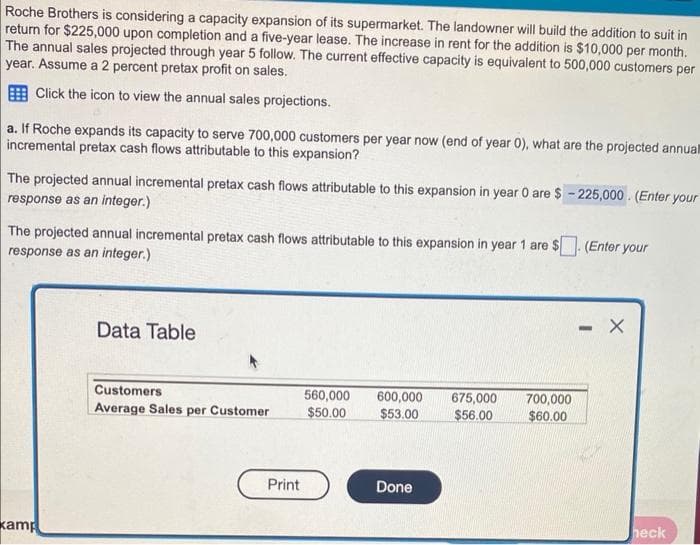

Roche Brothers is considering a capacity expansion of its supermarket. The landowner will build the addition to suit in return for $225,000 upon completion and a five-year lease. The increase in rent for the addition is $10,000 per month. The annual sales projected through year 5 follow. The current effective capacity is equivalent to 500,000 customers per year. Assume a 2 percent pretax profit on sales. Click the icon to view the annual sales projections. a. If Roche expands its capacity to serve 700,000 customers per year now (end of year 0), what are the projected annuall incremental pretax cash flows attributable to this expansion? The projected annual incremental pretax cash flows attributable to this expansion in year 0 are $-225,000. (Enter your response as an integer.) The projected annual incremental pretax cash flows attributable to this expansion in year 1 are $ (Enter your response as an integer.)

Roche Brothers is considering a capacity expansion of its supermarket. The landowner will build the addition to suit in return for $225,000 upon completion and a five-year lease. The increase in rent for the addition is $10,000 per month. The annual sales projected through year 5 follow. The current effective capacity is equivalent to 500,000 customers per year. Assume a 2 percent pretax profit on sales. Click the icon to view the annual sales projections. a. If Roche expands its capacity to serve 700,000 customers per year now (end of year 0), what are the projected annuall incremental pretax cash flows attributable to this expansion? The projected annual incremental pretax cash flows attributable to this expansion in year 0 are $-225,000. (Enter your response as an integer.) The projected annual incremental pretax cash flows attributable to this expansion in year 1 are $ (Enter your response as an integer.)

Chapter14: Capital Structure Management In Practice

Section14.A: Breakeven Analysis

Problem 8P

Related questions

Question

Transcribed Image Text:Roche Brothers is considering a capacity expansion of its supermarket. The landowner will build the addition to suit in

return for $225,000 upon completion and a five-year lease. The increase in rent for the addition is $10,000 per month.

The annual sales projected through year 5 follow. The current effective capacity is equivalent to 500,000 customers per

year. Assume a 2 percent pretax profit on sales.

Click the icon to view the annual sales projections.

a. If Roche expands its capacity to serve 700,000 customers per year now (end of year 0), what are the projected annuall

incremental pretax cash flows attributable to this expansion?

The projected annual incremental pretax cash flows attributable to this expansion in year 0 are $-225,000 (Enter your

response as an integer.)

The projected annual incremental pretax cash flows attributable to this expansion in year 1 are $. (Enter your

response as an integer.)

kamp

Data Table

Customers

Average Sales per Customer

Print

560,000 600,000

$50.00

$53.00

Done

675,000

$56.00

700,000

$60.00

- X

heck

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College