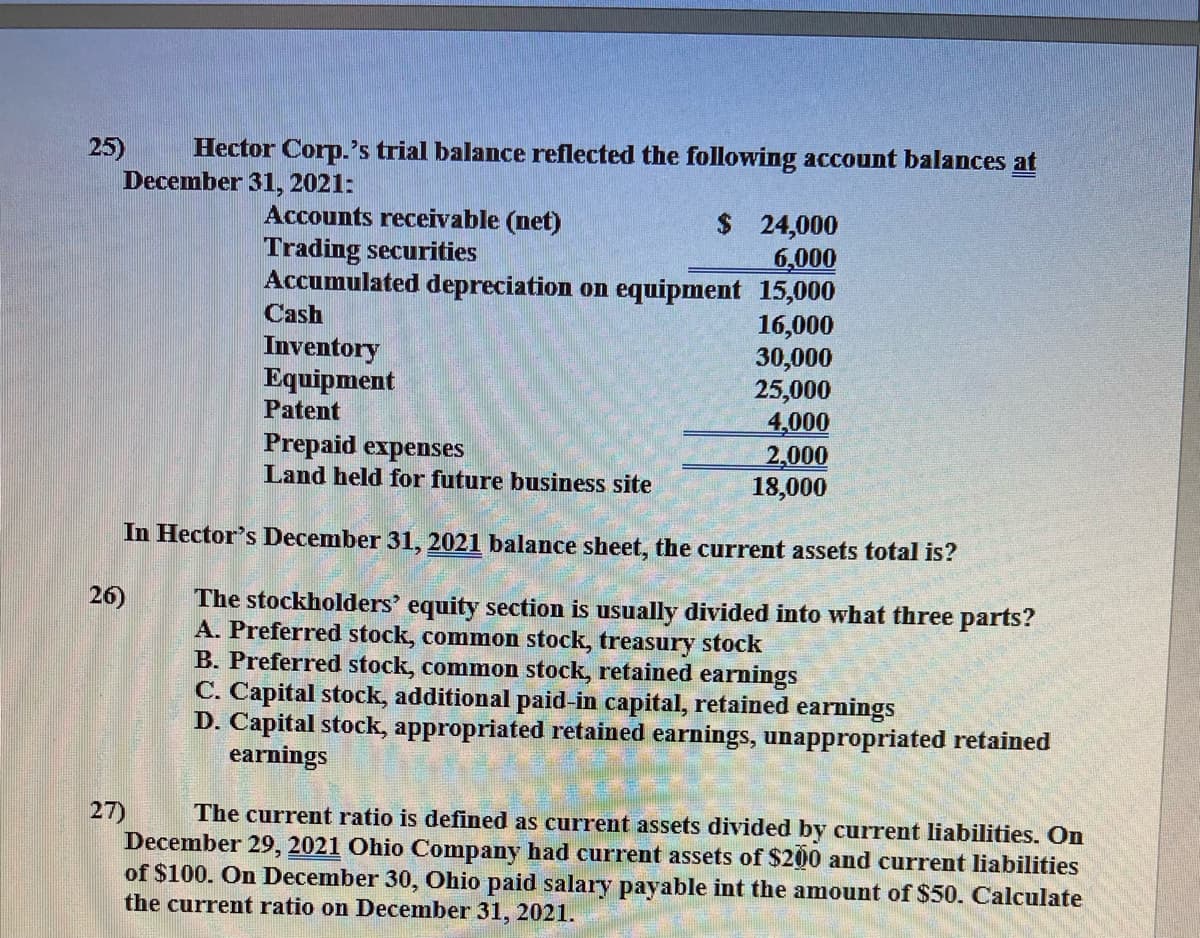

held for future business site 18,000 In Hector's December 31, 2021 balance sheet, the current assets total is? 26) The stockholders' equity section is usually divided into what three parts? A. Preferred stock, common stock, treasury stock B. Preferred stock, common stock, retained earnings C. Capital stock, additional paid-in capital, retained earnings D. Capital stock, appropriated retained earnings, unappropriated retained earnings 27) The current ratio is defined as current assets divided by current liabilities. On December 29, 2021 Ohio Company had current assets of $200 and current liabilities of $100. On December 30, Ohio paid salary payable int the amount of $50. Calculate the current ratio on December 31, 2021.

held for future business site 18,000 In Hector's December 31, 2021 balance sheet, the current assets total is? 26) The stockholders' equity section is usually divided into what three parts? A. Preferred stock, common stock, treasury stock B. Preferred stock, common stock, retained earnings C. Capital stock, additional paid-in capital, retained earnings D. Capital stock, appropriated retained earnings, unappropriated retained earnings 27) The current ratio is defined as current assets divided by current liabilities. On December 29, 2021 Ohio Company had current assets of $200 and current liabilities of $100. On December 30, Ohio paid salary payable int the amount of $50. Calculate the current ratio on December 31, 2021.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter22: Accounting For Changes And Errors.

Section: Chapter Questions

Problem 10MC: Shannon Corporation began operations on January 1, 2019. Financial statements for the years ended...

Related questions

Question

25 and 27 .

Transcribed Image Text:25)

Hector Corp.'s trial balance reflected the following account balances at

December 31, 2021:

Accounts receivable (net)

$ 24,000

6,000

Accumulated depreciation on equipment 15,000

16,000

30,000

25,000

4,000

2,000

18,000

Trading securities

Cash

Inventory

Equipment

Patent

Prepaid expenses

Land held for future business site

In Hector's December 31, 2021 balance sheet, the current assets total is?

26)

The stockholders' equity section is usually divided into what three parts?

A. Preferred stock, common stock, treasury stock

B. Preferred stock, common stock, retained earnings

C. Capital stock, additional paid-in capital, retained earnings

D. Capital stock, appropriated retained earnings, unappropriated retained

earnings

27)

December 29, 2021 Ohio Company had current assets of $200 and current liabilities

of $100. On December 30, Ohio paid salary payable int the amount of $50. Calculate

the current ratio on December 31, 2021.

The current ratio is defined as current assets divided by current liabilities. On

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning