mathis returned $1,000 of the merchandise, which had originally cost Reece $700.

d. On April 10, Mathis paid Reece the balance due.

Required:

Prepare the journal entries to record these transactions on Reece's books. Assume that Reece uses the net method to record sales on account. If an amount box does not

require an entry, leave it blank.

April 1

April 1

April 8

April 8

April 10

(Recorded sale on account)

(Recorded cost of merchandise sold)

(Recorded return of merchandise)

(Recorded cost of merchandise returned).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning