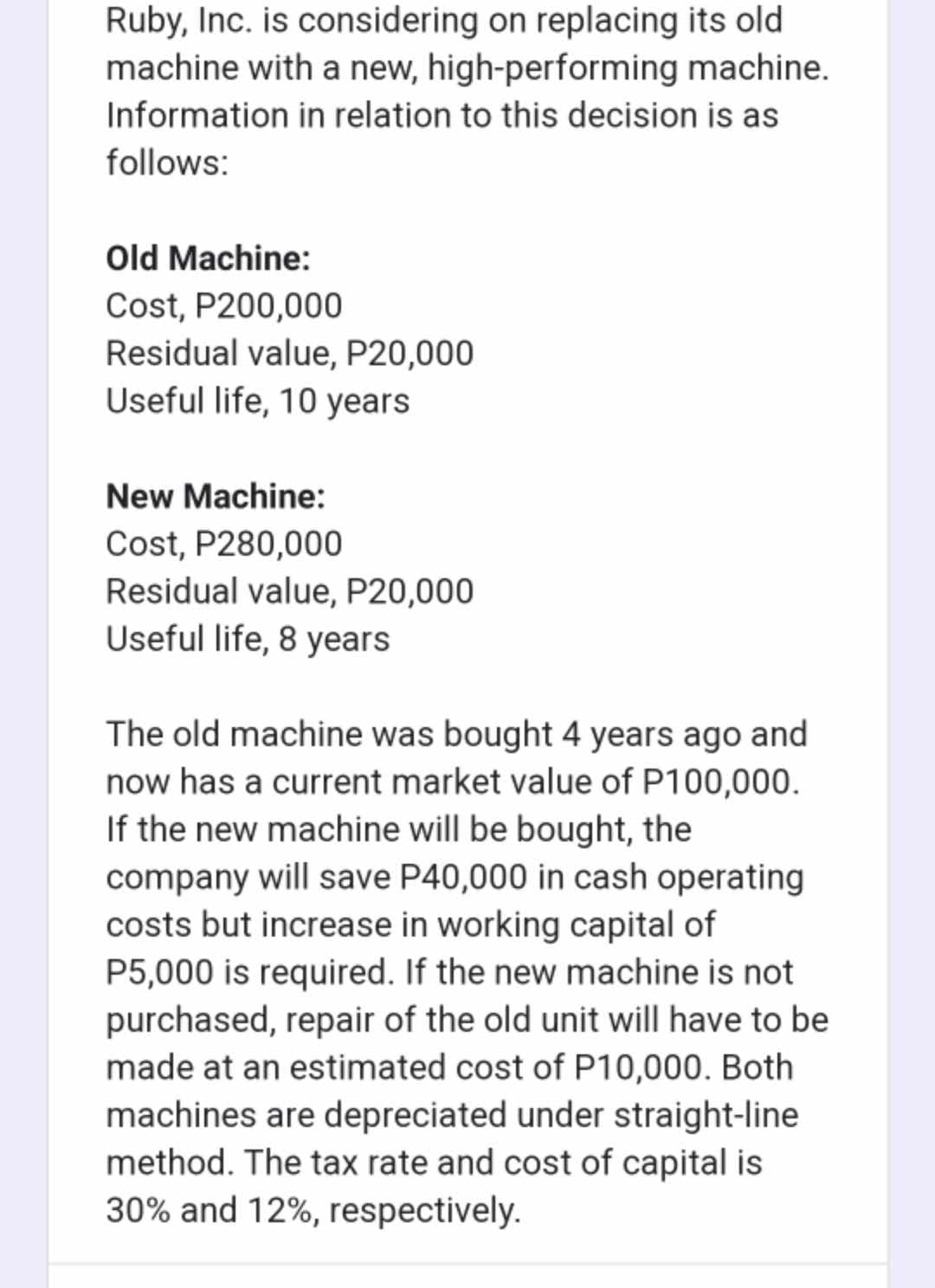

Ruby, Inc. is considering on replacing its old machine. machine with a new, high-performing Information in relation to this decision is as follows: Old Machine: Cost, P200,000

Q: Starwood Corporation has current assets of $410,000, total current liabilities of $960,000, net…

A: Net credit sales=$15,10,000 Beginning account receivable=$86,000 Ending account receivable=$90,000…

Q: A company buys a delivery vehicle today for R60 000 and assumes that the cost of replacing the…

A: Value of old vehicle decreases with time and value of new vehicle increases with time and this is…

Q: Coore Manufacturing has the following two possible projects. The required return is 11 percent.…

A: Years Project Y 0 ($28,800) 1 $14,800 2 $13,200 3 $15,600 4 $11,200 Years Project…

Q: In a binomial tree created to value an option on a stock, what is the expected return on the option?…

A: The binomial tree model is a commonly used method in finance for valuing options and other financial…

Q: A trader enters into a short position on a call and a long forward position on the same underlying…

A: Long position means we will buy futures now and sell them in future expecting the price increased.…

Q: C(x)=0.08x+11.75 What is the total cost for an order of 20 copies?

A: Here, Total No. of Copies (x) is 20 Equation of Cost is C(x)=0.08x+11.75

Q: You have the choice amount the five projects below. Which project should be selecte the projects are…

A: Independent project refers to the type of capital budgeting that defines the project which is not…

Q: XYZ bank currently has 600 million in transaction deposits on its balance sheet. The current…

A: The required reserve is the portion of transaction deposits that banks are required to hold in…

Q: A pension fund manager is considering three mutual funds. The first is a stock fund, the second is a…

A: As per the given information: Risk free rate (rf) - 5.5%Correlation between the fund returns -…

Q: Angie’s Bakery bakes bagels. The June production is given below. 290 290 290 450 290 290 330 290…

A: The relative weight or importance of each data point in a set is taken into consideration by the…

Q: Sabine Co has outstanding bonds with 10 years remaining until maturity, a coupon rate of 7%,…

A: Data given: Coupon rate=7% (semi-annual) N=10 years Par value=$1000 Market price=$1000 * 96.5%=$965…

Q: ou want to come up with a plan to save for retirement. You will contribute to your retirement…

A: Due to compounding of interest large amount of interest is accumulated over the long period of time…

Q: An investment manager based in Germany hedges a portfolio of UK gilts with a 3-month forward…

A: As per the given information: Current spot rate - GBP0.833/EUR90-day forward rate - GBP0.856/EURRise…

Q: Determining the Cost of Insurance. Suppose you are 45 and have a $50,000 face amount, 15-year,…

A: Face Value = $50,000 Annual Premium = $1,000 Cash value of the policy = $12,000 Time period = 15…

Q: Give typing answer with explanation and conclusion Project S requires an initial outlay at t = 0 of…

A: NPV analysis helps identify projects that are expected to generate the highest net benefit. By…

Q: der to test the weak form of the efficient-market hypothesis, researchers have used the following…

A: The weak form of market efficiency - the past price or historical value A reflected in the rice of…

Q: You are considering two bonds. Bond A has a 9% annual coupon while Bond B has a 6% annual coupon.…

A: Yield to maturity is the total rate of return a bond will have earned after all interest and…

Q: The firm wishes to estimate the beta of a portfolio that consists of two assets X and Y. The…

A: Beta of the portfolio = wX * Beta_X + wY * Beta_Y Where: wX = Weight of asset X in the portfolio,…

Q: Graham Potato Company has projected sales of $10,200 in September, $13,500 in October, $20.200 in…

A: Cash budget is used to estimate cash inflows (cash receipts) and cash outflows (cash payments) of a…

Q: (a) Compute the present value of an annuity immediate that pays £50 per year for 10 years at an…

A: Present value refers to the current worth of the expected sum of the amount. It is computed by…

Q: WellyWeta workshop is considering buying a machine that costs $545,000. The machine will be…

A: A lease agreement defines the responsibilities of both parties regarding the maintenance and repair…

Q: 1) Miguel is attending a 4-year college. As a freshman, he was approved for a 10-year, federal…

A: Principal Amount = $6800 Rate of Interest = 4.29% No. of years = 4.5

Q: Suppose now that your portfolio must yield an expected return of 13% and be efficient, that is, on…

A: The expected return of a portfolio consisting of three securities is calculated as shown below.…

Q: A loan of £10,000 is repaid in 5 years with quarterly payments made in arrears. The initial payment…

A: Using the formula below you would have found that the first payment (P) is GBP 2286.150662 P = Loan…

Q: Q u e s t i o n A . C a l c u l a t e t h e i n d i v i d u a l c o s t o f e a c h s…

A: Rd= (100+(50/10))/((950+1000)/2) Rd=105/975 =10.76% Cost of preference stock = 11% Cost of…

Q: A firm has $100 million in current liabilities, $200 million in long-term debt, $300 million in…

A: Long Term debt = $200 million Equity = $300 million

Q: On April 18th, 2007, a 7% coupon-bond is maturin April 20th, 2014. The bond pays interest semiann on…

A: The duration of bond shows the sensitivity of bond's prices to the interest rate that how much would…

Q: Describe how underinvestment and asset substitution can destroy firm value and how risk management…

A: Underinvestment and asset replacement can have a negative impact on a company's value, however risk…

Q: Assuming that you are holding two bonds. The first bond's term to maturity is 20 years, and the…

A: A bond is a kind of debt security issued by the government and private companies for raising funds…

Q: 6A. Village Farms is a North American green-house producer of tomatoes. VFF operates four…

A: Revenue is a product of sales price per unit and the volume of production in units. Here the unit…

Q: Describe the following assets and categorise them into real or financial assets giving reasons for…

A: The financial assets a type of acids that are held by traders and investors and these assets help…

Q: surement of the profitability of trading rules used by technical analysts. c.measurement of how…

A: The weak form of market efficiency - the past price or historical value A reflected in the rice of…

Q: You are considering investing $1,000 in a T-bill that pays 4% and a risky portfolio, P, constructed…

A: A portfolio is a combination of different securities in one basket and portfolios are created for…

Q: Sub : Finance Pls answer very fast.I ll upvote. Thank You Bobbie has $6,000 that she wants to…

A: Present value is the estimation of the current value of future cash value which is likely to be…

Q: Which of the following is TRUE? An American call option on a stock should never be exercised early…

A: Call option gives holder a right to buy a stock, but it is not an obligation to buy the stock.

Q: a) Can you make money off of this ???? b) What are the effects of covered interest arbitrage? c)…

A: Spot rate “S” = 9.5 pesos/$ Forward rate “F” = 10 pesos/$ Investment amount = $1,000,000 Mexico rate…

Q: The management of LTTP Corp. is preparing for issuing equity to fund a new project. Rights offer is…

A: Subscription price refers to the price at which the shareholders who are already in existence can be…

Q: Orange Inc's next two annual dividends be $6.05 and $5.55, with the first occurring exactly one year…

A: To calculate the fair price of Orange Inc. stock, we can use the dividend discount model (DDM). The…

Q: Next, consider the case of Windsor Flooring Company: The management at Windsor Flooring has…

A: A collection float is when a check is received but has not been reflected in the bank statement. A…

Q: The common stock of Textile Inc. pays a quarterly dividend of $0.40 a share. The company has…

A: Value of stock is the present value of dividend that are going to be received in the future and…

Q: Kate and her brother Rustin own a piece of property in Dallas as tenants in common valued at…

A: Co-owners of a tenancy refers to multiple individuals or entities who jointly hold ownership rights…

Q: Which of the following is uses electronic trading 1.The JSE 2.The Nasdaq 3.The NYSE 4.The…

A: The American stock exchange known as Nasdaq (National Association of Securities Dealers Automated…

Q: Consider a zero-coupon bond issued on 1st of March 2017 with maturity in two years and face value…

A: A bond refers to an instrument used for raising debt capital from investors rather than traditional…

Q: Many companies still go ahead to undertake capital projects even when these projects have a negative…

A: The net present value method is used to evaluate projects for investment by the companies. The…

Q: Approximately, what is the value of (P) if F=114120, n=8 years, and i= 7% per year? O a. 79703 b.…

A: Present value is the current value of certain amount of future money at a required rate of return or…

Q: What will be the account's valu if the interest is compounded r 4000(1+(0.07)/(12))^(12(10))

A: Here, PV is 4000 Interest Rate is 7% Compounding Period is Monthly Time Period is 10 years

Q: b. What would be your annual dividend income from those shares? (Round your answer to 2 decimal…

A: Shares represent stock ownership in a company. Management of a company makes decision with regards…

Q: For each project unless stated otherwise: (a) compute the net present value (b) compute the…

A: Project A Year Annual Net cashflows pv factors @12% PV of cashflows 0 -108000 1…

Q: NAME Herbalife Nutrition Herc Holdings Heritage Insurance Holdings HRTG Hersha Hospitality Trust CIA…

A: Amount = $5,000 Hess Midstream Partners closing price = $17.87 Net Change = 0.25 PE ratio = 14.60…

Q: A Japanese company has a bond that sells for 104.615 percent of its ¥100,000 par value. The bond has…

A:

From the problem below :

1. For capital budgeting purposes, what is the net investment in the new, high-performing machine?

A. P186,400

B. P185,000

C. P169,600

D. P148,000

2. What is the payback period?

A. 4.49 years

B. 5.24 years

C. 5.76 years

D. None from the choices

3. Compute the new, high-performing machine's net present value.

A. P1,200

B. P15,892

C. P28,025

D. P6,729

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 2 images

- Dauten is offered a replacement machine which has a cost of 8,000, an estimated useful life of 6 years, and an estimated salvage value of 800. The replacement machine is eligible for 100% bonus depreciation at the time of purchase- The replacement machine would permit an output expansion, so sales would rise by 1,000 per year; even so, the new machines much greater efficiency would cause operating expenses to decline by 1,500 per year The new machine would require that inventories be increased by 2,000, but accounts payable would simultaneously increase by 500. Dautens marginal federal-plus-state tax rate is 25%, and its WACC is 11%. Should it replace the old machine?Filkins Fabric Company is considering the replacement of its old, fully depreciated knitting machine. Two new models are available: Machine 190-3, which has a cost of $190,000, a 3-year expected life, and after-tax cash flows (labor savings and depreciation) of $87,000 per year; and Machine 360-6, which has a cost of $360,000, a 6-year life, and after-tax cash flows of $98,300 per year. Knitting machine prices are not expected to rise because inflation will be offset by cheaper components (microprocessors) used in the machines. Assume that Filkins’ cost of capital is 14%. Should the firm replace its old knitting machine? If so, which new machine should it use? By how much would the value of the company increase if it accepted the better machine? What is the equivalent annual annuity for each machine?Thaler Company bought 26,000 of raw materials a year ago in anticipation of producing 5,000 units of a deluxe version of its product to be priced at 75 each. Now the price of the deluxe version has dropped to 35 each, and Thaler is now deciding whether to produce 1,500 units of the deluxe version at a cost of 48,000 or to scrap the project. What is the opportunity cost of this decision? a. 175,000 b. 375,000 c. 48,000 d. 26,000

- Mallette Manufacturing, Inc., produces washing machines, dryers, and dishwashers. Because of increasing competition, Mallette is considering investing in an automated manufacturing system. Since competition is most keen for dishwashers, the production process for this line has been selected for initial evaluation. The automated system for the dishwasher line would replace an existing system (purchased one year ago for 6 million). Although the existing system will be fully depreciated in nine years, it is expected to last another 10 years. The automated system would also have a useful life of 10 years. The existing system is capable of producing 100,000 dishwashers per year. Sales and production data using the existing system are provided by the Accounting Department: All cash expenses with the exception of depreciation, which is 6 per unit. The existing equipment is being depreciated using straight-line with no salvage value considered. The automated system will cost 34 million to purchase, plus an estimated 20 million in software and implementation. (Assume that all investment outlays occur at the beginning of the first year.) If the automated equipment is purchased, the old equipment can be sold for 3 million. The automated system will require fewer parts for production and will produce with less waste. Because of this, the direct material cost per unit will be reduced by 25 percent. Automation will also require fewer support activities, and as a consequence, volume-related overhead will be reduced by 4 per unit and direct fixed overhead (other than depreciation) by 17 per unit. Direct labor is reduced by 60 percent. Assume, for simplicity, that the new investment will be depreciated on a pure straight-line basis for tax purposes with no salvage value. Ignore the half-life convention. The firms cost of capital is 12 percent, but management chooses to use 20 percent as the required rate of return for evaluation of investments. The combined federal and state tax rate is 40 percent. Required: 1. Compute the net present value for the old system and the automated system. Which system would the company choose? 2. Repeat the net present value analysis of Requirement 1, using 12 percent as the discount rate. 3. Upon seeing the projected sales for the old system, the marketing manager commented: Sales of 100,000 units per year cannot be maintained in the current competitive environment for more than one year unless we buy the automated system. The automated system will allow us to compete on the basis of quality and lead time. If we keep the old system, our sales will drop by 10,000 units per year. Repeat the net present value analysis, using this new information and a 12 percent discount rate. 4. An industrial engineer for Mallette noticed that salvage value for the automated equipment had not been included in the analysis. He estimated that the equipment could be sold for 4 million at the end of 10 years. He also estimated that the equipment of the old system would have no salvage value at the end of 10 years. Repeat the net present value analysis using this information, the information in Requirement 3, and a 12 percent discount rate. 5. Given the outcomes of the previous four requirements, comment on the importance of providing accurate inputs for assessing investments in automated manufacturing systems.Although the Chen Company’s milling machine is old, it is still in relatively good working order and would last for another 10 years. It is inefficient compared to modern standards, though, and so the company is considering replacing it. The new milling machine, at a cost of $110,000 delivered and installed, would also last for 10 years and would produce after-tax cash flows (labor savings and depreciation tax savings) of $19,000 per year. It would have zero salvage value at the end of its life. The project cost of capital is 10%, and its marginal tax rate is 25%. Should Chen buy the new machine?Newmarge Products Inc. is evaluating a new design for one of its manufacturing processes. The new design will eliminate the production of a toxic solid residue. The initial cost of the system is estimated at 860,000 and includes computerized equipment, software, and installation. There is no expected salvage value. The new system has a useful life of 8 years and is projected to produce cash operating savings of 225,000 per year over the old system (reducing labor costs and costs of processing and disposing of toxic waste). The cost of capital is 16%. Required: 1. Compute the NPV of the new system. 2. One year after implementation, the internal audit staff noted the following about the new system: (1) the cost of acquiring the system was 60,000 more than expected due to higher installation costs, and (2) the annual cost savings were 20,000 less than expected because more labor cost was needed than anticipated. Using the changes in expected costs and benefits, compute the NPV as if this information had been available one year ago. Did the company make the right decision? 3. CONCEPTUAL CONNECTION Upon reporting the results mentioned in the postaudit, the marketing manager responded in a memo to the internal audit department indicating that cash inflows also had increased by a net of 60,000 per year because of increased purchases by environmentally sensitive customers. Describe the effect that this has on the analysis in Requirement 2. 4. CONCEPTUAL CONNECTION Why is a postaudit beneficial to a firm?

- Austins cell phone manufacturer wants to upgrade their product mix to encompass an exciting new feature on their cell phone. This would require a new high-tech machine. You are excited about his new project and are recommending the purchase to your board of directors. Here is the information you have compiled in order to complete this recommendation: According to the information, the project will last 10 years and require an initial investment of $800,000, depreciated with straight-line over the life of the project until the final value is zero. The firms tax rate is 30% and the required rate of return is 12%. You believe that the variable cost and sales volume may be as much as 10% higher or lower than the initial estimate. Your boss understands the risks but asks you to explain the alternatives in a brief memo to the board, Write a memo to the Board of Directors objectively weighing out the pros and cons of this project and make your recommendation(s).Jonfran Company manufactures three different models of paper shredders including the waste container, which serves as the base. While the shredder heads are different for all three models, the waste container is the same. The number of waste containers that Jonfran will need during the following years is estimated as follows: The equipment used to manufacture the waste container must be replaced because it is broken and cannot be repaired. The new equipment would have a purchase price of 945,000 with terms of 2/10, n/30; the companys policy is to take all purchase discounts. The freight on the equipment would be 11,000, and installation costs would total 22,900. The equipment would be purchased in December 20x4 and placed into service on January 1, 20x5. It would have a five-year economic life and would be treated as three-year property under MACRS. This equipment is expected to have a salvage value of 12,000 at the end of its economic life in 20x9. The new equipment would be more efficient than the old equipment, resulting in a 25 percent reduction in both direct materials and variable overhead. The savings in direct materials would result in an additional one-time decrease in working capital requirements of 2,500, resulting from a reduction in direct material inventories. This working capital reduction would be recognized at the time of equipment acquisition. The old equipment is fully depreciated and is not included in the fixed overhead. The old equipment from the plant can be sold for a salvage amount of 1,500. Rather than replace the equipment, one of Jonfrans production managers has suggested that the waste containers be purchased. One supplier has quoted a price of 27 per container. This price is 8 less than Jonfrans current manufacturing cost, which is as follows: Jonfran uses a plantwide fixed overhead rate in its operations. If the waste containers are purchased outside, the salary and benefits of one supervisor, included in fixed overhead at 45,000, would be eliminated. There would be no other changes in the other cash and noncash items included in fixed overhead except depreciation on the new equipment. Jonfran is subject to a 40 percent tax rate. Management assumes that all cash flows occur at the end of the year and uses a 12 percent after-tax discount rate. Required: 1. Prepare a schedule of cash flows for the make alternative. Calculate the NPV of the make alternative. 2. Prepare a schedule of cash flows for the buy alternative. Calculate the NPV of the buy alternative. 3. Which should Jonfran domake or buy the containers? What qualitative factors should be considered? (CMA adapted)St. Johns River Shipyards welding machine is 15 years old, fully depreciated, and has no salvage value. However, even though it is old, it is still functional as originally designed and can be used for quite a while longer. A new welder will cost 182,500 and have an estimated life of 8 years with no salvage value. The new welder will be much more efficient, however, and this enhanced efficiency will increase earnings before depreciation from 27,000 to 74,000 per year. The new machine will be depreciated over its 5-year MACRS recovery period, so the applicable depreciation rates are 20.00%, 32.00%, 19.20%, 11.52%, 11.52%, and 5.76%. The applicable corporate tax rate is 25%, and the project cost of capital is 12%. What is the NPV if the firm replaces the old welder with the new one?

- Flanders Manufacturing is considering purchasing a new machine that will reduce variable costs per part produced by $0.15. The machine will increase fixed costs by $18,250 per year. The information they will use to consider these changes is shown here.Gina Ripley, president of Dearing Company, is considering the purchase of a computer-aided manufacturing system. The annual net cash benefits and savings associated with the system are described as follows: The system will cost 9,000,000 and last 10 years. The companys cost of capital is 12 percent. Required: 1. Calculate the payback period for the system. Assume that the company has a policy of only accepting projects with a payback of five years or less. Would the system be acquired? 2. Calculate the NPV and IRR for the project. Should the system be purchasedeven if it does not meet the payback criterion? 3. The project manager reviewed the projected cash flows and pointed out that two items had been missed. First, the system would have a salvage value, net of any tax effects, of 1,000,000 at the end of 10 years. Second, the increased quality and delivery performance would allow the company to increase its market share by 20 percent. This would produce an additional annual net benefit of 300,000. Recalculate the payback period, NPV, and IRR given this new information. (For the IRR computation, initially ignore salvage value.) Does the decision change? Suppose that the salvage value is only half what is projected. Does this make a difference in the outcome? Does salvage value have any real bearing on the companys decision?Den-Tex Company is evaluating a proposal to replace its HID (high intensity discharge) lighting with LED (light emitting diode) lighting throughout its warehouse. LED lighting consumes less power and lasts longer than HID lighting for similar performance. The following information was developed: a. Determine the investment cost for replacing the 700 fixtures. b. Determine the annual utility cost savings from employing the new energy solution. c. Should the proposal be accepted? Evaluate the proposal using net present value, assuming a 15-year life and 8% minimum rate of return. (Present value factors are available in Appendix A.)