Required 1. Calculate (a) net present value, (b) payback period, (c) discounted payback period, and (d) internal rate of return. 2. Compare and contrast the capital budgeting methods in requirement 1.

Required 1. Calculate (a) net present value, (b) payback period, (c) discounted payback period, and (d) internal rate of return. 2. Compare and contrast the capital budgeting methods in requirement 1.

Chapter10: Project Cash Flows And Risk

Section: Chapter Questions

Problem 1PROB

Related questions

Question

N9.

Account

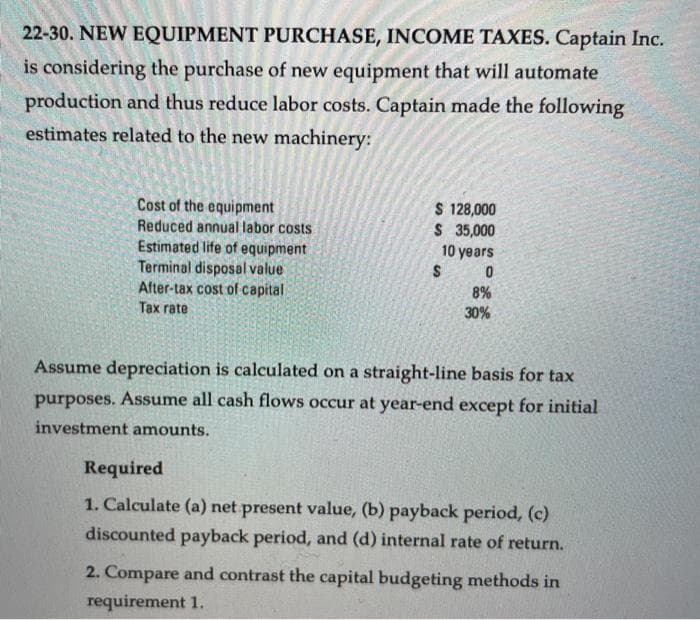

Transcribed Image Text:22-30. NEW EQUIPMENT PURCHASE, INCOME TAXES. Captain Inc.

is considering the purchase of new equipment that will automate

production and thus reduce labor costs. Captain made the following

estimates related to the new machinery:

Cost of the equipment

Reduced annual labor costs

Estimated life of equipment

Terminal disposal value

After-tax cost of capital

Tax rate

$ 128,000

$ 35,000

10 years

0

8%

30%

S

Assume depreciation is calculated on a straight-line basis for tax

purposes. Assume all cash flows occur at year-end except for initial

investment amounts.

Required

1. Calculate (a) net present value, (b) payback period, (c)

discounted payback period, and (d) internal rate of return.

2. Compare and contrast the capital budgeting methods in

requirement 1.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning