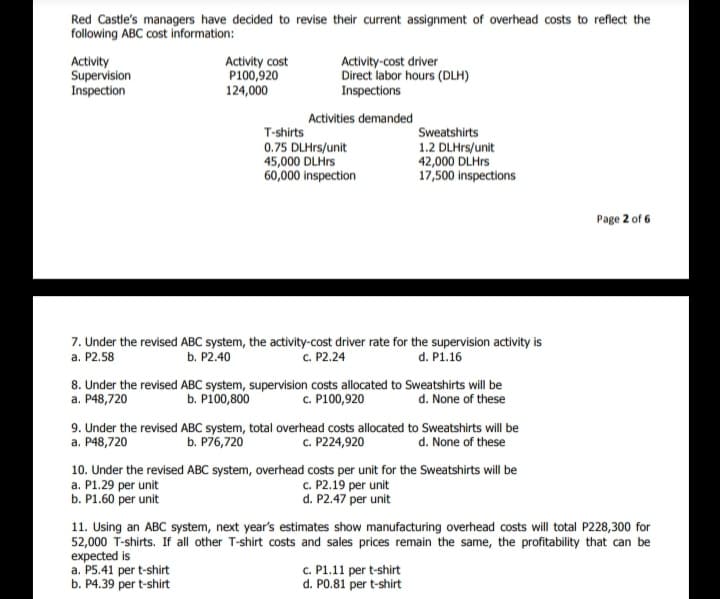

Red Castle's managers have decided to revise their current assignment of overhead costs to reflect the following ABC cost information: Activity Supervision Inspection Activity cost P100,920 124,000 Activity-cost driver Direct labor hours (DLH) Inspections Activities demanded T-shirts 0.75 DLHrs/unit 45,000 DLHrs 60,000 inspection Sweatshirts 1.2 DLHrs/unit 42,000 DLHrs 17,500 inspections Page 2 of 6 7. Under the revised ABC system, the activity-cost driver rate for the supervision activity is a. P2.58 b. P2.40 c. P2.24 d. P1.16 8. Under the revised ABC system, supervision costs allocated to Sweatshirts will be a. P48,720 b. P100,800 c. P100,920 d. None of these 9. Under the revised ABC system, total overhead costs allocated to Sweatshirts will be c. P224,920 b. P76,720 a. P48,720 d. None of these 10. Under the revised ABC system, overhead costs per unit for the Sweatshirts will be a. P1.29 per unit b. P1.60 per unit c. P2.19 per unit d. P2.47 per unit 11. Using an ABC system, next year's estimates show manufacturing overhead costs will total P228,300 for 52,000 T-shirts. If all other T-shirt costs and sales prices remain the same, the profitability that can be expected is a. P5.41 per t-shirt b. P4.39 per t-shirt c. P1.11 per t-shirt d. PO.81 per t-shirt

Red Castle's managers have decided to revise their current assignment of overhead costs to reflect the following ABC cost information: Activity Supervision Inspection Activity cost P100,920 124,000 Activity-cost driver Direct labor hours (DLH) Inspections Activities demanded T-shirts 0.75 DLHrs/unit 45,000 DLHrs 60,000 inspection Sweatshirts 1.2 DLHrs/unit 42,000 DLHrs 17,500 inspections Page 2 of 6 7. Under the revised ABC system, the activity-cost driver rate for the supervision activity is a. P2.58 b. P2.40 c. P2.24 d. P1.16 8. Under the revised ABC system, supervision costs allocated to Sweatshirts will be a. P48,720 b. P100,800 c. P100,920 d. None of these 9. Under the revised ABC system, total overhead costs allocated to Sweatshirts will be c. P224,920 b. P76,720 a. P48,720 d. None of these 10. Under the revised ABC system, overhead costs per unit for the Sweatshirts will be a. P1.29 per unit b. P1.60 per unit c. P2.19 per unit d. P2.47 per unit 11. Using an ABC system, next year's estimates show manufacturing overhead costs will total P228,300 for 52,000 T-shirts. If all other T-shirt costs and sales prices remain the same, the profitability that can be expected is a. P5.41 per t-shirt b. P4.39 per t-shirt c. P1.11 per t-shirt d. PO.81 per t-shirt

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter4: Activity-based Costing

Section: Chapter Questions

Problem 30P: Primera Company produces two products and uses a predetermined overhead rate to apply overhead....

Related questions

Question

10 and 11

Transcribed Image Text:Red Castle's managers have decided to revise their current assignment of overhead costs to reflect the

following ABC cost information:

Activity

Supervision

Inspection

Activity cost

P100,920

124,000

Activity-cost driver

Direct labor hours (DLH)

Inspections

Activities demanded

T-shirts

0.75 DLHrs/unit

45,000 DLHrs

60,000 inspection

Sweatshirts

1.2 DLHPS/unit

42,000 DLHPS

17,500 inspections

Page 2 of 6

7. Under the revised ABC system, the activity-cost driver rate for the supervision activity is

a. P2.58

b. P2.40

c. P2.24

d. P1.16

8. Under the revised ABC system, supervision costs allocated to Sweatshirts will be

a. P48,720

b. P100,800

c. P100,920

d. None of these

9. Under the revised ABC system, total overhead costs allocated to Sweatshirts will be

c. P224,920

b. P76,720

a. P48,720

d. None of these

10. Under the revised ABC system, overhead costs per unit for the Sweatshirts will be

a. P1.29 per unit

b. P1.60 per unit

c. P2.19 per unit

d. P2.47 per unit

11. Using an ABC system, next year's estimates show manufacturing overhead costs will total P228,300 for

52,000 T-shirts. If all other T-shirt costs and sales prices remain the same, the profitability that can be

expected is

a. P5.41 per t-shirt

b. P4.39 per t-shirt

c. P1.11 per t-shirt

d. PO.81 per t-shirt

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,