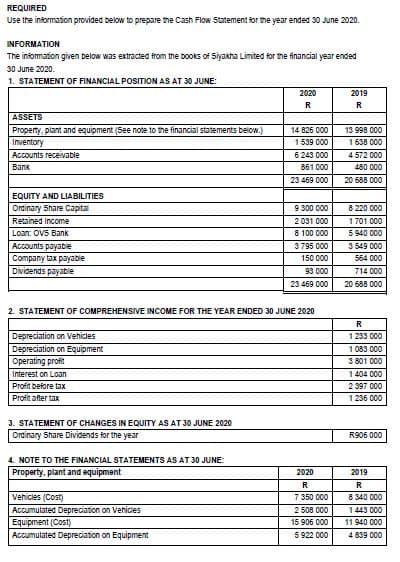

REQUIRED Use the intormation provided below to prepare he Cash Flow Statement for he year ended 30 June 2020. INFORMATION The information given below was extracted from the books of Siyakha Limited for the financial year ended 30 June 2020. 1. STATEMENT OF FINANCIAL POSITION AS AT 30 JUNE: 2020 2019 R ASSETS Property, plant and equipment (See note to the financial statements below.) Inventory 14 826 000 13 998 000 1539 000 6 243 000 1 638 000 Accounts receivable Bank 4 572 000 861 000 480 000 23 469 000 20 688 000 EQUITY AND LIABILITIES Ordinary Share Capital 9 300 000 8 220 000 Retained income 2031 000 1 701 000 8 100 000 3 795 000 Loan: OVs Bank 5 940 000 Accounts payabie Company tax payable Dividends payable 3 549 000 150 000 564 000 93 000 714 000 23 469 000 20 688 000 2. STATEMENT OF COMPREHENSIVE INCOME FOR THE YEAR ENDED 30 JUNE 2020 R Depreciation on Vehicies Depreciation on Equipment Operating profit 1 233 000 1 083 000 3 801 000 Interest on Loan 1 404 000 Profit before tax 2 397 000 Profit after tax 1 236 000 3. STATEMENT OF CHANGES IN EQUITY AS AT 30 JUNE 2020 Ordinary Share Dividends for the year R906 000 4. NOTE TO THE FINANCIAL STATEMENTS AS AT 30 JUNE: Property, plant and equipment 2020 2019 R 8 340 000 Vehicies (Cost) Accumulated Depreciation on Vehicies Equipment (Cost) Accumulated Depreciation on Equipment 7 350 000 2 508 000 1 443 000 11 940 000 15 906 000 5 922 000 4 839 000

REQUIRED Use the intormation provided below to prepare he Cash Flow Statement for he year ended 30 June 2020. INFORMATION The information given below was extracted from the books of Siyakha Limited for the financial year ended 30 June 2020. 1. STATEMENT OF FINANCIAL POSITION AS AT 30 JUNE: 2020 2019 R ASSETS Property, plant and equipment (See note to the financial statements below.) Inventory 14 826 000 13 998 000 1539 000 6 243 000 1 638 000 Accounts receivable Bank 4 572 000 861 000 480 000 23 469 000 20 688 000 EQUITY AND LIABILITIES Ordinary Share Capital 9 300 000 8 220 000 Retained income 2031 000 1 701 000 8 100 000 3 795 000 Loan: OVs Bank 5 940 000 Accounts payabie Company tax payable Dividends payable 3 549 000 150 000 564 000 93 000 714 000 23 469 000 20 688 000 2. STATEMENT OF COMPREHENSIVE INCOME FOR THE YEAR ENDED 30 JUNE 2020 R Depreciation on Vehicies Depreciation on Equipment Operating profit 1 233 000 1 083 000 3 801 000 Interest on Loan 1 404 000 Profit before tax 2 397 000 Profit after tax 1 236 000 3. STATEMENT OF CHANGES IN EQUITY AS AT 30 JUNE 2020 Ordinary Share Dividends for the year R906 000 4. NOTE TO THE FINANCIAL STATEMENTS AS AT 30 JUNE: Property, plant and equipment 2020 2019 R 8 340 000 Vehicies (Cost) Accumulated Depreciation on Vehicies Equipment (Cost) Accumulated Depreciation on Equipment 7 350 000 2 508 000 1 443 000 11 940 000 15 906 000 5 922 000 4 839 000

Chapter16: Statement Of Cash Flows

Section: Chapter Questions

Problem 2TP: Use a spreadsheet and the following financial information from Mineola Companys financial statements...

Related questions

Question

100%

Please help.

Transcribed Image Text:REQUIRED

Use the information provided below to prepare the Cash Flow Statement for the year ended 30 June 2020.

INFORMATION

The information given below was extracted from the books of Siyakha Limited for he financial year ended

30 June 2020.

1. STATEMENT OF FINANCIAL POSITION AS AT 30 JUNE:

2020

2019

R

R

ASSETS

Property, plant and equipment (See note to the financial statements below.)

Inventory

14 826 000

13 998 000

1539 000

1638 000

Accounts receivable

6 243 000

4 572 000

Bank

861 000

480 000

23 469 000

20 688 000

EQUITY AND LIABILITIES

Ordinary Share Capital

9 300 000

8 220 000

Retained Income

2 031 000

1701 000

8 100 000

5 940 000

3 549 000

Loan: OVS Bank

Accounts payable

3 795 000

Company tax payable

Dividends payable

150 000

564 000

93 000

714 000

23 469 000

20 688 000

2. STATEMENT OF COMPREHENSIVE INCOME FOR THE YEAR ENDED 30 JUNE 2020

R

Depreciation on Vehicles

1 233 000

Depreciation on Equipment

Operating profit

1083 000

3 801 000

1 404 000

Interest on Loan

Profit before tax

2 397 000

Profit after taxX

1236 000

3. STATEMENT OF CHANGES IN EQUITY AS AT 30 JUNE 2020

Ordinary Share Dividends for the year

R906 000

4. NOTE TO THE FINANCIAL STATEMENTS AS AT 30 JUNE:

Property, plant and equipment

2020

2019

R

7 350 000

R

Vehicles (Cost)

8 340 000

Accumulated Depreciation on Vehicles

Equipment (Cost)

Accumulated Depreciation on Equipment

2508 000

1443 000

15 906 000

11 940 000

5 922 000

4 839 000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub