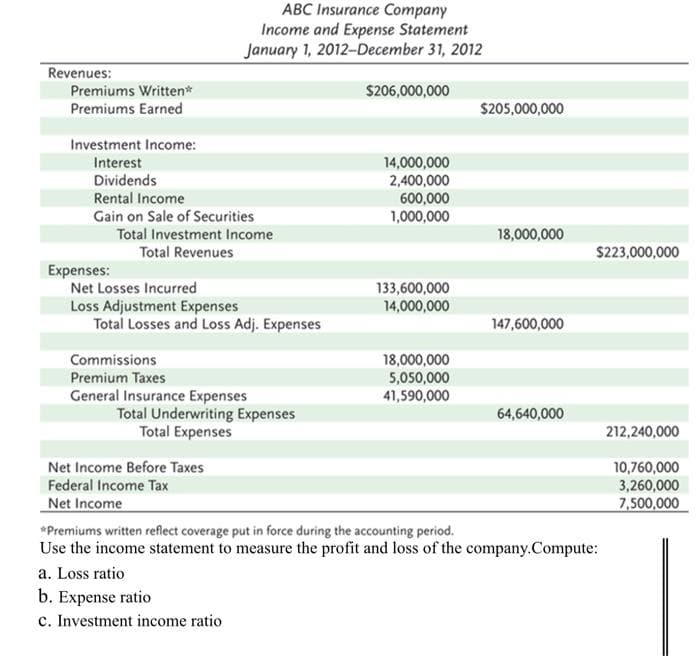

Revenues: Premiums Written* Premiums Earned Investment Income: Interest Dividends Rental Income Gain on Sale of Securities Expenses: Total Investment Income Total Revenues Net Losses Incurred ABC Insurance Company Income and Expense Statement January 1, 2012-December 31, 2012 Loss Adjustment Expenses Total Losses and Loss Adj. Expenses Commissions Premium Taxes General Insurance Expenses Total Underwriting Expenses Total Expenses Net Income Before Taxes Federal Income Tax Net Income a. Loss ratio b. Expense ratio c. Investment income ratio $206,000,000 14,000,000 2,400,000 600,000 1,000,000 133,600,000 14,000,000 18,000,000 5,050,000 41,590,000 $205,000,000 18,000,000 147,600,000 64,640,000 $223,000,000 *Premiums written reflect coverage put in force during the accounting period. Use the income statement to measure the profit and loss of the company.Compute: 212,240,000 10,760,000 3,260,000 7,500,000

Revenues: Premiums Written* Premiums Earned Investment Income: Interest Dividends Rental Income Gain on Sale of Securities Expenses: Total Investment Income Total Revenues Net Losses Incurred ABC Insurance Company Income and Expense Statement January 1, 2012-December 31, 2012 Loss Adjustment Expenses Total Losses and Loss Adj. Expenses Commissions Premium Taxes General Insurance Expenses Total Underwriting Expenses Total Expenses Net Income Before Taxes Federal Income Tax Net Income a. Loss ratio b. Expense ratio c. Investment income ratio $206,000,000 14,000,000 2,400,000 600,000 1,000,000 133,600,000 14,000,000 18,000,000 5,050,000 41,590,000 $205,000,000 18,000,000 147,600,000 64,640,000 $223,000,000 *Premiums written reflect coverage put in force during the accounting period. Use the income statement to measure the profit and loss of the company.Compute: 212,240,000 10,760,000 3,260,000 7,500,000

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter13: Marketable Securities And Derivatives

Section: Chapter Questions

Problem 26P

Related questions

Question

Transcribed Image Text:Revenues:

Premiums Written*

Premiums Earned

Investment Income:

Interest

Dividends

Rental Income

Gain on Sale of Securities

Expenses:

Total Investment Income

Total Revenues

Net Losses Incurred

ABC Insurance Company

Income and Expense Statement

January 1, 2012-December 31, 2012

Loss Adjustment Expenses

Total Losses and Loss Adj. Expenses

Commissions

Premium Taxes

General Insurance Expenses

Total Underwriting Expenses

Total Expenses

Net Income Before Taxes

Federal Income Tax

Net Income

a. Loss ratio

b. Expense ratio

c. Investment income ratio

$206,000,000

14,000,000

2,400,000

600,000

1,000,000

133,600,000

14,000,000

18,000,000

5,050,000

41,590,000

$205,000,000

18,000,000

147,600,000

64,640,000

$223,000,000

*Premiums written reflect coverage put in force during the accounting period.

Use the income statement to measure the profit and loss of the company.Compute:

212,240,000

10,760,000

3,260,000

7,500,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning