Refer to the data for Pettijohn Inc. What is the firm's quick ratio? 0.49 0.61 O 0.73 0.87 O 1.05 Pettijohn Inc. The balance sheet and income statement shown below are for Pettijohn Inc. Note that has no amortization charges, it does not lease any assets, none of its debt must be ret the next 5 years, and the notes payable will be rolled over. Refer to the data for Pettijohn Inc. What is the fırm's ROE? 8.99% O 9.91% O 8.54% O 9.44% 10.41%

Refer to the data for Pettijohn Inc. What is the firm's quick ratio? 0.49 0.61 O 0.73 0.87 O 1.05 Pettijohn Inc. The balance sheet and income statement shown below are for Pettijohn Inc. Note that has no amortization charges, it does not lease any assets, none of its debt must be ret the next 5 years, and the notes payable will be rolled over. Refer to the data for Pettijohn Inc. What is the fırm's ROE? 8.99% O 9.91% O 8.54% O 9.44% 10.41%

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter7: Financial Activities

Section: Chapter Questions

Problem 7QE

Related questions

Question

Practice Pack

Please help me

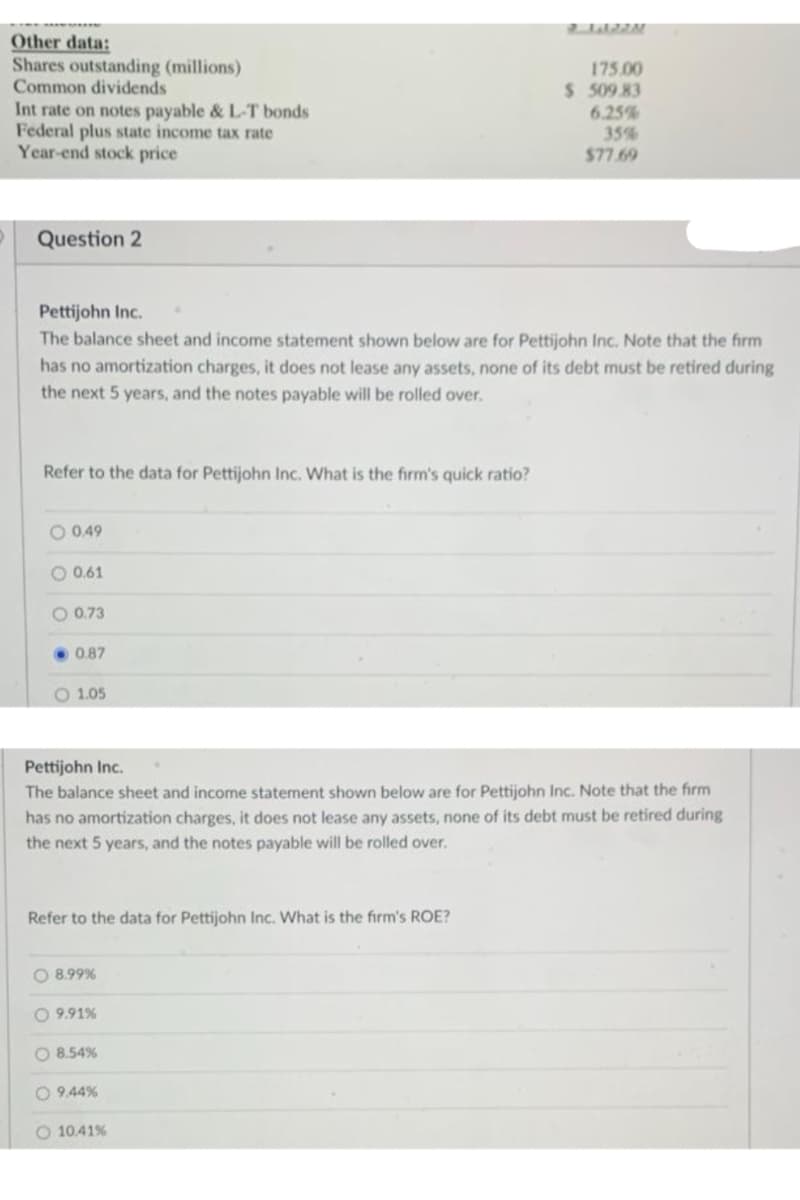

Transcribed Image Text:Other data:

Shares outstanding (millions)

Common dividends

175.00

$ 509 83

Int rate on notes payable & L-T bonds

Federal plus state income tax rate

Year-end stock price

6.25%

35%

$77.69

Question 2

Pettijohn Inc.

The balance sheet and income statement shown below are for Pettijohn Inc. Note that the firm

has no amortization charges, it does not lease any assets, none of its debt must be retired during

the next 5 years, and the notes payable will be rolled over.

Refer to the data for Pettijohn Inc. What is the firm's quick ratio?

O 0.49

O 0.61

O 0.73

• 0.87

O 1.05

Pettijohn Inc.

The balance sheet and income statement shown below are for Pettijohn Inc. Note that the firm

has no amortization charges, it does not lease any assets, none of its debt must be retired during

the next 5 years, and the notes payable will be rolled over.

Refer to the data for Pettijohn Inc. What is the firm's ROE?

O 8.99%

O 9,91%

O 8.54%

O 9.44%

O 10.41%

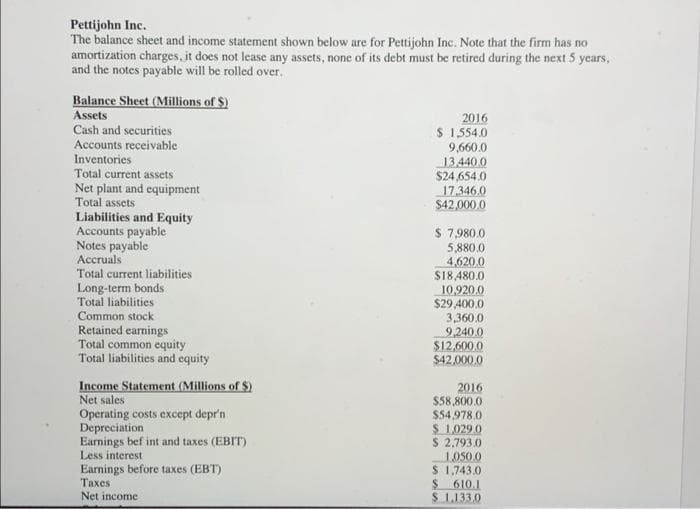

Transcribed Image Text:Pettijohn Inc.

The balance sheet and income statement shown below are for Pettijohn Inc. Note that the firm has no

amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years,

and the notes payable will be rolled over.

Balance Sheet (Millions of $)

Assets

Cash and securities

Accounts receivable

Inventories

Total current assets

Net plant and equipment

Total assets

Liabilities and Equity

Accounts payable

Notes payable

Accruals

2016

S 1,554.0

9,660.0

13,440.0

$24,654.0

17.346.0

$42,000.0

S 7,980.0

5,880.0

4,620.0

$18,480.0

10,920.0

$29 400.0

3,360.0

9,240.0

$12,600.0

$42,000.0

Total current liabilities

Long-term bonds

Total liabilities

Common stock

Retained earnings

Total common equity

Total liabilities and equity

Income Statement (Millions of $)

2016

$58,800.0

$54,978.0

$ 1,029 0

$ 2,793.0

1.050 0

S 1,743.0

$ 610.1

$ 1,133.0

Net sales

Operating costs except depr'n

Depreciation

Earnings bef int and taxes (EBIT)

Less interest

Earnings before taxes (EBT)

Тахes

Net income

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Includes step-by-step video

Trending now

This is a popular solution!

Learn your way

Includes step-by-step video

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning