Required: Using the Abbott Lab’s balance sheet, answer the following: Which balance sheet line items would you use to evaluate the company’s liquidity, i.e., ability to meet short-term obligations and remain capable of dealing with unexpected opportunities or challenges. For both periods presented, compute “net working capital” for the periods presented. Net working capital = Current assets – Current liabilities Based on your computation, has Abbott’s net working capital improved or declined? Which balance sheet line items would you use to evaluate the company’s solvency, i.e. ability to meet long-term obligations, execute the company’s long-term strategic initiatives, and remain in business. For both periods presented, compute Abbott Lab’s “Debt-to-equity” ratio. Debt-to-equity = Total liabilities ÷ Total shareholders’ equity. Based on your computations, has Abbott’s Debt-to-equity improved or declined?

Required: Using the Abbott Lab’s balance sheet, answer the following: Which balance sheet line items would you use to evaluate the company’s liquidity, i.e., ability to meet short-term obligations and remain capable of dealing with unexpected opportunities or challenges. For both periods presented, compute “net working capital” for the periods presented. Net working capital = Current assets – Current liabilities Based on your computation, has Abbott’s net working capital improved or declined? Which balance sheet line items would you use to evaluate the company’s solvency, i.e. ability to meet long-term obligations, execute the company’s long-term strategic initiatives, and remain in business. For both periods presented, compute Abbott Lab’s “Debt-to-equity” ratio. Debt-to-equity = Total liabilities ÷ Total shareholders’ equity. Based on your computations, has Abbott’s Debt-to-equity improved or declined?

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter3: The Basics Of Record Keeping And Financial Statement Preparation: Income Statement

Section: Chapter Questions

Problem 10E

Related questions

Question

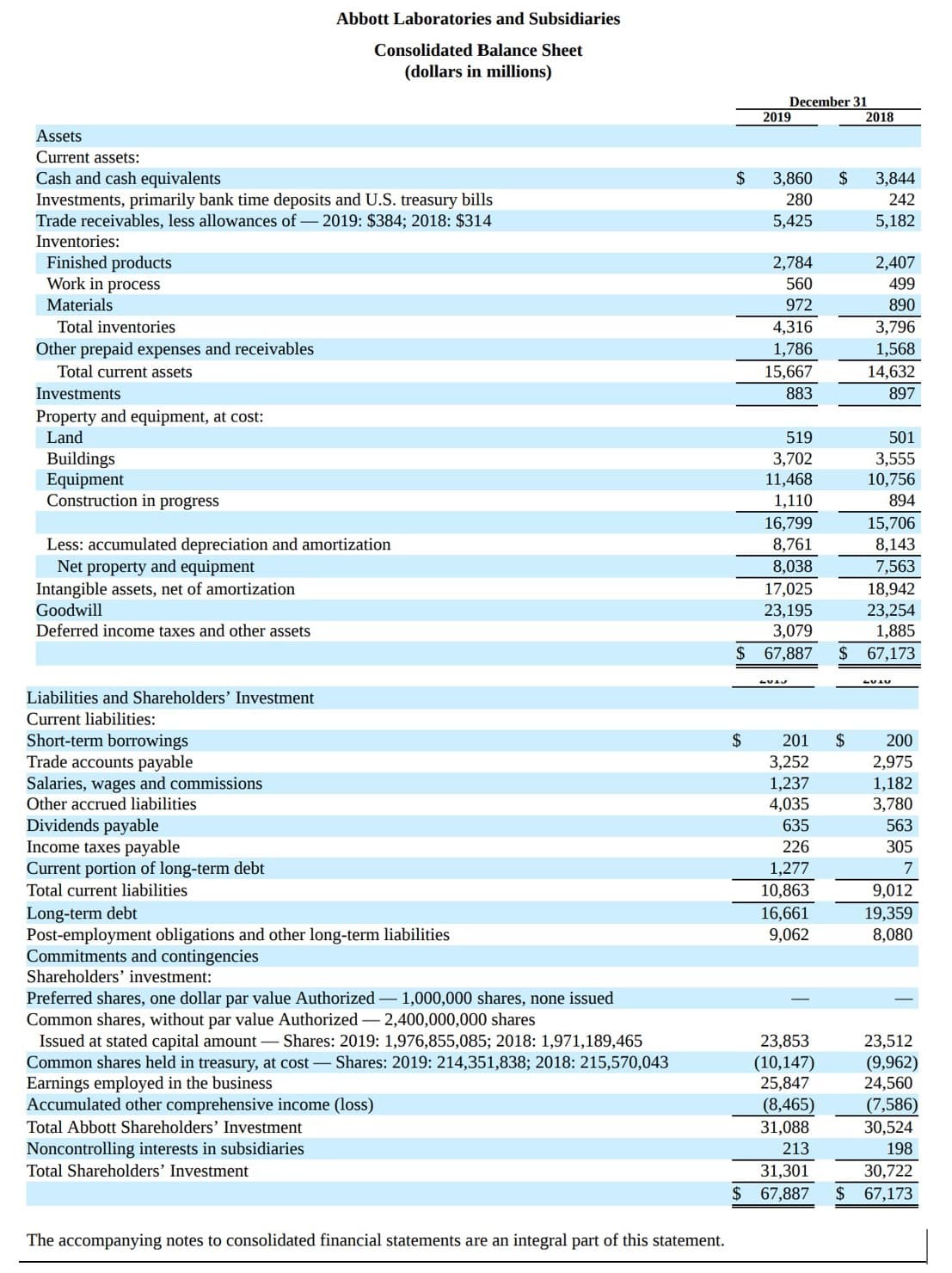

I have attached their Consolidated Balance Sheets which reports assets, liabilities and shareholders’ equity as of December 31, 2019 and 2018.

Required: Using the Abbott Lab’s

- Which balance sheet line items would you use to evaluate the company’s liquidity, i.e., ability to meet short-term obligations and remain capable of dealing with unexpected opportunities or challenges.

- For both periods presented, compute “net

working capital ” for the periods presented. Net working capital = Current assets – Current liabilities - Based on your computation, has Abbott’s net working capital improved or declined?

- For both periods presented, compute “net

- Which balance sheet line items would you use to evaluate the company’s solvency, i.e. ability to meet long-term obligations, execute the company’s long-term strategic initiatives, and remain in business.

- For both periods presented, compute Abbott Lab’s “Debt-to-equity” ratio. Debt-to-equity = Total liabilities ÷ Total shareholders’ equity.

- Based on your computations, has Abbott’s Debt-to-equity improved or declined?

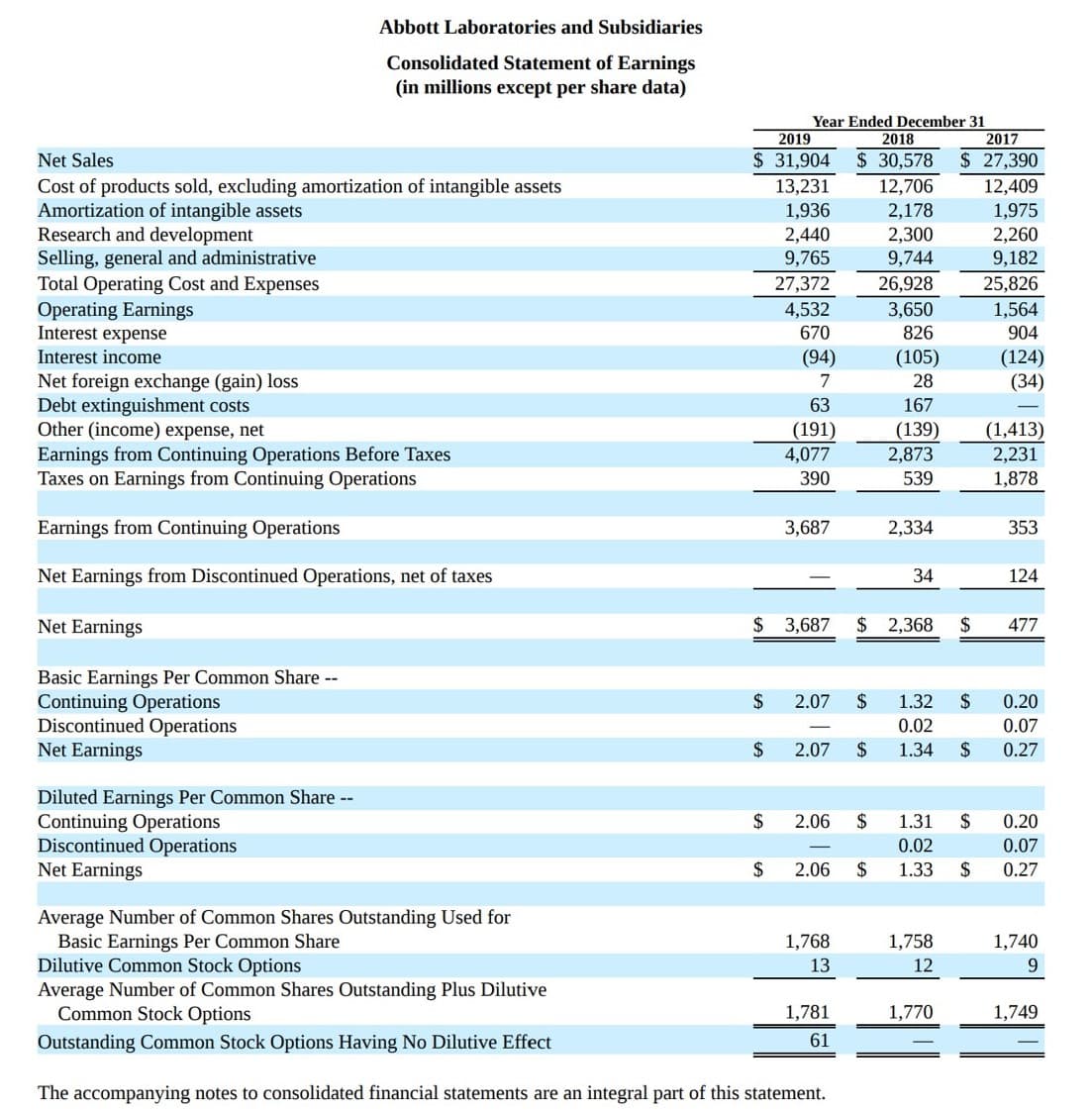

Transcribed Image Text:Abbott Laboratories and Subsidiaries

Consolidated Statement of Earnings

(in millions except per share data)

Year Ended December 31

2019

2018

2017

Net Sales

$ 31,904

$ 30,578

$ 27,390

Cost of products sold, excluding amortization of intangible assets

Amortization of intangible assets

Research and development

Selling, general and administrative

Total Operating Cost and Expenses

Operating Earnings

Interest expense

13,231

1,936

2,440

9,765

12,706

2,178

2,300

9,744

12,409

1,975

2,260

9,182

27,372

4,532

670

26,928

25,826

3,650

1,564

826

904

(105)

28

(124)

(34)

Interest income

(94)

Net foreign exchange (gain) loss

Debt extinguishment costs

Other (income) expense, net

Earnings from Continuing Operations Before Taxes

Taxes on Earnings from Continuing Operations

7

63

167

(191)

4,077

(139)

2,873

(1,413)

2,231

390

539

1,878

Earnings from Continuing Operations

3,687

2,334

353

Net Earnings from Discontinued Operations, net of taxes

34

124

Net Earnings

$ 3,687

$ 2,368

$

477

Basic Earnings Per Common Share --

Continuing Operations

Discontinued Operations

Net Earnings

$

2.07

$

1.32

$

0.20

0.02

0.07

2$

2.07

2$

1.34

$

0.27

Diluted Earnings Per Common Share --

Continuing Operations

Discontinued Operations

Net Earnings

$

2.06

$

1.31

$

0.20

0.02

0.07

2$

2.06

$

1.33

$

0.27

Average Number of Common Shares Outstanding Used for

Basic Earnings Per Common Share

Dilutive Common Stock Options

Average Number of Common Shares Outstanding Plus Dilutive

Common Stock Options

1,768

1,758

1,740

13

12

9.

1,781

1,770

1,749

Outstanding Common Stock Options Having No Dilutive Effect

61

The accompanying notes to consolidated financial statements are an integral part of this statement.

Transcribed Image Text:Abbott Laboratories and Subsidiaries

Consolidated Balance Sheet

(dollars in millions)

December 31

2019

2018

Assets

Current assets:

Cash and cash equivalents

Investments, primarily bank time deposits and U.S. treasury bills

Trade receivables, less allowances of-2019: $384; 2018: $314

$

3,860

2$

3,844

280

242

5,425

5,182

Inventories:

Finished products

Work in process

2,784

2,407

560

499

Materials

972

890

Total inventories

4,316

3,796

Other prepaid expenses and receivables

Total current assets

1,786

1,568

15,667

14,632

Investments

883

897

Property and equipment, at cost:

Land

519

501

Buildings

Equipment

Construction in progress

3,555

10,756

3,702

11,468

1,110

894

15,706

8,143

16,799

Less: accumulated depreciation and amortization

Net property and equipment

Intangible assets, net of amortization

Goodwill

8,761

8,038

7,563

17,025

23,195

3,079

18,942

23,254

1,885

Deferred income taxes and other assets

$ 67,887

$ 67,173

Liabilities and Shareholders' Investment

Current liabilities:

Short-term borrowings

Trade accounts payable

Salaries, wages and commissions

Other accrued liabilities

2$

201

200

3,252

1,237

4,035

2,975

1,182

3,780

Dividends payable

Income taxes payable

Current portion of long-term debt

635

563

226

305

1,277

7

Total current liabilities

10,863

9,012

Long-term debt

Post-employment obligations and other long-term liabilities

Commitments and contingencies

Shareholders' investment:

16,661

9,062

19,359

8,080

Preferred shares, one dollar par value Authorized – 1,000,000 shares, none issued

Common shares, without par value Authorized – 2,400,000,000 shares

Issued at stated capital amount – Shares: 2019: 1,976,855,085; 2018: 1,971,189,465

Common shares held in treasury, at cost -Shares: 2019: 214,351,838; 2018: 215,570,043

Earnings employed in the business

Accumulated other comprehensive income (loss)

23,853

23,512

(10,147)

25,847

(9,962)

24,560

(7,586)

(8,465)

Total Abbott Shareholders' Investment

31,088

30,524

Noncontrolling interests in subsidiaries

213

198

Total Shareholders' Investment

31,301

30,722

2$

67,887

$ 67,173

The accompanying notes to consolidated financial statements are an integral part of this statement.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning