Renewable Co. uses leasing as a secondary means of selling its products. The company contracted with Green Corporation to lease a machine with an economic life of 12 years to be used by Green Corporation in its operations. The fair value of the asset at the inception of the lease was $400,000; it cost Renewable Co. $360,000 and is carried as equipment at that value. Payments of $44,925 are to be made by Green Corporation at the beginning of each of the eight years of the lease. Renewable Co.'s implicit interest rate is 6% per year, which is not known by Green Corporation. Green Corporation's incremental borrowing rate is 7%. Renewable Co. estimates the residual value of the leased asset to be $166,217 at the end of the lease term. The residual value is not guaranteed by Green Corporation. Renewable Co. will depreciate the equipment on a straight-line basis (assume no salvage value).

Renewable Co. uses leasing as a secondary means of selling its products. The company contracted with Green Corporation to lease a machine with an economic life of 12 years to be used by Green Corporation in its operations. The fair value of the asset at the inception of the lease was $400,000; it cost Renewable Co. $360,000 and is carried as equipment at that value. Payments of $44,925 are to be made by Green Corporation at the beginning of each of the eight years of the lease. Renewable Co.'s implicit interest rate is 6% per year, which is not known by Green Corporation. Green Corporation's incremental borrowing rate is 7%. Renewable Co. estimates the residual value of the leased asset to be $166,217 at the end of the lease term. The residual value is not guaranteed by Green Corporation. Renewable Co. will depreciate the equipment on a straight-line basis (assume no salvage value).

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter19: Lease Financing

Section: Chapter Questions

Problem 3P

Related questions

Question

Note: it asks about Green's balance sheet. See photos please.

Transcribed Image Text:Renewable Co. uses leasing as a secondary means of selling its products. The company contracted with

Green Corporation to lease a machine with an economic life of 12 years to be used by Green Corporation

in its operations. The fair value of the asset at the inception of the lease was $400,000; it cost Renewable

Co. $360,000 and is carried as equipment at that value. Payments of $44,925 are to be made by Green

Corporation at the beginning of each of the eight years of the lease. Renewable Co.'s implicit interest rate is

6% per year, which is not known by Green Corporation. Green Corporation's incremental borrowing rate is

7%. Renewable Co. estimates the residual value of the leased asset to be $166,217 at the end of the lease

term. The residual value is not guaranteed by Green Corporation. Renewable Co. will depreciate the

equipment on a straight-line basis (assume no salvage value).

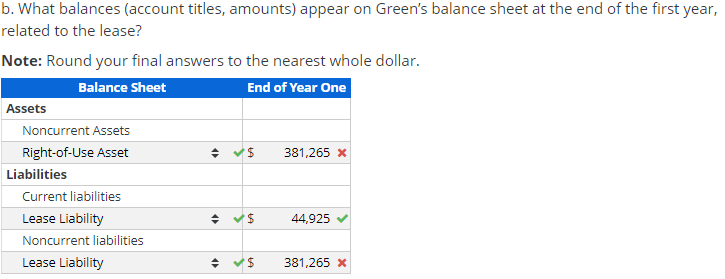

Transcribed Image Text:b. What balances (account titles, amounts) appear on Green's balance sheet at the end of the first year,

related to the lease?

Note: Round your final answers to the nearest whole dollar.

Balance Sheet

End of Year One

Assets

Noncurrent Assets

Right-of-Use Asset

381,265 x

Liabilities

Current liabilities

Lease Liability

44,925

Noncurrent liabilities

Lease Liability

381,265 x

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Business Its Legal Ethical & Global Environment

Accounting

ISBN:

9781305224414

Author:

JENNINGS

Publisher:

Cengage

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Business Its Legal Ethical & Global Environment

Accounting

ISBN:

9781305224414

Author:

JENNINGS

Publisher:

Cengage

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT