Required: 1. Separate the variable and fixed elements, using the high-lo method. 2. Determine the variable cost to be charged to the product f the year. (Hint. First determine the number of annual uni produced.) 3. Determine the fixed cost to be charged to factory overhead f the var

Required: 1. Separate the variable and fixed elements, using the high-lo method. 2. Determine the variable cost to be charged to the product f the year. (Hint. First determine the number of annual uni produced.) 3. Determine the fixed cost to be charged to factory overhead f the var

Principles of Cost Accounting

17th Edition

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Edward J. Vanderbeck, Maria R. Mitchell

Chapter4: Accounting For Factory Overhead

Section: Chapter Questions

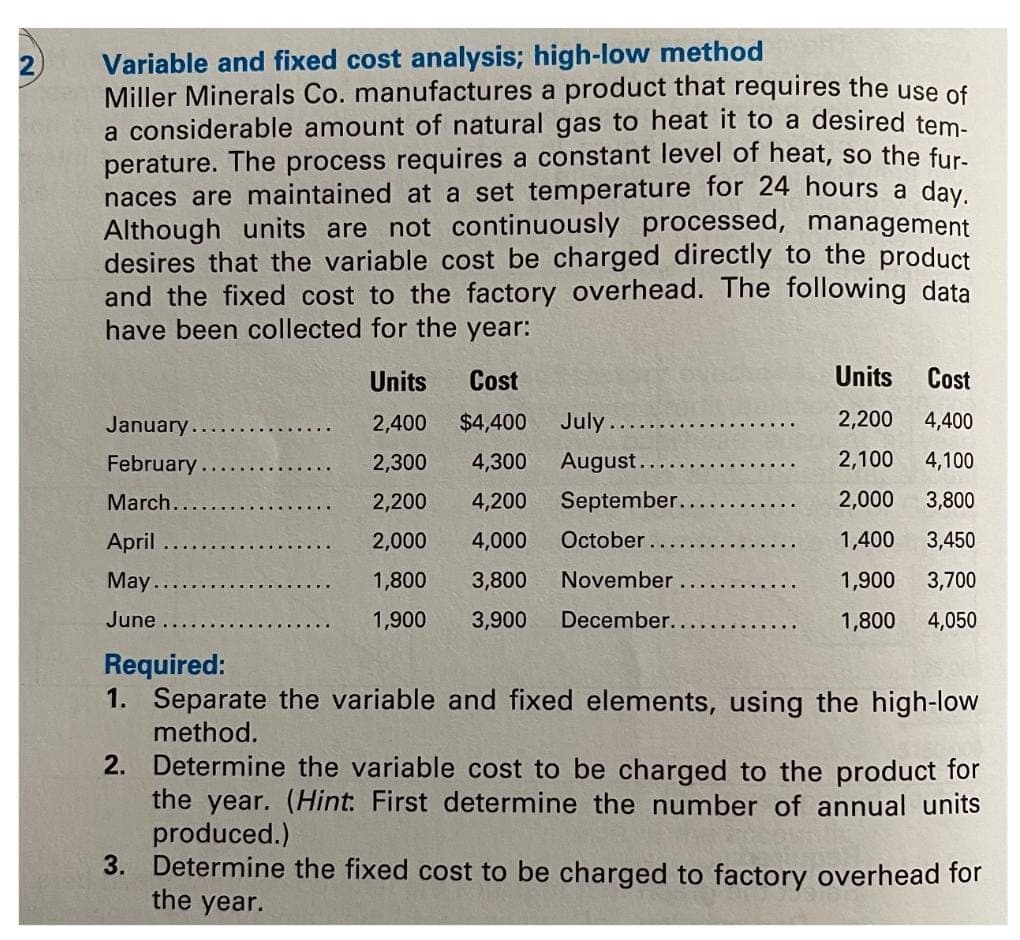

Problem 2P: Miller Minerals Co. manufactures a product that requires the use of a considerable amount of natural...

Related questions

Question

Transcribed Image Text:Variable and fixed cost analysis; high-low method

Miller Minerals Co. manufactures a product that requires the use of

a considerable amount of natural gas to heat it to a desired tem-

perature. The process requires a constant level of heat, so the fur-

naces are maintained at a set temperature for 24 hours a day.

Although units are not continuously processed, management

desires that the variable cost be charged directly to the product

and the fixed cost to the factory overhead. The following data

have been collected for the year:

Units Cost

2,400 $4,400

2,300 4,300

2,200 4,200

2,000 4,000 October.

1,800 3,800

November

1,900 3,900 December..

January .........

February

March.....

April

May.

June

July.

August.

September.

Units

Cost

2,200 4,400

2,100

4,100

2,000

3,800

1,400 3,450

1,900

3,700

1,800

4,050

Required:

1. Separate the variable and fixed elements, using the high-low

method.

2. Determine the variable cost to be charged to the product for

the year. (Hint. First determine the number of annual units

produced.)

3. Determine the fixed cost to be charged to factory overhead for

the year.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub